|

By Editorial Staff This is an excerpt from Elliott Wave International's free Club EWI resource, "What Can a Fractal Teach Me About the Stock Market?" by EWI's president Robert Prechter. In the 1930s, Ralph Nelson Elliott described the stock market as a fractal — an object that is similarly shaped at different scales. Scientists today… Read more The Stock Market Is Patterned — Here’s Proof |

Category: Economy

Articles about the general economy, macro-economic indicators, money supply, FED and government policies.

What To Do With Your Pension Plan

|

Enjoy your 8 free chapters from Prechter’s Conquer the Crash — the book that foresaw what others have missed. March 16, 2010 By Editorial Staff There is no question that Robert Prechter’s Conquer the Crash foresaw and explained nearly every chapter of today’s financial crisis, years before it happened. Enjoy your 8 free chapters from… Read more What To Do With Your Pension Plan |

What Can Movies Tell You About the Stock Market?

|

By Editorial Staff The following article is adapted from a special report on "Popular Culture and the Stock Market" published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. Although originally published in 1985, "Popular Culture and the Stock Market" is so timeless and relevant that USA Today… Read more What Can Movies Tell You About the Stock Market? |

Surviving Deflation: First, Understand It

|

The following article is an excerpt from Elliott Wave International's free Club EWI resource, "The Guide to Understanding Deflation. Robert Prechter's Most Important Writings on Deflation." The Primary Precondition of Deflation Deflation requires a precondition: a major societal buildup in the extension of credit. Bank credit and Elliott wave expert Hamilton Bolton, in a 1957… Read more Surviving Deflation: First, Understand It |

More Credit Default Swaps Means Trouble for European Debt

|

By Editorial Staff Government debt is no longer just a problem for emerging countries. Portugal, Spain, France and Greece (as we have seen in recent weeks) are living in fear of credit default. Consequently, the value of their credit default swaps is skyrocketing. The following is an excerpt from the February issue of Global Market… Read more More Credit Default Swaps Means Trouble for European Debt |

What Chinese Malls Tell Us about the Economic Reality

|

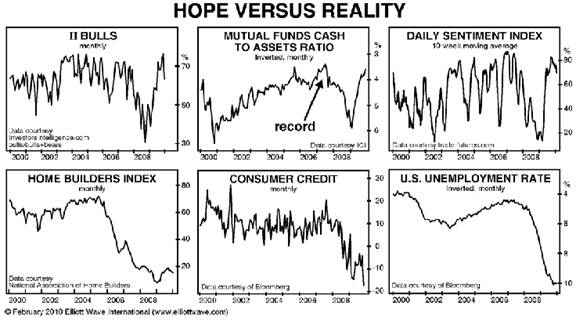

By Editorial Staff Investor expectations are decidely bullish right now, and many people expect an economic turnaround this year. What do the underlying economic conditions suggest? The Chinese mall "The Place" demonstrates the contrast between investor hope and economic reality. The following is an excerpt from the February issue of Global Market Perspective. For a… Read more What Chinese Malls Tell Us about the Economic Reality |

Europe’s Return to Risky Investment

|

By Editorial Staff Over 100 banks are opening soon, buying junk bonds is gaining popularity and emerging markets are the trendy investment. Sound familiar? Europe appears to be returning to some bad investment habits. The following is an excerpt from the February issue of Global Market Perspective. For a limited time, you can visit Elliott… Read more Europe’s Return to Risky Investment |

Robert Prechter on Herding and Markets’ “Irony and Paradox”

|

By Editorial Staff The following is an excerpt from a classic issue of Robert Prechter's Elliott Wave Theorist. For a limited time, you can visit Elliott Wave International to download the rest of the 10-page issue free. Market Herding Have you ever watched a dog interact with its owner? The dog repeatedly looks at the owner,… Read more Robert Prechter on Herding and Markets’ “Irony and Paradox” |

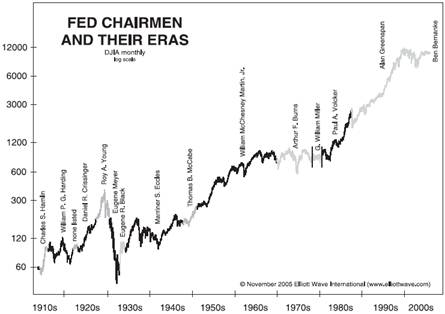

Bernanke’s Burn Notice

|

Bernanke’s Burn Notice: Why Now? Research Reveals Insight Into Fed Chairman’s Popularity By Elliott Wave International Like a spy who gets a burn notice, Federal Reserve Chairman Ben Bernanke has suddenly lost his support. Bernanke has gone from being Time magazine's Man of the Year in 2009 to … what? A Fed chairman embroiled in… Read more Bernanke’s Burn Notice |

