|

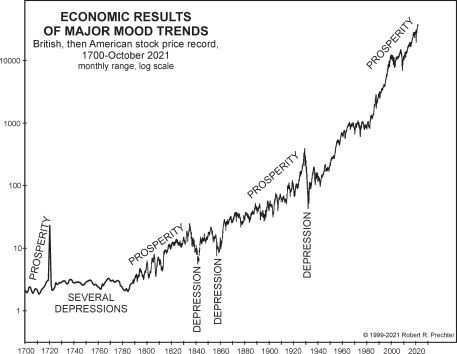

Why the Recession Consensus Might Be Too Optimistic “Major stock market declines lead directly to…” The verdict seems to be in: The economy is headed for a recession. These headlines from the past few months show what I’m talking about: A 2023 recession would mean job losses for most industries … (USA Today, Feb. 3)… Read more Recession Consensus Might Be Too Optimistic |

Category: Economy

Articles about the general economy, macro-economic indicators, money supply, FED and government policies.

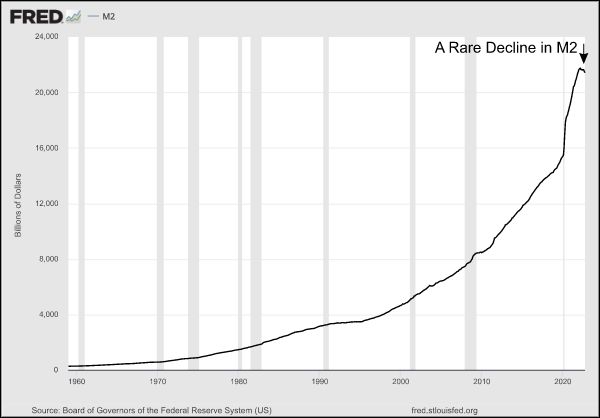

Deflation Threat

|

Why the Threat of Deflation is Real “The Federal Reserve is forging ahead with its balance sheet reduction” I know — inflation has been grabbing all the headlines for a good while now — so you may wonder why the subject of deflation is relevant. First, the definitions of inflation and deflation go beyond commonly… Read more Deflation Threat |

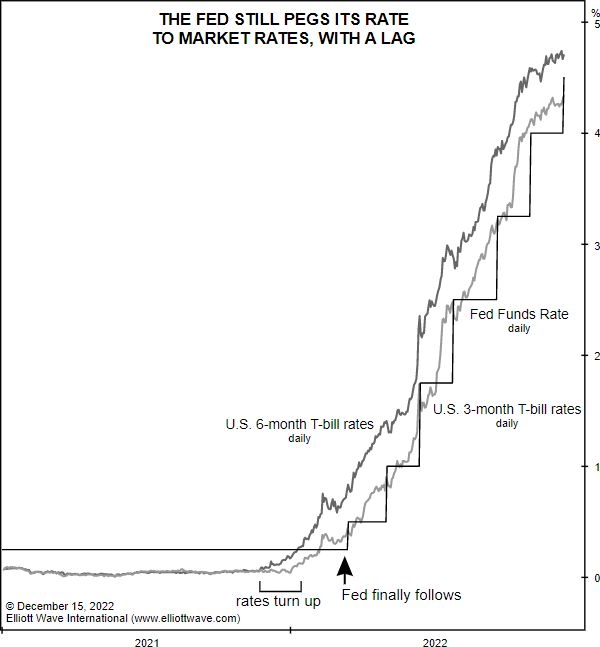

FED Follows Treasury Rates Again

|

Major Fed Myth: Debunked The Fed is reactive in setting rates – not proactive The days of near-zero interest rates are long gone — at least for now. As we look back on 2022, we know that it’s been a year of rising interest rates, and many observers say it’s all due to the Fed.… Read more FED Follows Treasury Rates Again |

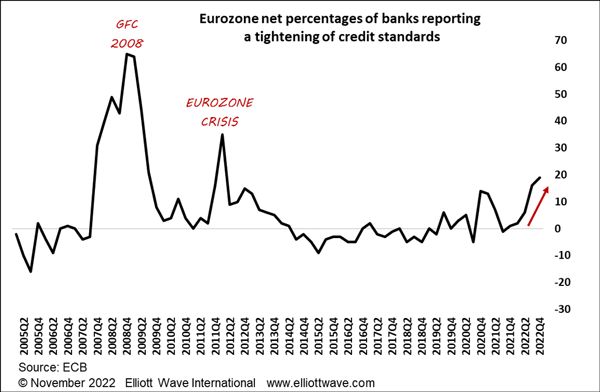

Tighter Lending Standards for Bank Loans

|

“Banks are becoming more cautious about lending” And the implications are bigger than just getting a loan Robert Prechter’s Last Chance to Conquer the Crash discusses the psychological aspect of a deflation: When the trend of social mood changes from optimism to pessimism, creditors, debtors, investors, producers and consumers all change their primary orientation from… Read more Tighter Lending Standards for Bank Loans |

Investors in US Treasuries Face Major Risk

|

Why Investors in U.S. Treasuries Face Major Risk Rising rates will be “disastrous” for governments, other debtors and creditors The market for U.S. Treasuries is the biggest bond market in the world, and it appears that potentially big trouble may be afoot. Earlier this month, none other than the U.S. Treasury Secretary herself (Janet Yellen)… Read more Investors in US Treasuries Face Major Risk |

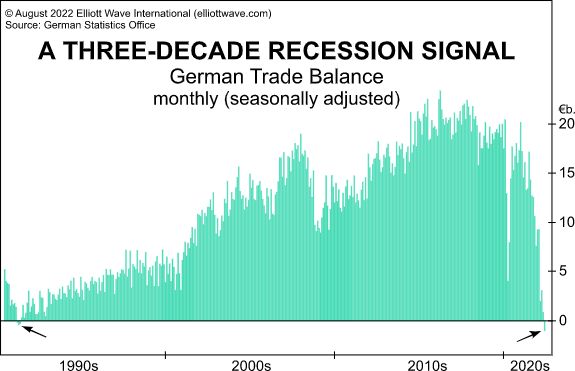

Will the Greatest Depression Start in Europe?

|

Will the “Greatest Depression” Start in Europe? This action by investors resulted in “the highest total since 2014, and probably ever” Many people are familiar with the Great Depression of the early 1930s, but most of them may not know that this economic calamity began in Europe before arriving in the U.S., as a past… Read more Will the Greatest Depression Start in Europe? |

How to Navigate a Bear Market

|

Market action this year has hurt A LOT of people. Cryptos. Meme stocks. Tech stocks. We’ve seen some huge percentage declines — all against a backdrop of historic leaps in interest rates and inflation. Lifestyles irrevocably changed, not for the better. Economists missed it. The Fed missed it. Politicians missed it. But a few folks… Read more How to Navigate a Bear Market |

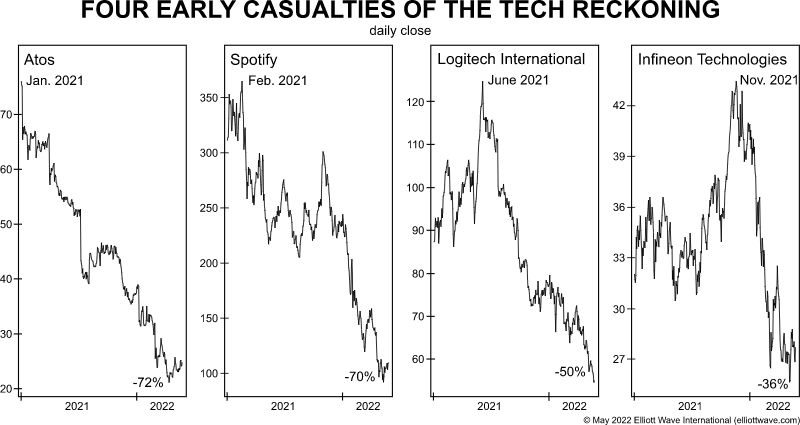

Tech Stocks and the Dot-com “Echo”

|

“Downside surprises should become the norm” The Wave Principle’s basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves, as illustrated in both bull and bear markets below: You probably recall the bursting of the dot-com bubble when the tech-heavy Nasdaq 100 plummeted 78% between March 2000 and… Read more Tech Stocks and the Dot-com “Echo” |

J.P. Morgan Hurricane Warning

|

Economic “Hurricane”: Here’s a Take on a Bank CEO’s Warning Here’s what reached a nadir as the war in Ukraine broke out On June 1, a CNBC headline said: [Major bank CEO] says ‘brace yourself’ for an economic hurricane caused by the Fed and Ukraine war Yes, the U.S. central bank is engaging in so-called… Read more J.P. Morgan Hurricane Warning |

Stock Market is the Leading Indicator

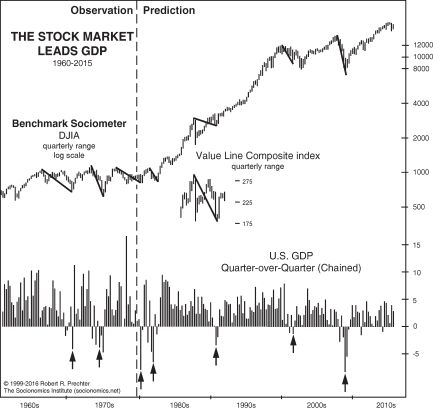

|

Why the Timing of the Next Economic Slump May Surprise — Big Time “The stock market leads GDP,” not the other way around Do you recall how many government officials, economists or bankers anticipated the severity of the “Great Recession” before late 2007 into 2009? Do you recall even one? If a name doesn’t come… Read more Stock Market is the Leading Indicator |

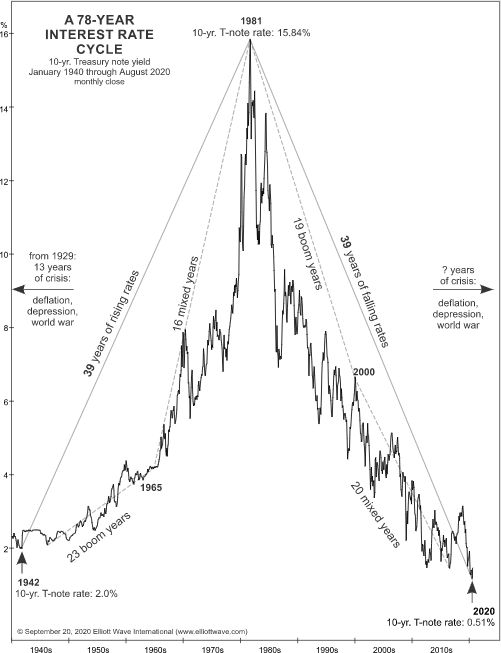

The Reversal in Interest Rates

|

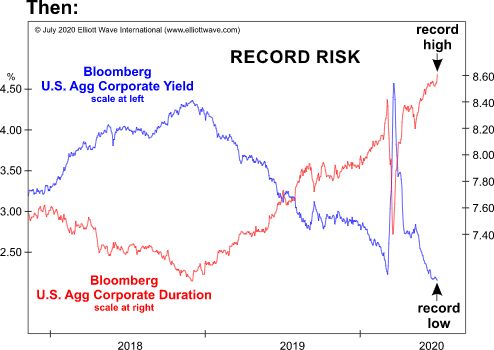

Interest Rates: The Warning That Few Wanted to Heed Here’s an update on this “hugely dangerous bet” Back in mid-2020, a common sentiment toward interest rates was that they would stay historically low for the foreseeable future. Indeed, in July of that year, no less than the Bank of Canada governor said (BNN Bloomberg): ‘Interest… Read more The Reversal in Interest Rates |

NFTs and Tulip Mania

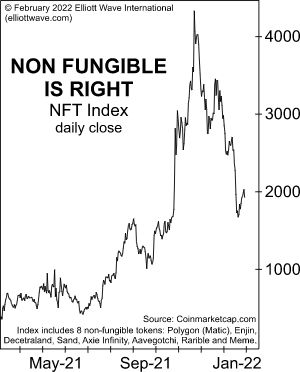

|

Non-Fungible Tokens (NFTs): A Replay of Holland’s “Tulip Mania”? The NFT Index is down more than 55% from its November high. It seems the financial world has gone a little crazy — maybe a lot crazy. Specifically, I’m talking about non-fungible tokens or NFTs for short. You may be familiar with them, but in case… Read more NFTs and Tulip Mania |

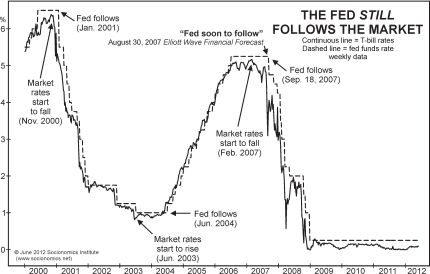

Does the FED Determine the Trend of Interest Rates?

|

Here’s what “leads” the effective federal funds rate Forbes magazine summed up the Fed’s January statement this way (Jan. 26): The federal funds rate remains on hold at zero to 0.25% for now, bond purchases should end in March — and then it’s time to raise rates. The speculation on Wall Street is that the… Read more Does the FED Determine the Trend of Interest Rates? |

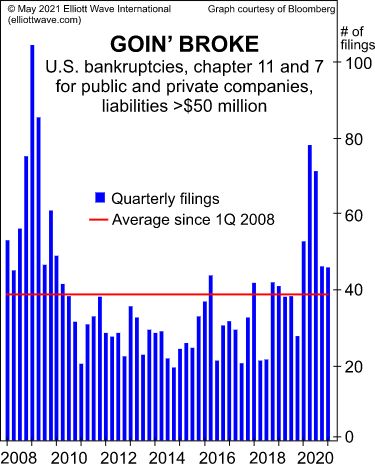

Corporate Bankruptcies

|

Why U.S. Corporate Bankruptcies Could Skyrocket “U.S. bankruptcies in the first quarter of 2021 and all of 2020 were above the 13-year average” An April 17 article headline on the website of National Public Radio says: U.S Economy Looking Good As Spending Jumps In March And, on April 29, The New York Times said: Americans’… Read more Corporate Bankruptcies |

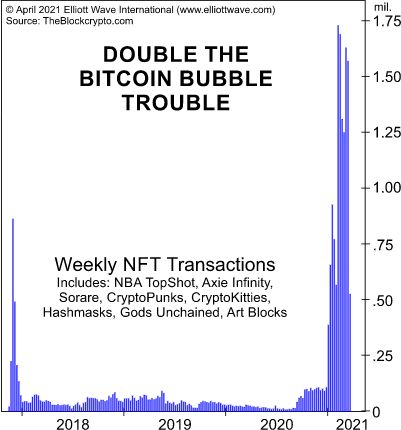

Non-Fungible Tokens Mania

|

Cryptos: What the “Bizarre” World of Non-Fungible Tokens May Be Signaling The world of cryptos includes something known as non-fungible tokens, which go by the acronym NFTs. If you’re unfamiliar with them, they’re a bit bizarre but quite simple. Here’s what the April Global Market Perspective, a monthly Elliott Wave International publication which covers 50+… Read more Non-Fungible Tokens Mania |

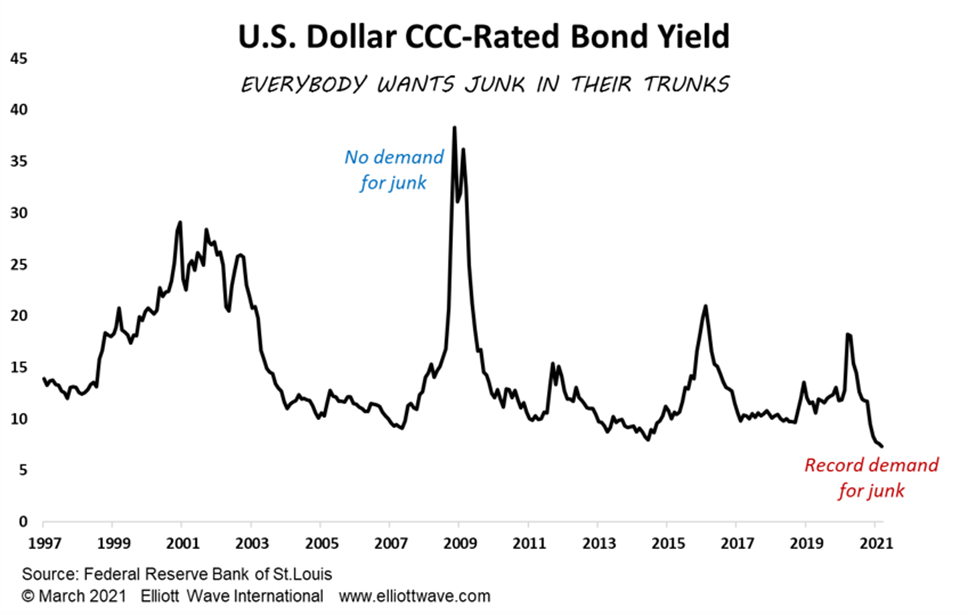

Record High Junk Bond Demand

|

If raising money doesn’t get any easier than this, what’s next? The latest data from Refinitiv shows that companies have raised a record $140 billion in the U.S. dollar junk bond market during the first quarter of this year. That beats the previous record set during the second quarter last year when companies scrambled to… Read more Record High Junk Bond Demand |

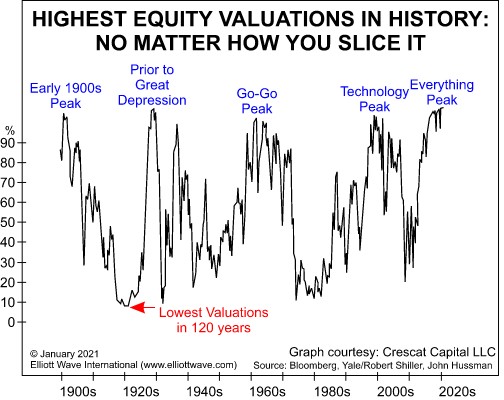

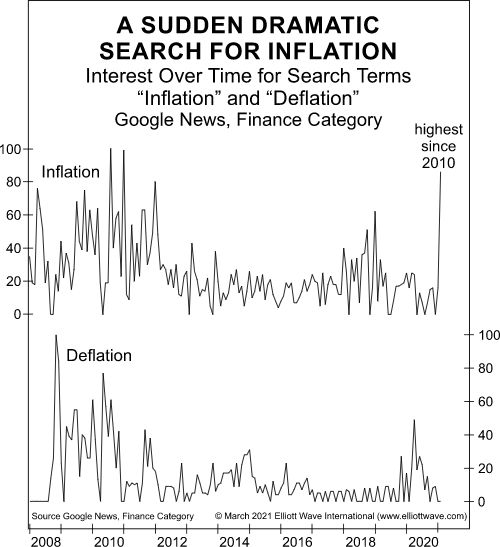

Inflation or Deflation?

|

What the “Sudden, Dramatic” Surge in Googling “Inflation” Tells You It likely “typifies the end of an old economic trend and the beginning of a new one” In the news, you hear that the big monetary fear these days is the prospect for a jump in inflation. Here are some headlines since the start of… Read more Inflation or Deflation? |

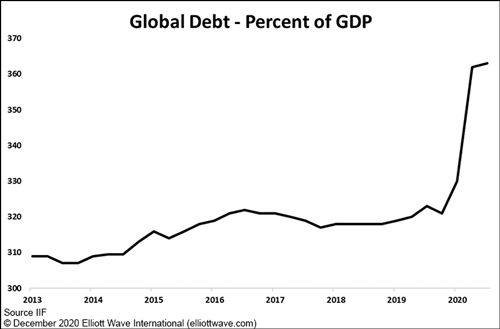

Debt: Precursor to an Economic Depression

|

Global Tipping Point: “Good” Debt Vs. “Bad” Debt (Which is Winning?) All major U.S. economic depressions were “set off” by this single factor! Isn’t all debt “bad”? Well, in a word, no. Broadly speaking, there are two types of debt. One of them actually adds value to the economy if handled in the right way,… Read more Debt: Precursor to an Economic Depression |

