|

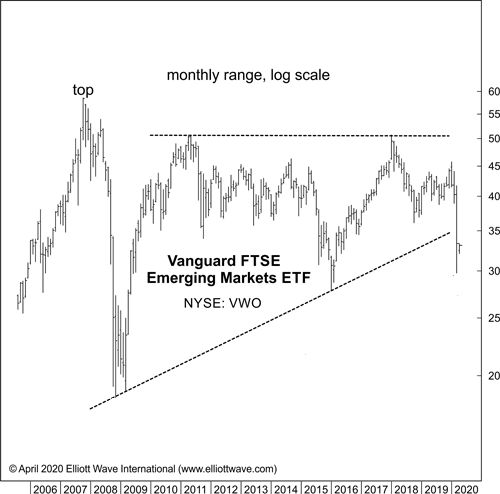

An Eye-Opening Perspective: Emerging Markets and Epidemics People across the entire planet remain very much aware of the COVID-19 health threat. The global disruption associated with the pandemic far surpasses other major health scares in modern history. Even so, you may recall 2009 news articles similar to this one from the New York Times (June… Read more Emerging Markets and Epidemics |

Category: Economy

Articles about the general economy, macro-economic indicators, money supply, FED and government policies.

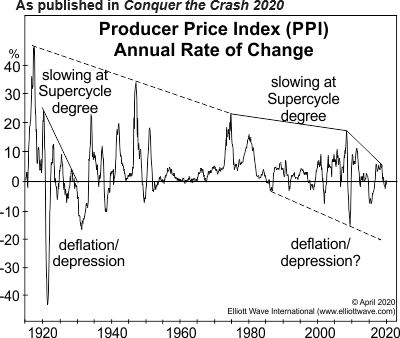

Deflation vs the FED

|

Weeks before the February top in the DJIA, the January Elliott Wave Theorist (Elliott Wave International President Robert Prechter’s monthly publication about financial markets and social trends since 1979) said: Most economists believe the Fed can prevent financial crises and depressions. [EWI’s analysts] disagree. Socionomic theory proposes that naturally fluctuating waves of social mood regulate… Read more Deflation vs the FED |

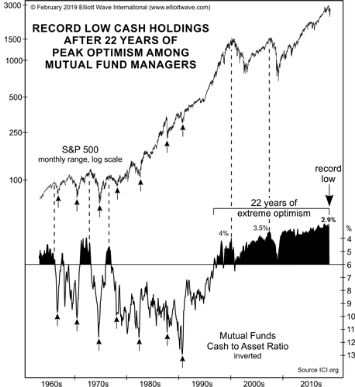

US dollar goes up in a Deflationary Crash

|

The relative value of cash will necessarily zoom higher when stocks plunge. A negative sentiment toward cash had been in place for quite some time. Let’s go back a little more than a year when our Feb. 2019 Elliott Wave Theorist showed this chart and said: The average cash holding in mutual funds just fell… Read more US dollar goes up in a Deflationary Crash |

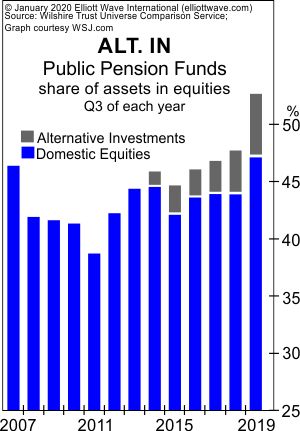

Pension Plans Investing in Stock Market

|

You Won’t Believe WHEN Pension Funds “Embraced Stocks as a Safe Investment” Pension funds were already in a highly precarious position before the DJIA’s February 12 high and the subsequent start of the high drama in stock moves. The 2018 edition of Robert Prechter’s Conquer the Crash noted: The bull market in stocks has gone… Read more Pension Plans Investing in Stock Market |

