Stocks: Why “Buying the Dip” is Fraught with Danger

Investors know that the main U.S. stock indexes have tumbled very quickly.

On a historical basis, some may not realize just how quickly.

A March 23 Marketwatch headline referred to a “mind-bending stat”:

The S&P 500 has dropped 30% from peak to trough faster than any other time in history. The next three fastest were all nasty pullbacks during the Great Depression era. Yes, just 22 days for this stock market to get cut by a third.

This historically swift downturn has prompted a “buy the dip” mentality.

On March 23, a prominent founder of a financial firm told CNBC:

“I’m nibbling right now, for what it is worth.”

Other professional investors have also mentioned that they were doing a little nibbling of their own.

The sentiment expressed was that the market may have a little more downside to go, but that’s about it.

These professionals might turn out to be correct in their judgments of the market. Then again, just because stocks have fallen far and fast – doesn’t mean they can’t fall way farther.

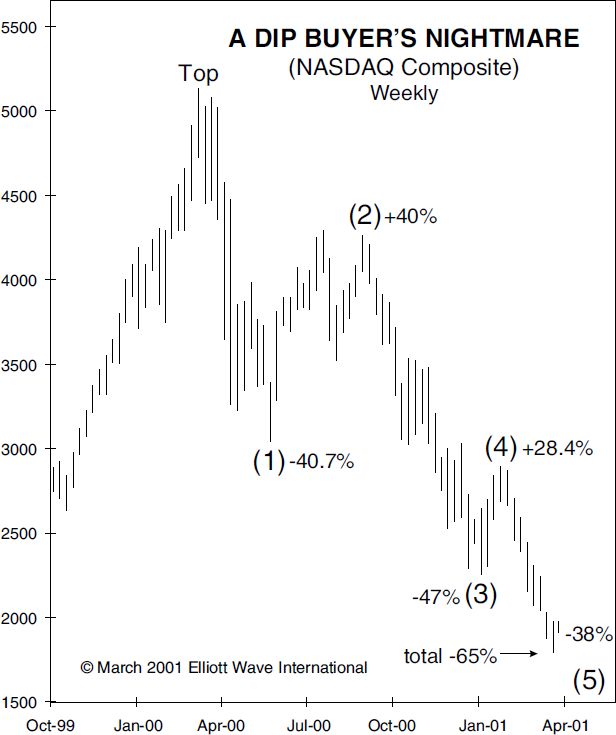

As a historical lesson, let’s take you back 19 years, when our April 2001 Elliott Wave Financial Forecast showed this chart and said:

“If there were ever a testament to the importance of market timing, the NASDAQ over the last year is it. Anyone who bought into the euphoria at the all-time high or the bull trap highs of early September and late January, would have taken successive hits of 40%, 47% and 38%. You can bet that many people followed the “buy” advice in the media on every bounce, losing even more than the “hold-only” loss of 65% from top to bottom.”

Bear in mind, the NASDAQ continued to fall into October 2002, handing even deeper losses to investors who continued to buy on the way down.

Returning to 2020, only time will tell when the bear market has bottomed, if it hasn’t already done so.

Yet, one thing’s for sure even now: The Elliott wave model is offering its own clues about what’s next for the main stock indexes.

See for yourself – 100% free.

You see, Elliott Wave International has just made available our entire “Stocks” section of our monthly Elliott Wave Financial Forecast to Club EWI members. Joining Club EWI is also free.

Elliott Wave International has been guiding investors through bull and bear markets since 1979. From that long experience, EWI’s analysts know that at certain market junctures, they can help the most by giving everyone their latest analysis free.

Now is one of those market junctures.

Read the Financial Forecast excerpt now, free.

This will help you understand how the markets got to this juncture — and, more importantly what’s likely next.

Also, please feel free to share this special excerpt with friends and family.

Again, simply follow this link:

Read the Financial Forecast excerpt now, free.

This article was syndicated by Elliott Wave International and was originally published under the headline Stocks: Why “Buying the Dip” is Fraught with Danger. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.