You Won’t Believe WHEN Pension Funds “Embraced Stocks as a Safe Investment”

Pension funds were already in a highly precarious position before the DJIA’s February 12 high and the subsequent start of the high drama in stock moves.

The 2018 edition of Robert Prechter’s Conquer the Crash noted:

The bull market in stocks has gone on so long that pension funds, formerly boasting conservative portfolios, have embraced stocks as a safe investment. … This is a setup for disaster.

Fast forward to Nov. 5, 2019 when the Wall Street Journal said:

Public Pension Plans Continue to Shift Into U.S. Stocks

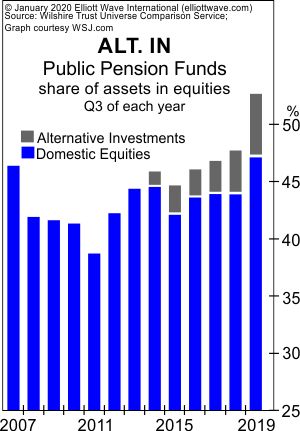

Discussing the same theme, our January 2020 Elliott Wave Financial Forecast showed this chart and said:

At the end of the third quarter, alternative investments such as private equity and who-knows-what made up 5.6% of [U.S.] public pension fund portfolios, a new record. At 47.3% in 2019, equities exceed the allocation at the stock market peak of 2007. ” … As in 2008, pension funds are doubling down. Once again, the strategy will prove a miserable failure.

Yes, deficit-plagued pension funds were nearly half invested in stocks — just when the main indexes started to plunge a few weeks ago.

On March 9, the Guardian, a British newspaper, put a positive spin on pensions and the market’s rapid downturn:

How badly has my pension been hit?

It’s bad, but not as grim as the headline falls in the FTSE or Dow suggest. As a rule of thumb, for every 10% fall in the FTSE, the value of your pension investments falls by about 5% to 6%.

Well, whether one chooses to call it “bad” or “grim,” one thing’s for sure: the British and U.S. stock markets have fallen even more since that article published.

Many observers believe the coronavirus “triggered” the big plunge in stock values. However, you may be interested in knowing that the Elliott wave model pointed to a big decline in the equity market well before the coronavirus became widespread frontpage news.

As example, our January 2020 Elliott Wave Financial Forecast (published Jan. 10) said:

The new year has coincided with new highs in the Dow Jones Industrial Average, but key pieces of evidence indicate that the rally is at or very near an end. … Now is the time to be prepared for a change of trend, which very few investors are currently anticipating.

Indeed, that “change of trend” did occur.

Now is the time to find out what EWI’s analysts anticipate for the stock market in the weeks ahead.

Elliott Wave International has been guiding investors through bull and bear markets since 1979. From that long experience, we know that at certain market junctures, we can help the most by giving everyone our latest analysis free.

Now is one of those market junctures.

Elliott Wave International has just made the entire “Stocks” section of our flagship market letter, the monthly Elliott Wave Financial Forecast, available to all Club EWI members, free. Your membership in Club EWI is also free.

It’s a rare opportunity to see what EWI’s subscribers are reading.

Read the Financial Forecast excerpt now, free

This will help you understand how the markets got to this juncture — and, more importantly what’s likely next.

Also, please feel free to share this special excerpt with friends and family.

Again, here’s that link: