Euro Stoxx 600: “Following the Script”

“If the 2007 analogue holds, the current rally [will] persist …”

On Oct. 24, 2022, Bloomberg said:

Forget about a Santa rally to rescue European stocks from their doldrums, say strategists from Goldman Sachs Group Inc. to Bank of America Corp.

A week and a half later, our November 2022 Global Market Perspective offered a different view:

If the 2007 analogue holds, the current rally [will] persist …

As it turned out, not only did the rally in the Euro Stoxx 600 persist through the holiday season, it carried well into 2023.

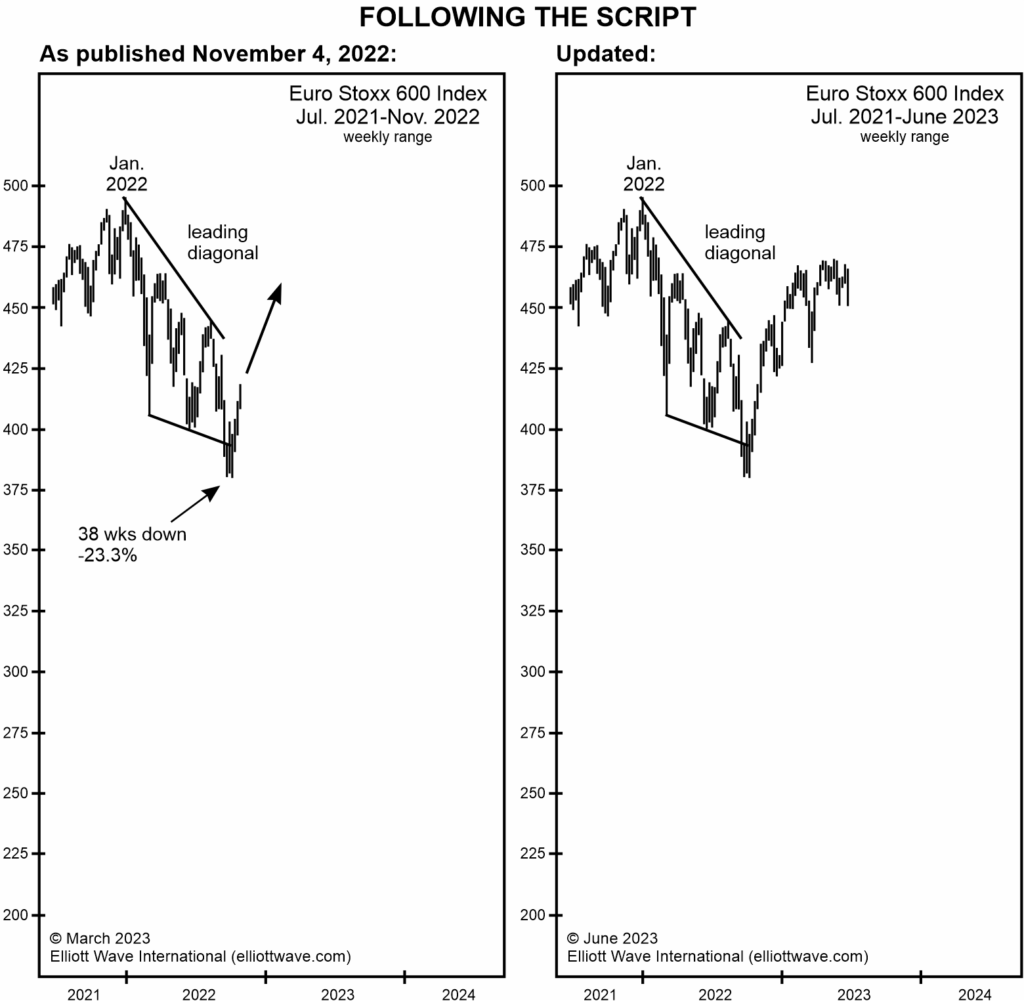

The just-published July Global Market Perspective, an Elliott Wave International publication which offers forecasts for 50-plus financial markets, provided an update with these charts and commentary [keep in mind that wave labels are available to subscribers]:

The charts bring the forecast up to date. In April and May, the Stoxx 600 briefly exceeded its 75% retracement level. On June 18, prices fell back below it and have yet to look back. The wave structure shows a complete zigzag at the May 19 high (see Elliott Wave Principle, p. 41, for the definition of a zigzag). A decline beneath the wave B low … will confirm the onset of [the next Elliott wave] down.

The July Global Market Perspective mentions that specific price level which will confirm the next sizeable leg down.

Do know that not all our forecasts work out so well. At the same time, the Elliott wave model is the best analytical tool of which we’re aware so we’ll continue to base our forecasts on the repetitive patterns of investor psychology.

As Frost & Prechter noted in Elliott Wave Principle: Key to Market Behavior:

The Wave Principle is governed by man’s social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.

Check Out These 5 Elliott Wave Setups — That EVERY Investor Needs to See NOW

Elliott Wave International’s Waves in Europe event is underway!

Now through July 21, EWI’s resident global market experts, Brian Whitmer and Murray Gunn, will show you 5 compelling Elliott wave setups for Europe’s biggest markets — opportunities that may be floating under your radar.

Even if you don’t invest in Europe, we encourage you to join. Brian and Murray are among the very best Elliott wave forecasters in the world. If you care about the markets, you shouldn’t miss this.

FREE, join EWI’s Waves in Europe event (easily a $99 value) >>