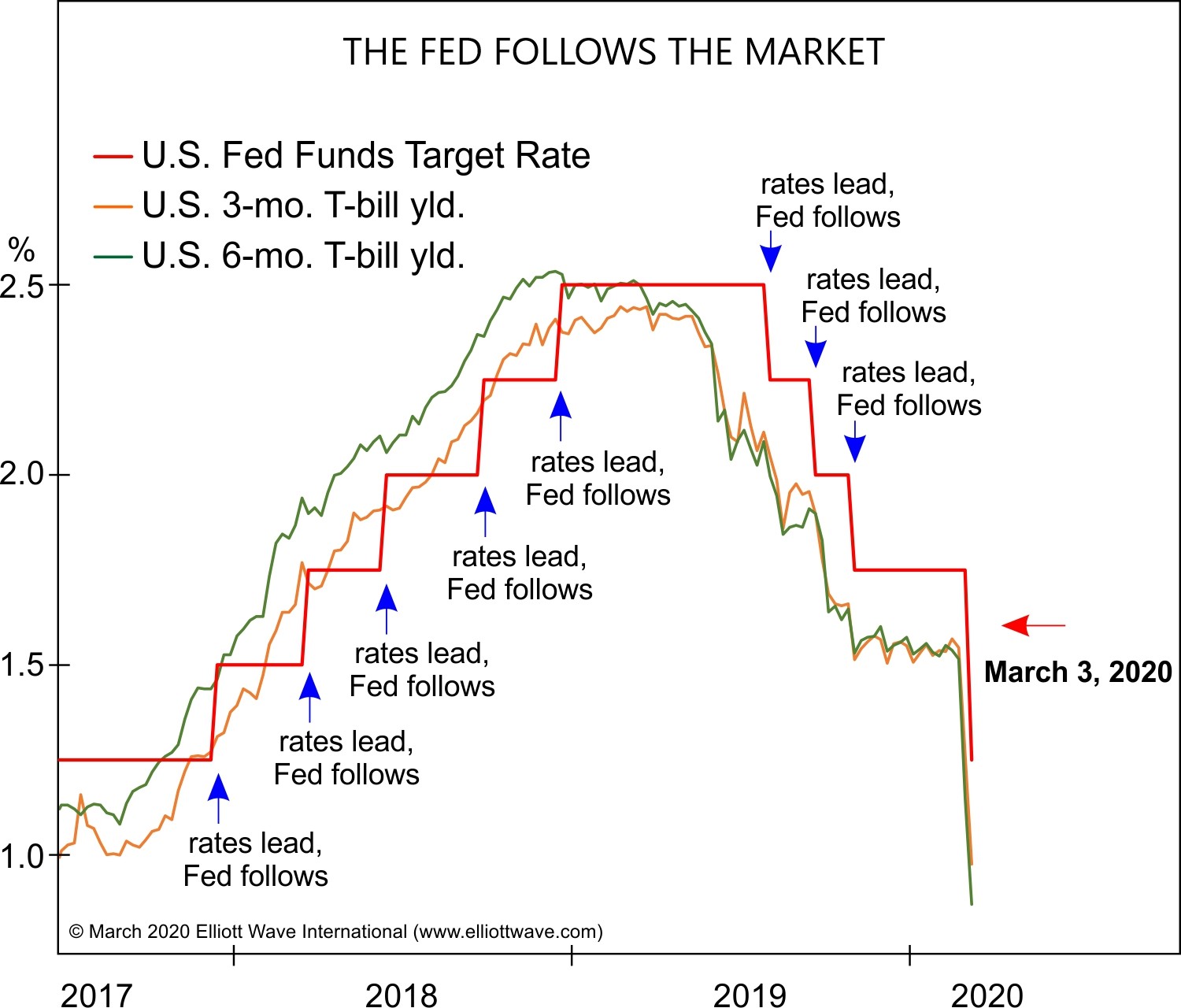

Why did the Fed cut the rates

|

Think the Fed’s Emergency Rate Cut is Proactive? Think Again. You might think that the Fed’s recent, unscheduled 50 basis-point cut in the federal funds rate is a proactive move that places the central bank at the vanguard of revolutionary uses of monetary policy. But that could hardly be further from the truth. For decades… Read more Why did the Fed cut the rates |

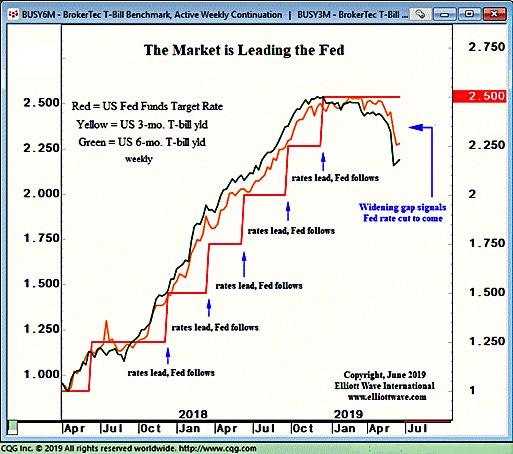

FED is Going To Cut the Rates Soon

|

Elliott Wave: Market Signaling Fed to Cut Rates Soon We have tracked the U.S. Federal Reserve’s interest rates decisions for years. Back in March 24th, we said FED follows the market lead. This week, the Fed once again decided to keep the funds rate unchanged. We expect the Fed to change course soon. We have… Read more FED is Going To Cut the Rates Soon |

