|

Another Blowout Ahead for Credit Spreads? Credit investors aren’t worried about a thing. They sneer at the possibility of a recession. A slew of corporate defaults? Nah. Complacency is so extreme that Elliott Wave International’s December Global Market Perspective warned that a tipping point might be at hand: Two of the most important credit-market sentiment… Read more Credit Spread Blow-out Ahead |

Category: Economy

Articles about the general economy, macro-economic indicators, money supply, FED and government policies.

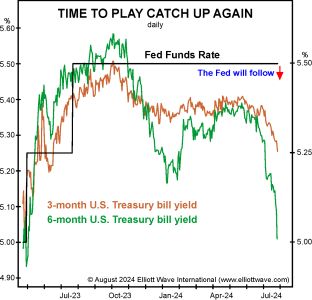

FED Follows the Treasury Rates

|

Will the Fed Do an About-Face in 2025? Would you like the ability to predict what the Fed will do with its fed funds rate? Just watch the bond market. Elliott Wave International’s August Financial Forecast did just that and predicted the Fed would “play catch up.” The chart below shows the current fed funds… Read more FED Follows the Treasury Rates |

Defaults Jump to Highest Level Since 2010

|

Debt, Defaults and Delinquencies (Oh My!) It’s a double whammy: U.S. credit card defaults jump to the highest level since 2010 as personal savings dry up. Expectations for the months ahead are even more glum. Elliott Wave International lay it out in their November Financial Forecast: The latest New York Fed Consumer Loan Survey reveals… Read more Defaults Jump to Highest Level Since 2010 |

2008 Will Look Like Child’s Play

|

This is Going to Shock People!”: Avi Gilburt and Bob Prechter Chat “It’s going to make 2008 look like child’s play,” says ElliottWave Trader’s Avi Gilburt when discussing the precarious balance sheets of U.S. banks with Elliott Wave International’s Robert Prechter. In the just-released webinar “A Fireside Market Chat with Robert Prechter & Avi Gilburt,”… Read more 2008 Will Look Like Child’s Play |

Deflation in China

|

Deflation in China: Impossible to Ignore Producer Price Index registers 22 straight months of decline Deflation’s grip on the world’s second largest economy is getting tighter. As Bloomberg noted on Sept. 9: China’s Deflationary Spiral Is Now Entering Dangerous New Stage The demand for goods has been weakening. Wages are stagnant. And, in addition to… Read more Deflation in China |

Don’t Count on FED

|

Don’t Count on Fed to Rescue Economy: Here’s Why The Fed’s September lowering of the fed funds rate was greeted with widespread celebration on Wall Street. Yet, history shows that such moves by the Fed don’t always translate into a glowing economy. Elliott Wave International’s October Financial Forecast provides perspective: The August 2 issue forecast… Read more Don’t Count on FED |

Printed Money Supply is Deflating

|

This Trend Will Likely Soon Rock the U.S. Financial System Why monetary inflation has been shrinking Nearly everyone who buys groceries, fills their car tank with gas, pays rent, buys car insurance and so on is talking about the high cost of living. And it’s true that consumer price inflation is higher today than before… Read more Printed Money Supply is Deflating |

China-Taiwan Conflict

|

Is a China-Taiwan Conflict Likely? Watch the Region’s Stock Market Indexes By Mark Galasiewski | Elliott Wave International The U.S. government in early May sanctioned 300 Chinese entities for supplying machine tools and parts to Russia for its war against Ukraine, while in mid-May Russian president Vladimir Putin made a two-day visit to China. In… Read more China-Taiwan Conflict |

Trouble Lies Ahead

|

Trouble Lies Ahead. Are You Ready For It? By Steven Hochberg | Elliott Wave International Conversations about whether or not the Fed will cut interest rates any time soon continue to dominate the airwaves. But we are looking elsewhere for signs about where markets and the economy are headed. Having observed market behavior for 45… Read more Trouble Lies Ahead |

FED leads or follows the markets?

|

The Fed Leads and the Market Follows? It’s a Big Fat MYTH We help investors by analyzing what really drives the markets. Along the way, we often uncover a market myth, something most investors believe moves the markets, but really doesn’t. I want to show you one of the biggest market myths in existence. It… Read more FED leads or follows the markets? |

