|

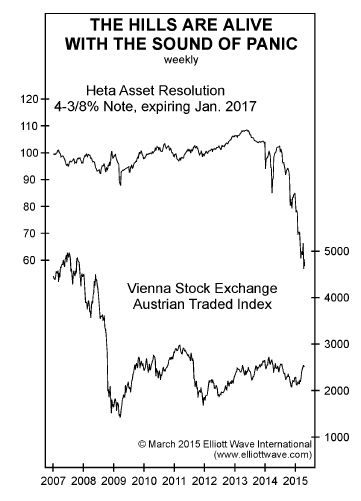

Elliott Wave International’s European markets expert Brian Whitmer often cautions his subscribers to beware of the pitfalls that will accompany the developing deflation in Europe. On May 20-27, Brian is hosting a free 5-video event at elliottwave.com: Investing in Europe: 5 Critical Insights. “Europe seems to be leading the way on important global trends, so… Read more Deflation Nightmare in Europe |

Category: Economy

Articles about the general economy, macro-economic indicators, money supply, FED and government policies.

IRS Seizes All Money from Country Store

|

Another shot fired in the “War on Cash” Learn how your hard-earned money may be in jeopardy. Read War on Cash Follow this link to download your free report » Lyndon McLellan owns the L&M Convenience Mart in rural North Carolina. A few months ago, the Internal Revenue Service went to McLellan’s bank and seized… Read more IRS Seizes All Money from Country Store |

New Perspectives on Gold, Euro & Crude Oil

|

Experienced traders say that sometimes, just 2 or 3 good trades make their entire year. True: If you get in early and ride the trend for a few weeks or months, that may be all you need. That’s why having a perspective on the markets is so important. That’s also why, our friends at Elliott… Read more New Perspectives on Gold, Euro & Crude Oil |

What is Next for Crude Oil?

|

Crashing oil is all over the news. Mainstream media tells us why the oil fell. And we keep hearing that it will continue to fall. But back in June all we heard was why the oil was destined for new highs. Why is the new so useless? Because 99% of oil forecasts out there are… Read more What is Next for Crude Oil? |

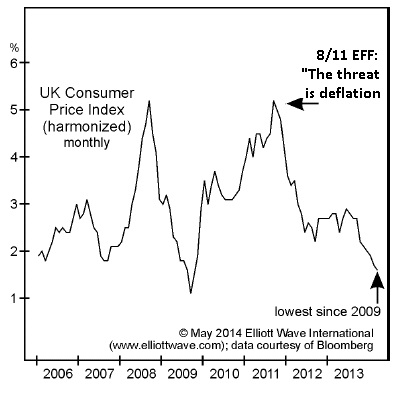

What is Scarier Than Deflation?

|

As early as 2011, our analysis warned that Europe’s deflation was coming — here’s why For the economies of Europe, the past few months have felt like one long ice-bucket challenge that never ends: A perpetual state of shock induced by the bone-chilling fact thatdeflation “…has become a reality in many European countries.” (Oct. 24,… Read more What is Scarier Than Deflation? |

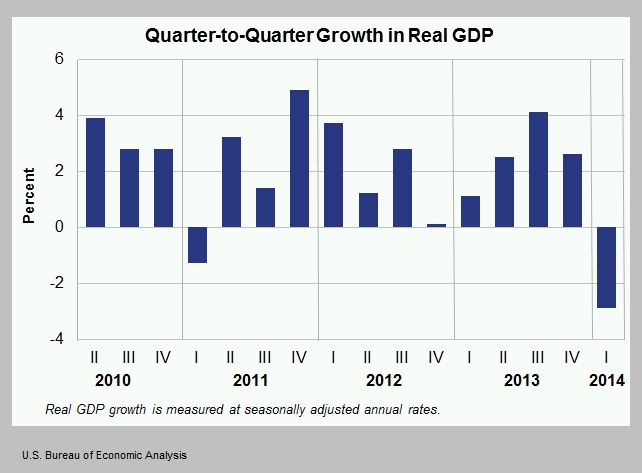

Is Deflation Coming Again?

