|

Tesla’s Troubles — Is it Musk or is it More? Tesla tumbled 15% on March 10, its biggest single day drop in more than five years. Elliott Wave International’s March Global Market Perspective provides this insight: The world’s richest man, Elon Musk, is also more vulnerable than most people realize. In March 2023, when a… Read more Tesla’s Troubles – Is it Musk or is it More? |

Category: Stock Market

Articles about stock market, market timing, technical indicators, stock market trends, market top, market bottom.

Stock Market Excessive Overvaluation in 2025

|

Valuations Are at the Furthest Edge of the Financial Solar System Figure 1 updates our history of year-end valuations for stocks of S&P companies on two bases: price to book value (Y axis) and dividend yield (X axis). I thought the year-end 2021 overvaluation would never be surpassed. But as you can see, the year-end… Read more Stock Market Excessive Overvaluation in 2025 |

Another Extreme Sentiment in Stocks

|

Why Stock-Market Success Is Usually Only Temporary Here’s a sample of record sentiment readings for stocks Recession coming or not, people are still EXTREMELY bullish. Read this excerpt from the May 17, 2024 Elliott Wave Theorist: Record Sentiment Readings for Stocks Investors are enamored with stocks that pay little or nothing in the way of… Read more Another Extreme Sentiment in Stocks |

Non-Confirmation in Europe

|

What You Can Learn from Europe’s “Dow Theory”-esque Non-confirmation By Brian Whitmer | European Financial Forecast editor Charles Dow (yes, the one with the averages named after him) developed a foundational concept in technical analysis that requires that price movement in industrial stocks and transportation shares confirm one another. The main condition for a Dow… Read more Non-Confirmation in Europe |

Calm in the markets

|

Stoxx Europe 600: What Signs of Investor Exuberance Keep Telling Us Every day, you read news stories about the state of the economy and the stock market affecting consumer and investor behavior. The story goes something like this: When the economy and financial markets show signs of improvement, consumers start to spend more, and investors… Read more Calm in the markets |

AI Revolution

|

Global X Robotics & Artificial Intelligence ETF (BOTZ) looks like it is having a counter trend rally. This was foreseen as in the following article from Elliot Wave International back in March 2024: AI Revolution and NVDA: Why Tough Going May Be Ahead “These things could get more intelligent than us” The topic with all… Read more AI Revolution |

Time Tested Indicator

|

Why You Should Pay Attention to This Time-Tested Indicator Now “How High Can Markets Go?” — asks this magazine cover Paul Montgomery’s Magazine Cover Indicator postulates that by the time a financial asset makes it to the cover of a well-known news weekly, the existing trend has been going on for so long that it’s… Read more Time Tested Indicator |

Bullish Buzz at Highest Level

|

This “Bullish Buzz” Reaches Highest Level in 53 Years Learn what the AIM Index reveals By Elliott Wave International Yes, there’s been a recent pickup in stock market volatility, but overall, bullish sentiment remains very much alive and well. Indeed, here’s a Feb. 18 Yahoo! Finance headline: A Bull Market is Here. On April 9,… Read more Bullish Buzz at Highest Level |

Insider Selling in Stocks

|

Stocks: What to Make of All This Insider Selling Here are details of “The Great Cash-Out” Corporate insiders may sell the shares of their company for any number of reasons but one of them is not because they think the price is going up. In other words, insider selling can serve as a warning. For… Read more Insider Selling in Stocks |

Extreme Greed in Stocks

|

S&P 500: What to Make of Fear Versus Greed This sentiment index combines seven indicators into one useful trend measure That is — market participants generally go from feeling deeply pessimistic all the way to feeling highly optimistic — and then back again. These swings in investor psychology tend to produce similar circumstances at corresponding… Read more Extreme Greed in Stocks |

What the Fear Index VIX May be Saying

|

What “Fear Index” VIX May Be Signaling “Note the succession of higher closing low relative to higher highs in…” First, just a quick basic fact about the CBOE Volatility Index (VIX) — also known as the stock market’s “fear gauge”: the lower the reading, the higher the complacency among investors. Higher readings indicate increased investor… Read more What the Fear Index VIX May be Saying |

Climbing Oil Prices

|

“Climbing Oil Prices Bearish for Stocks”? It’s a Myth! Oil and stocks sometimes trend together. Other times, they don’t. There’s a widespread belief that rising oil prices are bearish for the main stock indexes and falling oil prices are bullish for stocks. That belief is reflected in this Sept. 5 CNBC headline: Dow closes nearly… Read more Climbing Oil Prices |

Why Do Traders Lose Money?

|

Why Do Traders Really Lose Money? Answer: It’s Not the Market’s Fault And 1 FREE course on how to help you stop self-sabotaging “good enough” trade plans I have always been a “who cares about the odds” kinda person. Meaning, if someone tells me the likelihood of succeeding at, say, learning to skateboard at 40,… Read more Why Do Traders Lose Money? |

Insiders Selling

|

Pay Attention to This Group of Investors (They Know More) The stock market actions of corporate insiders is revealing It stands to reason that executives of a corporation know more about the goings-on of their business than outsiders. So, it’s wise to pay attention to their stock market actions regarding their own shares. Yes, the… Read more Insiders Selling |

Euro Stoxx 600 Following the Script

|

Euro Stoxx 600: “Following the Script” “If the 2007 analogue holds, the current rally [will] persist …” On Oct. 24, 2022, Bloomberg said: Forget about a Santa rally to rescue European stocks from their doldrums, say strategists from Goldman Sachs Group Inc. to Bank of America Corp. A week and a half later, our November… Read more Euro Stoxx 600 Following the Script |