Another Bank Failure

|

Another Bank Failure: How to Tell if Your Bank is At Risk Another bank failure, another underperforming share price. Philadelphia-based Republic First Bank was closed down on Friday, April 26, and the assets were sold to Fulton Bank. Republic First becomes the first bank failure of 2024. Given our outlook for the stock market and… Read more Another Bank Failure |

Time Tested Indicator

|

Why You Should Pay Attention to This Time-Tested Indicator Now “How High Can Markets Go?” — asks this magazine cover Paul Montgomery’s Magazine Cover Indicator postulates that by the time a financial asset makes it to the cover of a well-known news weekly, the existing trend has been going on for so long that it’s… Read more Time Tested Indicator |

Signs of Economic Slowdown

|

3 Signs of Developing U.S. Economic Slowdown “Credit standards are tightening, thereby freezing out borrowers” Recent headlines about the U.S. economy are rosy: US economic growth for last quarter is revised up slightly to a healthy 3.4% annual rate (AP News, March 28) US economy continues to shine with help from consumers, labor market (Reuters,… Read more Signs of Economic Slowdown |

Gold Price Targets

|

Gold: Setting Near-Term Price Targets This was our “initial upside target” — which has now been exceeded. What’s next? Around the first week of the year, the outlook for gold was not looking promising, at least according to this Jan. 5 headline (Reuters): Gold set for weekly decline as dollar, yields climb The rally in… Read more Gold Price Targets |

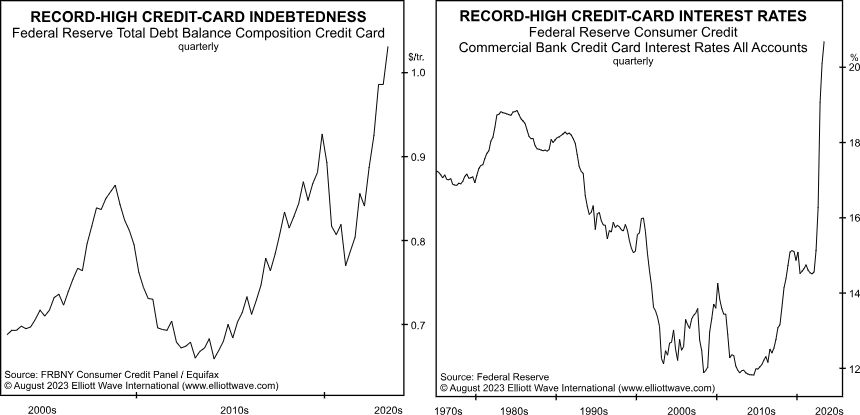

Once in a Lifetime Debt Crisis

|

Why You Should Expect a Once-in-a-Lifetime Debt Crisis U.S. credit card debt surpasses $1 trillion On a national level, a debt crisis occurs when a country is unable to pay back its government debt. This might result from government spending exceeding tax revenues for an extended period. On an individual level, a crisis can result… Read more Once in a Lifetime Debt Crisis |

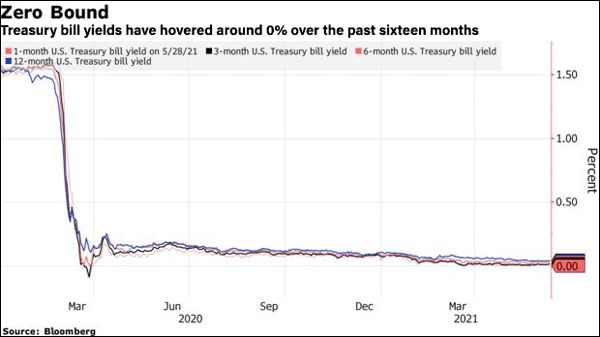

Interest Rates

|

Interest Rates: From 0% to Above 5% — to …? “The lines in the chart will turn up, and no policy will stop it” As you’re probably aware, many people who want to borrow to make a major purchase like a house or a car are bemoaning higher interest rates. It wasn’t so long ago… Read more Interest Rates |

