FED is printing money. They call it “Quantitative Easing” aka QE1, QE2 and so on. Many economists think this expansion of FED balance sheet will create inflation in the near future. But they were saying that back in 2009 too. And two years later we still do not have the promised inflation. Base money supply expanded from 800 billion to almost 3 trillion. Yet we have outright deflation in some sectors such as housing. Yes Oil, Food and other commodities are up, but that seems to be due to demand/supply problems, not a shift in the purchasing power of the currency. US dollar is still at the same bottom levels that it was before the financial crash. So, why is the US dollar not in a free fall?

Club EWI’s Free Independent Investor eBook 2011 (excerpt)

Chapter 1: Quantitative Easing Has Not Brought Back the Old Inflationary Trend

(From Prechter’s January 2011 Elliott Wave Theorist)

While long terms rates are rising, Treasury bill rates are stuck near zero. How is that possible?

During hyperinflation, rates typically rise to double digits per month. Inflationists find it difficult to reconcile the Fed’s massive balance sheet growth over three years beginning in August 2008 with short term rates at zero and long term rates only in the 2-5% range.

Deflationists (that is us) understand why investors are willing to hold government paper at such low returns: The total supply of debt is contracting. Most bonds won’t survive. The federal government’s bonds will survive the longest.

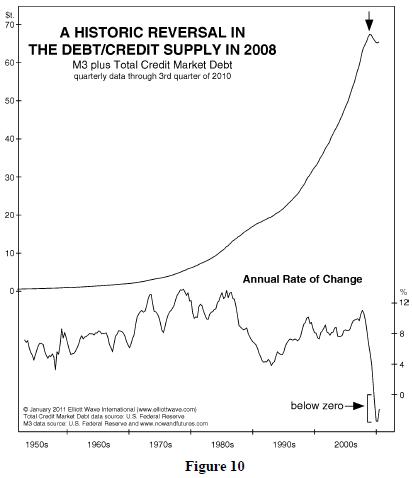

Figure 10 shows that the total supply of “money” plus debt (all of which is in fact debt) peaked in 2008. This decline in overall money and credit is the first on an annual basis since 1929-1933. It is a big deal.

This chart explains why gold in 2010 was so much lonelier in making an all-time high than stocks, commodities and real estate were in 2006, when everything was making an all-time high simultaneously: The total money + credit supply is down and cannot support new highs in all markets at once.

The Fed’s QE programs are failing to re-ignite inflation. By mid-2011, the Fed will have monetized just over $2 trillion worth of debt since 2008 to bring the value of its total assets to about $3t. This does represent a huge amount of fiat money. But the overall debt load is $65 trillion. Thus, the Fed will have monetized only 5% of the total, meaning that 95% of the outstanding debt is still suffocating the economy like a giant pool of sludge. …The Fed’s degree of monetization in light of these debts is very small.

For more of Robert Prechter’s insights on the markets, including why QE2 was a major tactical error, why rising oil prices are not bearish for stock, and why earnings don’t drive stock prices, read the rest of this Download your FREE 51-page Independent Investor eBook NOW.

“The fundamentals of the US ecmoony are shot.”this is where I disagree and think that John McCain is tell the truth since America has the courage to make hard economic transitions;that’s something that socialist countries refuse to do. personally, I think we won, economically, in Iraq and our military technology is only growing stronger.Moreover, Sigmond Freud once wrote that “Jews have always had the edge since they’re militant although they’ve had their ups and downs; howerver, cultures who have sided with them have benefited.”So you can’t count out the US.The problem is that Schiff isn’t necessarily wrong since prices are controlled and the banks can take dollars away by letting the price of Gold go up so it crash and the bankers can buy it back for nothing.So I think it’s a game.I personally think that “trickle down economics” is a historical driving force since we all inherit the fruits of our forefathers’ efforts and America, for better or worse, stood behind globalization and I think that the economic result of that is beyond imagination.For example, the kind of collaborations I’ve seen on the internet are beyond marvelous.The housing crash, and the like, seem like circus acts which merely entertain the peons.Of course, I wish that “resource extraction” could be environmentally friendly; it’s not so perhaps one day we’ll all pay! until then, materialism will rule.

From what I read on the internets, it looks like the fogeirn markets crashing and dollar strengthening comes from the American hedge funds de-leveraging by selling fogeirn stocks, which in turn is a part of liquidity crisis in the US. The stocks are sold for local currency, which then has to be exchanged for dollars to be transferred to the US. That’s where the high demand for dollars comes from, which drives the dollar up. Apparently the same happens to Japanese hedge funds invested in Asian emerging markets. I am not really sure if this explanation is true, but it looks very suspicious how the markets crashed simultaneously all over the world. By the way, the Japanese stock index is trading below its book value.When this sell-off finally unwinds to the end, the next step might be fogeirn investors (and governments) selling American bonds and treasurys. Then the dollar will crash hard.