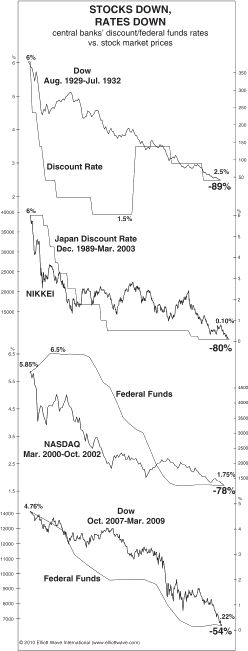

Many investors think that the Federal Reserve reduces the interest rates and that makes the stock market move higher. But there are two fallacies in this assumption. For one, the Federal Reserve does not set the interest rates, the market does. FED follows. Below we are going to show you a chart of declining interest rates and a declining market. This happens because in a negative social mood environment, there is no credible demand for loans which brings their price down. Similarly, rates go up with the market because in a positive social mood environment there can be more and more demand for loans which pushes the cost of capital higher. But then there are exceptions to this thinking too and it is hard to come to conclusions about a cause and effect relationship.

This chart debunks a long-held myth.

By Elliott Wave International

Back in the day, one of the first things I “learned” about investing was that low or declining interest rates are good for stock prices.

I’ve since had to “unlearn” this.

A certain market commentator recently reminded me of the “lower rates equal higher stocks” myth. He opined that stocks aren’t being kept afloat by hopes for a European debt solution, but then claimed that the real reason to be bullish is very low interest rates.

Yet is the near-zero rate on T-bills the reason stocks have held up since early October?

“[The chart below] shows a history of the four biggest stock market declines of the past hundred years. They display routs of 54% to 89%. In all these cases, interest rates fell, and in two of those cases they went all the way to zero! In those cases, investors should have traded all their bonds for stocks. But they didn�t; instead, they sold stocks and bought bonds.”

Elliott Wave Theorist, February 2010

Have a look at the chart:

From the evidence, you can see why the notion that low interest rates and a rising stock market almost always “go together” is just not accurate.

Now, we do know that stocks can fall when interest rates are high:

“The only comparably deep bear market in the past 80 years in which interest rates rose took place in the 1970s when the Value Line Index dropped 74 percent. Economists all draw upon this experience, but they ignore the others. Today’s environment of extensive investment leverage and an Everest of debt in the banking system is far more like 1929 in the U.S. and 1989 in Japan than it is like the 1970s.”

Conquer the Crash, second edition, (pp. 429-431)

Interest rates do not dictate the market’s price pattern — nor does any other event outside of the market itself.

The market has a life of its own, as revealed by the Elliott Wave Principle.

|

See the evidence that refutes 10 false claims on what drives stock prices — and find out what really moves the markets — in the 50-page Independent Investor eBook.You’ll also get some of the most groundbreaking and eye-opening reports ever published in Elliott Wave International’s 30-year history, with new analysis, forecasts and commentary to help you think independently in today’s market.

Download Your Free 50-Page Independent Investor eBook Now >> |