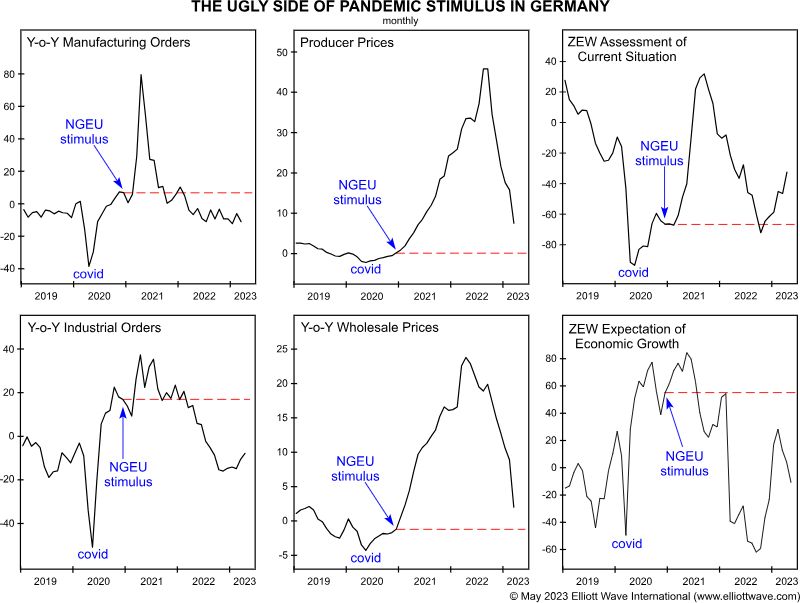

German Economy is Broken

|

How Germany’s Economy is Turning Ugly This economic gauge “dipped back below zero in less than a year” In November 2020, when fears were rampant over a second wave of the coronavirus pandemic, the president of the European Central Bank called for economic stimulus (Reuters): Facing gloomy outlook, Lagarde calls for unlocking EU aid In… Read more German Economy is Broken |

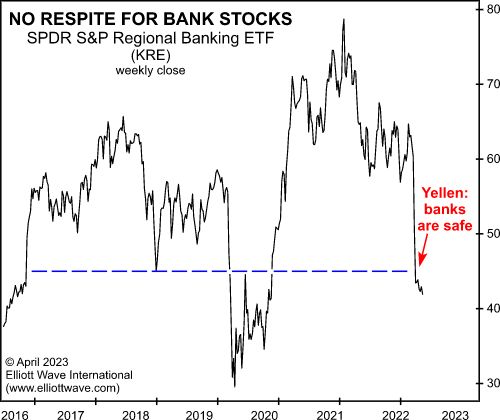

More Banks Could Fail

|

More Banks Could Collapse — A Lot More This ETF “continues to make lower lows” It’s sobering to reflect on the fact that the second, third and fourth largest bank failures in U.S. history have all occurred in just the past few months. They are First Republic, Silicon Valley Bank and Signature Bank of New… Read more More Banks Could Fail |

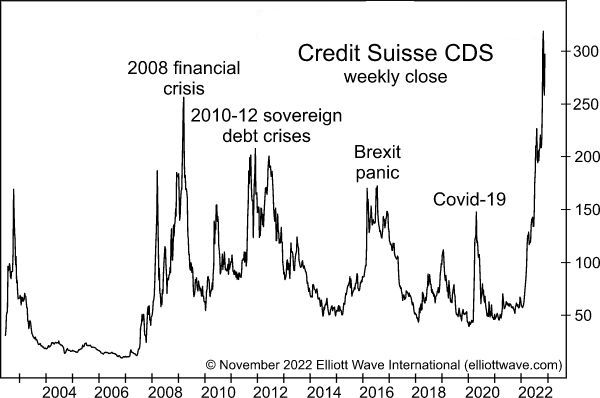

Credit Default Swaps Provide Warning

|

Credit Suisse: How the Price of Credit-Default Swaps Provided a Warning “… exceeded every high-water mark … of the past 15 years” Credit-default swaps were invented in the mid-1990s but a lot of people did not become aware of them until around 2000, and that awareness increased dramatically during the 2008 financial crisis. As you… Read more Credit Default Swaps Provide Warning |

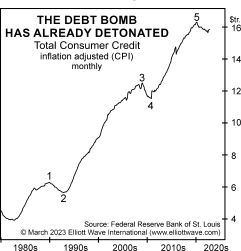

M2 Money Supply Deflates

|

U.S. Money Supply Deflates 2% Annually (What That Means) The debt bomb implodes: Expect recession and deflation Many pundits have expressed worry about the ramifications of global debt — and rightly so. As the Wall Street Journal noted toward the end of 2022: The world has amassed $290 trillion of debt and it’s getting more… Read more M2 Money Supply Deflates |