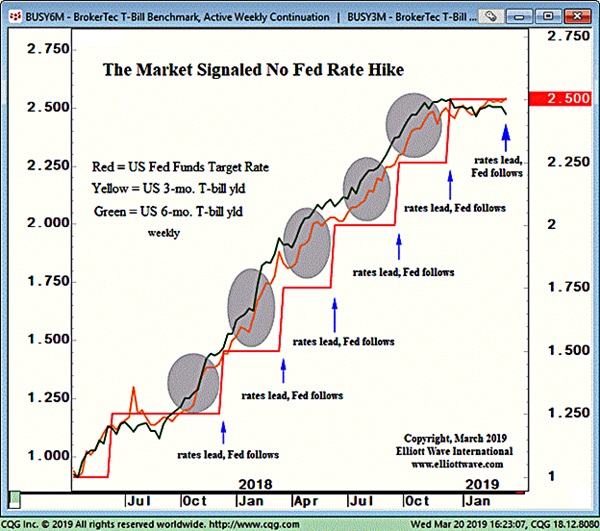

FED follows the market lead

|

Back in December, Elliot Wave International wrote an article titled “Interest Rates Win Again as Fed Follows Market.” In the piece, it was noted that while most experts believe that central banks set interest rates, it’s actually the other way around—the market leads, and the Fed follows. They pointed out that the December rate hike… Read more FED follows the market lead |

The Economist – The World in 2019

|

The Economist magazine, propaganda tool of the Globalist elite has a dark prediction for 2019. The cover is full black. There are speculations about what it really means. Is it the coming world war? Is it a financial crash? If yes, it is probably not a recession, but a depression that rivals Great Depression if… Read more The Economist – The World in 2019 |

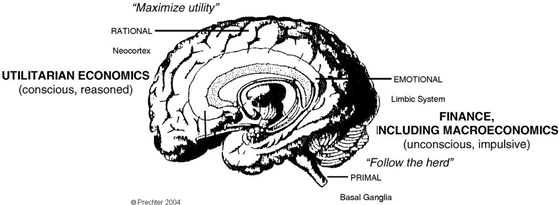

How To Beat Herding Impulse in the Financial Markets

|

We all love a bargain… …Except when it comes to stocks. The reason boils down to uncertainty. We know what our fruits and vegetables should cost at the grocer’s — but we’re far less certain about how much to pay for a blue-chip stock or shares in an S&P 500 Index fund. So how does… Read more How To Beat Herding Impulse in the Financial Markets |

Socionomics and Elliott Waves

|

Robert Prechter Talks About Elliott Waves and Socionomics According to Socionomic theory, behavior of the aggregate population is patterned just like seasons, and that has far reaching ramifications, especially for financial markets. Let’s hear it from the father of the Socionomic theory, Robert Prechter. 1. How did you come across Elliott wave analysis? My dad… Read more Socionomics and Elliott Waves |

Financial Forecast 2017

|

Our friends at Elliott Wave International (EWI) regularly put out great free content on their site. If you’ve visited their site before, you may have seen “Chart of the Day,” a featured series of videos that take a quick, but close examination of a chart from one of EWI’s paid publications. Since Robert Folsom began… Read more Financial Forecast 2017 |

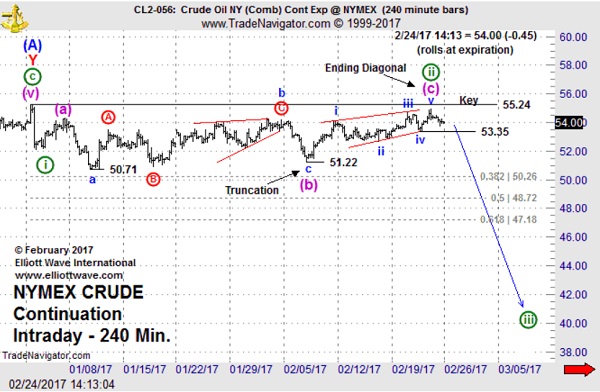

Crude Oil Sinks

|

Crude Oil Sinks 20%: Why “Oversupply” Isn’t the Half of It Oil prices have defied bullish efforts to curb oversupply. Here’s our take on why. I have a friend… let’s call him Larry. Let’s just say, Larry is not a fan of taking risks. He likes his reflexes fast, his cars slow, and his financial… Read more Crude Oil Sinks |

Central Bank Balance Sheet Expansion Continues without INFLATION

|

See our global market charts that cover $18 TRILLION, inflation(?), and a truly bold forecast. What You Need to Know NOW About Protecting Yourself from Deflation Get this free, special report about the unexpected but imminent and grave risk to your portfolio. You’ll also get 29 specific forecasts for Stocks, Real Estate, Gold, New… Read more Central Bank Balance Sheet Expansion Continues without INFLATION |

The Decline of the U.S. Retail – Is it Deflation?

|

For those tempted to chalk up the financial troubles of “bricks and mortar” shopping malls to the rise of online shopping, consider this from USA Today (Jan. 27, 2017): While online shopping is growing at a rapid rate of 15% a year, it’s still only 8% of all retail sales. The Decline of the U.S.… Read more The Decline of the U.S. Retail – Is it Deflation? |

