When Even Bears Act Bullishly (What It May Mean)

“Some indicators are making records”

It’s difficult for most investors to take an independent stand from the crowd.

For example, it may be wise to “buy when there’s blood in the streets,” as Baron Rothschild famously said, but for many investors, that’s easier said than done.

Likewise, when a financial uptrend has persisted, it’s difficult for many investors to act in a contrary way to the pervasive optimism.

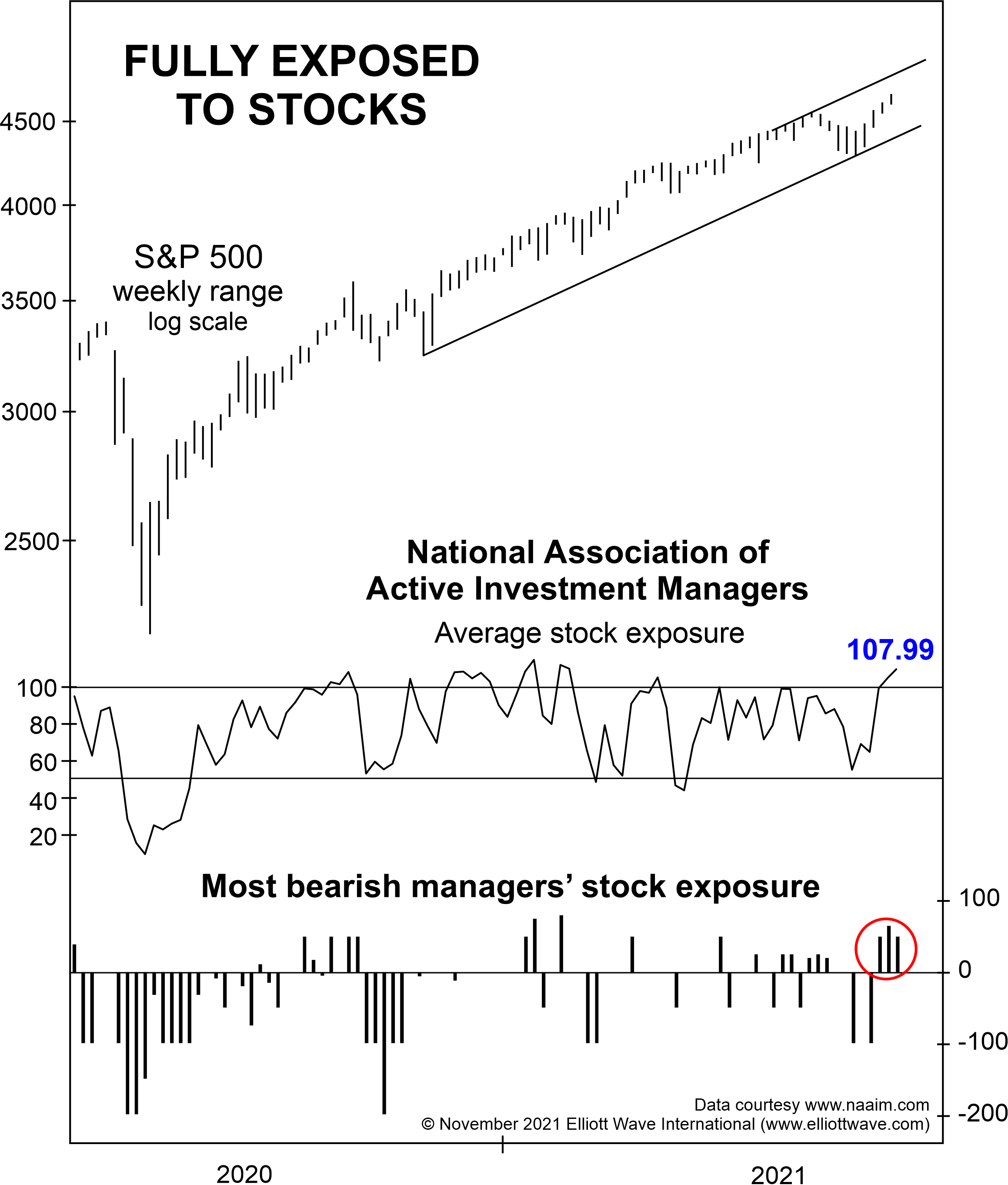

Consider this chart and commentary from the November Elliott Wave Financial Forecast, a monthly publication which provides coverage of major U.S. financial markets:

The chart shows the exposure to equities held by members of the National Association of Active Investment Managers. Readings above 100 mean that managers are leveraged long equities [and] this week’s reading [is] 107.99%. … Some indicators are making records. The bottom graph on the chart shows the equity exposure of the most bearish fund managers. Yes, even the bears are bullish. For the past three weeks, the most bearish fund managers were still net-long stocks by 50%, 65% and 50%. It’s the first time in the history of the data … that bearish fund managers have been net-long equities 50% or more for three consecutive weeks.

Here are three headlines which speak to the persistent bullish sentiment:

- Stocks Are Still the Place to Be, Our Exclusive Big Money Poll Finds (Barron’s, Oct. 16)

- Invesco records fifth straight quarter of net inflows (Pensions & Investments, Oct. 26)

- Fund managers make their biggest bets on U.S. stocks in 8 years … (Marketwatch, Nov. 16)

The takeaway is that when almost everyone acts bullishly, even the most bearish, there’s relatively few investors left to buy to keep an uptrend going.

This doesn’t mean that the financial uptrend will stop, say, tomorrow or the next day.

However, it does suggest that an investor will want to pay particularly close attention to the message of the Elliott wave model, which offers high-confidence insights into market turn junctures.

Indeed, here’s a quote from Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior:

When after a while the apparent jumble gels into a clear picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%. It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so.

The ability to identify such junctures is remarkable enough, but the Wave Principle is the only method of analysis that also provides guidelines for forecasting. Many of these guidelines are specific and can occasionally yield stunningly precise results. If indeed markets are patterned, and if those patterns have a recognizable geometry, then regardless of the variations allowed, certain price and time relationships are likely to recur. In fact, experience shows that they do.

You can gain insights into the recurring price patterns of the stock market by reading the entire online version of the book — 100% free!

All that’s required for free access is a Club EWI membership. Club EWI is the world’s largest Elliott wave educational community and is free to join.

Club EWI members are granted free access to a wealth of Elliott wave resources on financial markets, investing and trading.

Just follow this link to get started: Elliott Wave Principle: Key to Market Behavior — free and unlimited access.