Why You Should Care About DJIA Priced in Gold

|

By Vadim Pokhlebkin The following article is provided courtesy of Elliott Wave International (EWI). For more insights that challenge conventional financial wisdom, download EWI’s free 118-page Independent Investor eBook. ————- Of the many forward looking market indicators we at EWI employ, one of the most interesting tools (and least discussed in the financial media) is… Read more Why You Should Care About DJIA Priced in Gold |

Popular Culture and the Stock Market

|

By Robert Prechter, CMT The following article is adapted from a special report on "Popular Culture and the Stock Market" published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. Although originally published in 1985, "Popular Culture and the Stock Market" is so timeless and relevant that USA… Read more Popular Culture and the Stock Market |

The FDIC Anesthesia Is Wearing Off

|

By Robert Prechter The following article is an excerpt from Robert Prechter's Elliott Wave Theorist. For more information from Robert Prechter on bank safety, download his free report, Discover the Top 100 Safest U.S. Banks. Perhaps the single greatest reason for the unbridled expansion of credit over the past 50 years is the existence of… Read more The FDIC Anesthesia Is Wearing Off |

If Stocks Tank, Shouldn’t Gold Soar?

|

The following article is provided courtesy of Elliott Wave International (EWI). For more insights that challenge conventional financial wisdom, download EWI’s free 118-page Independent Investor eBook. ————- Large banks and more recently pension funds have suddenly become infatuated with gold. They chant the mantras that gold bugs have known for years: gold is a store… Read more If Stocks Tank, Shouldn’t Gold Soar? |

Earnings: Is That REALLY What’s Driving The DJIA Higher?

|

By Vadim Pokhlebkin It's corporate earnings season again, and everywhere you turn, analysts talk about the influence of earnings on the broad stock market: US Stocks Surge On Data, 3Q Earnings From JPMorgan, Intel (Wall Street Journal) Stocks Open Down on J&J Earnings (Washington Post) European Stocks Surge; US Earnings Lift Mood (Wall Street Journal)… Read more Earnings: Is That REALLY What’s Driving The DJIA Higher? |

How to Prepare for the Coming Crash and Preserve Your Wealth

|

Bob Prechter first released Conquer the Crash: You Can Survive and Prosper in a Deflationary Depression during a stock-market high in 2002, and it quickly became a New York Times–bestseller. Now he has updated the book with 188 new pages for a second edition, and it looks like it, too, will be published near a… Read more How to Prepare for the Coming Crash and Preserve Your Wealth |

Q&A With Robert Prechter: Why Technical Analysis Beats Out Fundamental Analysis

|

By Elliott Wave International As the major stock markets turned down in late 2007 and then started to rally in March 2009, many people who believed in fundamental analysis have begun to question its validity. Famed technical analyst and Elliott wave expert Robert Prechter has long called for the bear market we are now in the… Read more Q&A With Robert Prechter: Why Technical Analysis Beats Out Fundamental Analysis |

Prechter Stands Alone Again… He’s Done the Math

|

By Neil Beers So Bob Prechter is bearish again. That may be no surprise to some, but recall that Prechter was about the only bull on February 23 of this year when he covered the short position he had recommended on July 17, 2007. That was nearly two years later and 800 points lower in… Read more Prechter Stands Alone Again… He’s Done the Math |

Efficient Market Hypothesis: True “Villain” of the Financial Crisis?

|

By Robert Folsom Editor's Note: The following article discusses Robert Prechter's view of the Efficient Market Hypothesis. For more information, download this free 10-page issue of Prechter's Elliott Wave Theorist. When a maverick idea becomes vindicated, there's a good story to tell. It usually involves a person (or small group of people) who courageously challenge… Read more Efficient Market Hypothesis: True “Villain” of the Financial Crisis? |

A Road Map To SENSEX 100,000

|

By Mark Galasiewski This article was originally published as a special Interim Report of EWI's Asian-Pacific Financial Forecast on March 23, 2009. Since then the SENSEX has risen as much as 65%. For a limited time, Elliott Wave International is offering a full 10-page issue of the Asian Pacific Financial Forecast, Discover The Bull Markets… Read more A Road Map To SENSEX 100,000 |

Bob Prechter: Gold is Still Money

|

By Robert Prechter, CMT The following article is excerpted from a brand-new eBook on gold and silver published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. For the rest of this fascinating 40-page eBook, download it for free here. Have you ever traveled abroad and taken a… Read more Bob Prechter: Gold is Still Money |