|

Not Inflation, But Deflation The Elliott Wave Financial Forecast warns that the contracting U.S. economy signals deflation ahead In June, the U.S. government, revising its previous number, reported that the economy shrank by 2.9% in the first quarter of 2014. The steep plunge caught the bulls by surprise. It was substantially worse than the preliminary… Read more Is Deflation Coming Again? |

Deflationary Forces Preventing FED’s Rescue Efforts

|

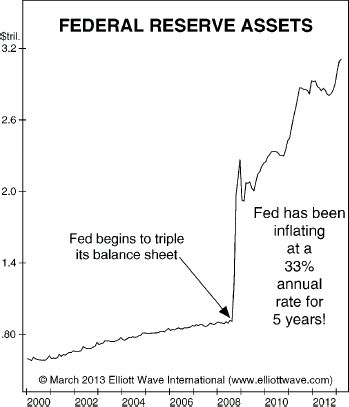

The Federal Reserve’s efforts to rescue the economy have been historically aggressive, starting with the initial round of quantitative easing in 2008 and continuing through 2013. Much money has been printed, despite what Bernanke says. M1 has been more than tripled. Yet Gold is down, commodities market is down, and inflation is still at historic low levels!… Read more Deflationary Forces Preventing FED’s Rescue Efforts |

Deflation Warning

|

Money Manager Startles Global Conference. History shows that the U.S. should pay attention to economies in Europe. The economy has been sluggish for five years. There’s no shortage of chatter about “why,” yet few observers mention deflation. Bernanke has been printing trillions. ECB and Bank of Japan has joined the reflation efforts and promised to… Read more Deflation Warning |

Is Deflation Possible?

|

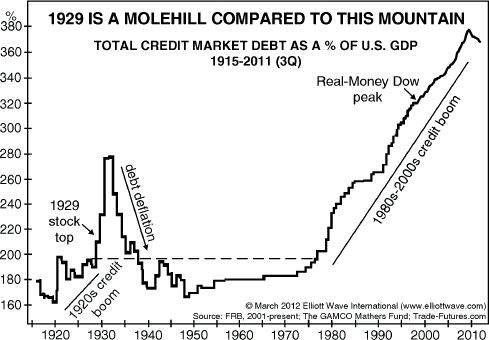

To understand the deflation problem, one must understand the nature of money and the amount of total debt in the US economy. In a credit based economy, money is created when banks make loans. Our money supply is not what Bernanke prints, but it is what we borrow. Fractional reserve banking coupled with interest based… Read more Is Deflation Possible? |

Financial Tsunami Coming

|

The size of the coming wave will surprise everyone It has been 4 years since the 2008 crash, and we have mostly forgotten about the dark days of financial calamity that almost destroyed the world economy. It was later revealed that FED made tens of trillions of loans to ailing institutions to save the world.… Read more Financial Tsunami Coming |

Deflation and Kondratieff Winter is About to Intensify

|

After the crash of 2008-2009, Kondratieff Winter has eased. Money supply expansion has resumed with more borrowers stepping upto the plate. QE1 and QE2 has added to the base money supply and saved the banks – for now. But financial changes can happen at lightning speed in a way we do not foresee. History books… Read more Deflation and Kondratieff Winter is About to Intensify |

Conquer the Crash in Kondratieff Winter

|

Financial assets has still not recovered from the financial crash of 2008. One could argue we are still in Kondratieff Winter. But will it get better or will it get worse? Have we seen the stock market bottom in 2009? Is it safe to buy and hold stocks for the long run? Or is buy… Read more Conquer the Crash in Kondratieff Winter |