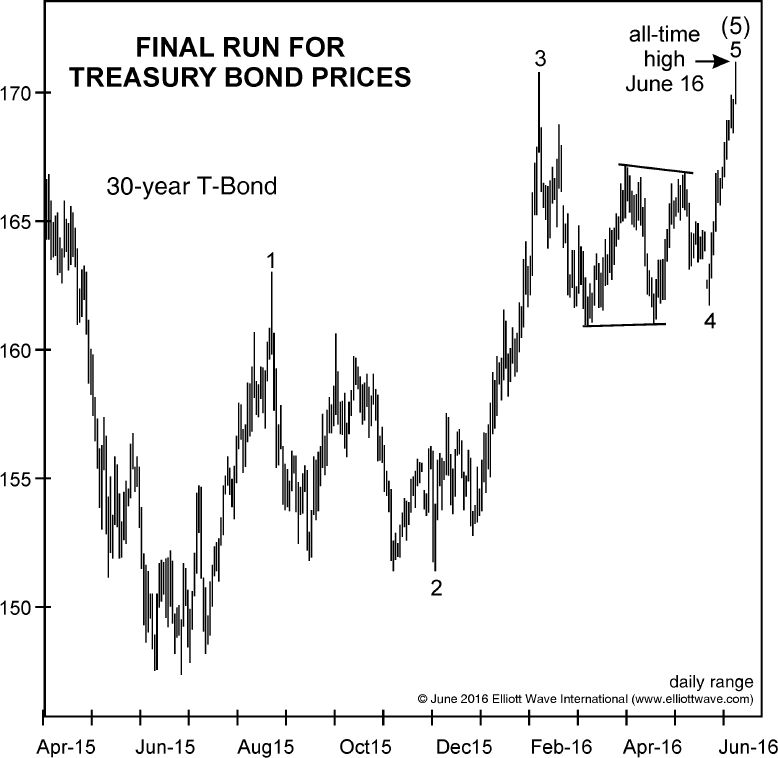

The Bond Market Rout

|

Violent Bond Selloff: An Eye-Opening Perspective In Elliott wave terms, bond investors have transitioned from extreme optimism to extreme pessimism. The bull market in bonds has been running for decades. We may have seen the top. Some call it the greatest bull market of our time, even exceeding stocks. Is it over? Have we seen… Read more The Bond Market Rout |

3 Charts That the FED Does NOT Want You To See

|

We recently saw all-time highs in the stock market,. But does it indicate a healthy economy? Usually the economic indicators lag the financial markets. Markets go up first, recession ends later. Similarly markets go down first and recession appears later. So the market is up. But the US economic data is lagging badly. The economy is going… Read more 3 Charts That the FED Does NOT Want You To See |

How to Invest for the Brexit?

|

Will the Britain exit EU? If you follow Europe’s major financial news networks, you’re no doubt inundated by all the rumor and conjecture surrounding the Brexit referendum — it dominates the headlines. Back across the pond, the Washington Post calls it the “most important vote in Europe in a half-century.” So will Great Britain exit… Read more How to Invest for the Brexit? |

Can the FED Go For Negative Interest Rates?

|

FED has kept interests close to 0% for many years. We went through many rounds of QE. We have inflated assets bubbles in housing and the stock market once again -according to some- to worse levels than 2007. FED has finally increased the rates marginally and the stocks started to come down furiously. After a… Read more Can the FED Go For Negative Interest Rates? |

How to Survive a Global Financial Crisis

|

Gold topped in 2011, oil topped 2014. Various commodities topped within the past few years. Stocks and housing still survived till 2016. Over 3 trillion dollars have been wiped off the value of global stocks since the start of 2016. With that in mind, I urge you to read Robert Prechter’s free report, How to… Read more How to Survive a Global Financial Crisis |

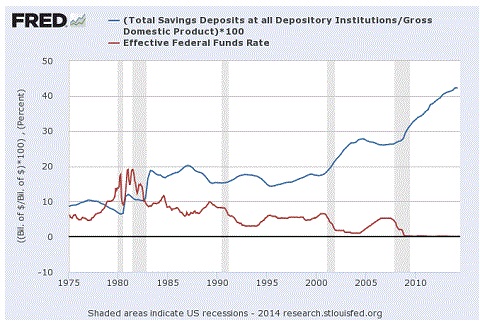

Consumers Are Now Savers

|

The real reason consumers aren’t spending is not a matter of monetary policy; it’s a matter of psychology. On June 2, the postman rang once — and, boy, did he ring. That day, the Wall Street Journal published a strongly worded letter titled, “Grand Central: A Letter to Stingy American Consumers,” which included these notable… Read more Consumers Are Now Savers |