Trump vs Biden

|

The U.S. presidential election is just days away. What does the stock market say about who is likely to win? Which party would be better for the stock market and the economy? And how can you anticipate trends in politics, the economy and broader society going forward, regardless of who wins? Get deeply researched answers… Read more Trump vs Biden |

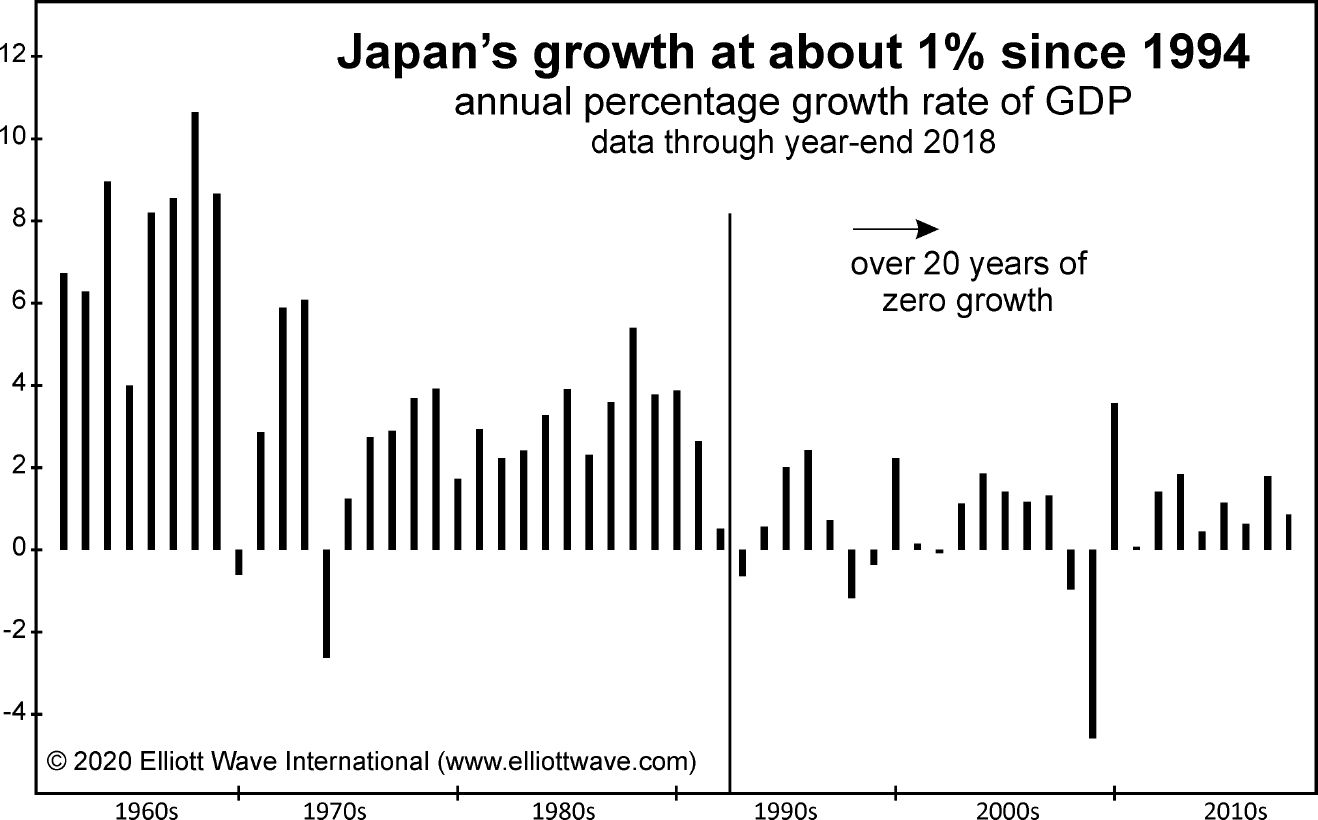

Japan Like Deflation in the United States

|

The U.S. faces the prospect of a Japan-like deflation. Let’s begin with a brief review of Japan. Here’s a chart and commentary from the 2020 edition of Robert Prechter’s Conquer the Crash: Japan had one of the strongest economies in the entire world, growing at a 9% rate for 20 years up to 1973, and… Read more Japan Like Deflation in the United States |