Austerity in America

|

What will austerity look like in America? State and local governments are broke. Pension plans are unfunded. Unemployment is as high as ever. Sovereign debt is a problem. The total debt in the world economy is too high. Entire western world has borrowed excessive amounts in the last few decades. This is not just the… Read more Austerity in America |

Global Debt Bubble

|

Debt Bubble is More Threatening Than Any Single Economic Sector Now History shows that once a financial bubble bursts, it can take a long time to bounce back. We had a crash in 2008 and since then nothing has been fixed other than printing money and handing it out to the failed banks. Now we are doing… Read more Global Debt Bubble |

Public Pension Funds Are In Trouble

|

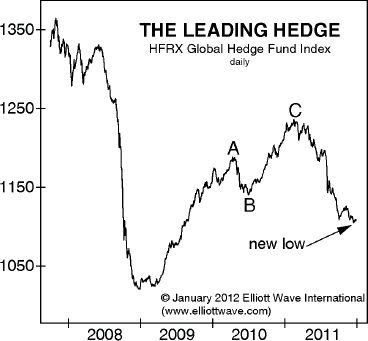

It has been years since the great recession, but unemployment remains stubbornly high. Europe is struggling with the debt problems of it’s members and the debt problem of the US is in check by strong demand to US dollar despite Bernanke’s printing press. But is a bull market ahead of us despite all of our… Read more Public Pension Funds Are In Trouble |

Is the World’s Central Bankers’ Strategy Working?

|

Debt is the world’s problem. After decades of credit inflation, deflationary pressures have been forcing central banks to take actions across the globe. The Fed is not the world’s only central bank dealing with debt. Watch as Steve Hochberg, EWI’s chief market analyst, shows what has happened to GDP in countries around the world as… Read more Is the World’s Central Bankers’ Strategy Working? |

Largest US City Bankruptcy is Coming

|

As pundits chatter about an economic recovery, 80 miles east of San Francisco you’ll find a city (pop. 292,000) facing bankruptcy: Stockton is on the verge of becoming the largest city in the United States to declare bankruptcy… San Francisco Chronicle (3/4) Bloomberg reports (2/25) that it costs the city $175,000 just to get a… Read more Largest US City Bankruptcy is Coming |

Who is Going To Win the Presidential Elections?

|

Is Obama going to win the elections to serve his second term? Can the Republican nominee beat Obama? Does it matter if it is Romney or Santorum or Ron Paul? or Gingrich? Or does Obama’s destiny rests on something else? A recently-published, landmark research paper shows the link between stock market performance and presidential election… Read more Who is Going To Win the Presidential Elections? |

Do Low Interest Rates Move Stocks Higher?

|

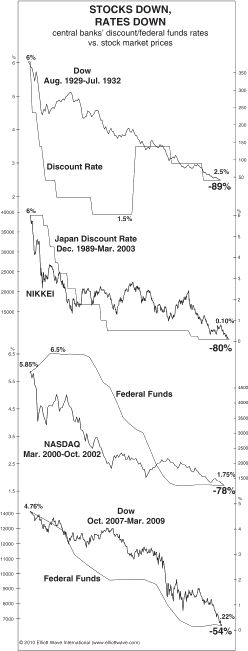

Many investors think that the Federal Reserve reduces the interest rates and that makes the stock market move higher. But there are two fallacies in this assumption. For one, the Federal Reserve does not set the interest rates, the market does. FED follows. Below we are going to show you a chart of declining interest… Read more Do Low Interest Rates Move Stocks Higher? |

Credit Crisis: Is The Perfect Storm Coming?

|

Robert Prechter discusses what’s backing your dollars In this video clip, taken from Robert Prechter’s interview with The Mind of Money, Prechter and host Douglass Lodmell discuss “real” money vs the FIAT money system, and what is backing your dollars under our current system. Enjoy this 4-minute clip and then watch Prechter’s full 45-minute interview… Read more Credit Crisis: Is The Perfect Storm Coming? |