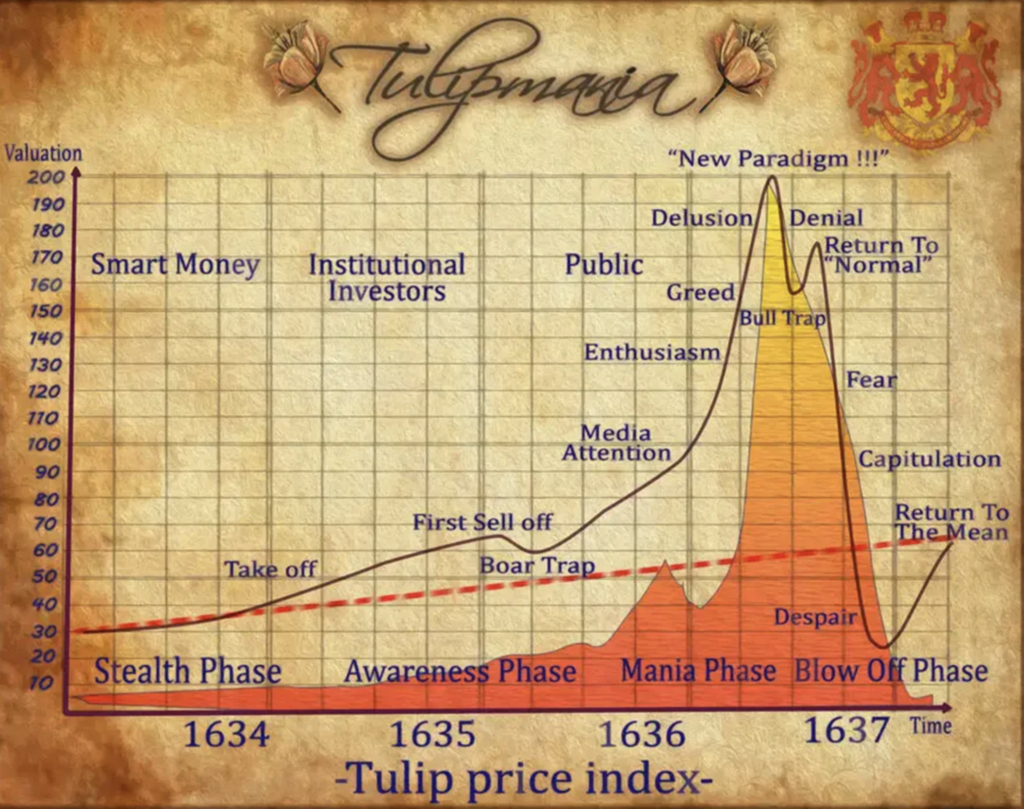

Tulip Mania Was Nothing

|

Recently, Elliott Wave International’s president Robert Prechter gave a rare interview. He covered a lot of ground – from stocks and Bitcoin to the economy and gold. Our friends at Elliott Wave International are sharing Prechter’s interview with you free. Listen as Prechter explains why 2021’s extreme market sentiment made the Tulip Mania look like… Read more Tulip Mania Was Nothing |

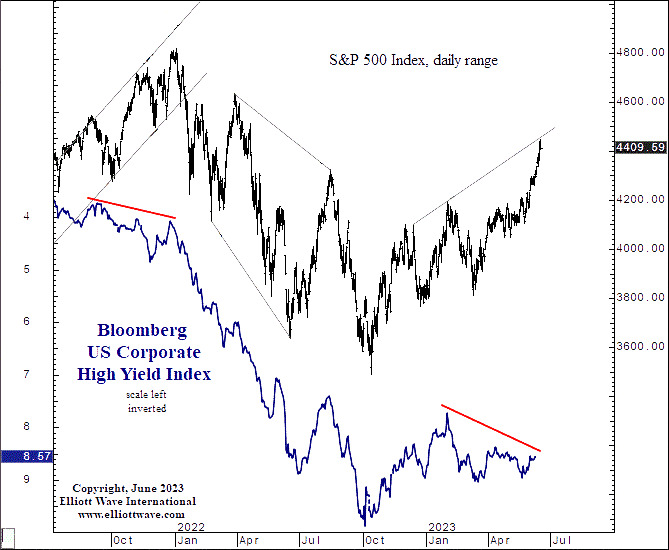

Divergence in Stocks vs Junk Bonds

|

Stocks and Junk Bonds: “This Divergence Appears Meaningful” “Everything was aligned until February 2” The trends of the junk bond and stock markets tend to be correlated. The reason why is that junk bonds and stocks are closely affiliated in the pecking order of creditors in case of default. The rank of junk bonds is… Read more Divergence in Stocks vs Junk Bonds |

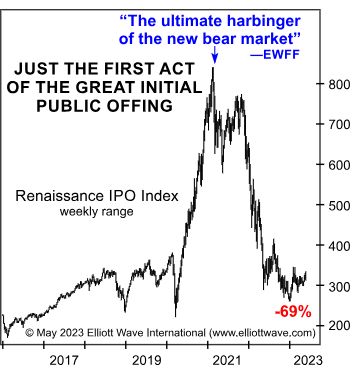

Harbinger of the Bear Market

|

Insights into This “Ultimate Harbinger” of the Bear Market Enthusiasm for U.S. IPOs seems to be dramatically decreasing Back in early 2021, many investors were chomping at the bits to invest in entities about which they knew next to nothing. These entities are known as Special Purpose Acquisition Companies (SPACs), which may be described as… Read more Harbinger of the Bear Market |

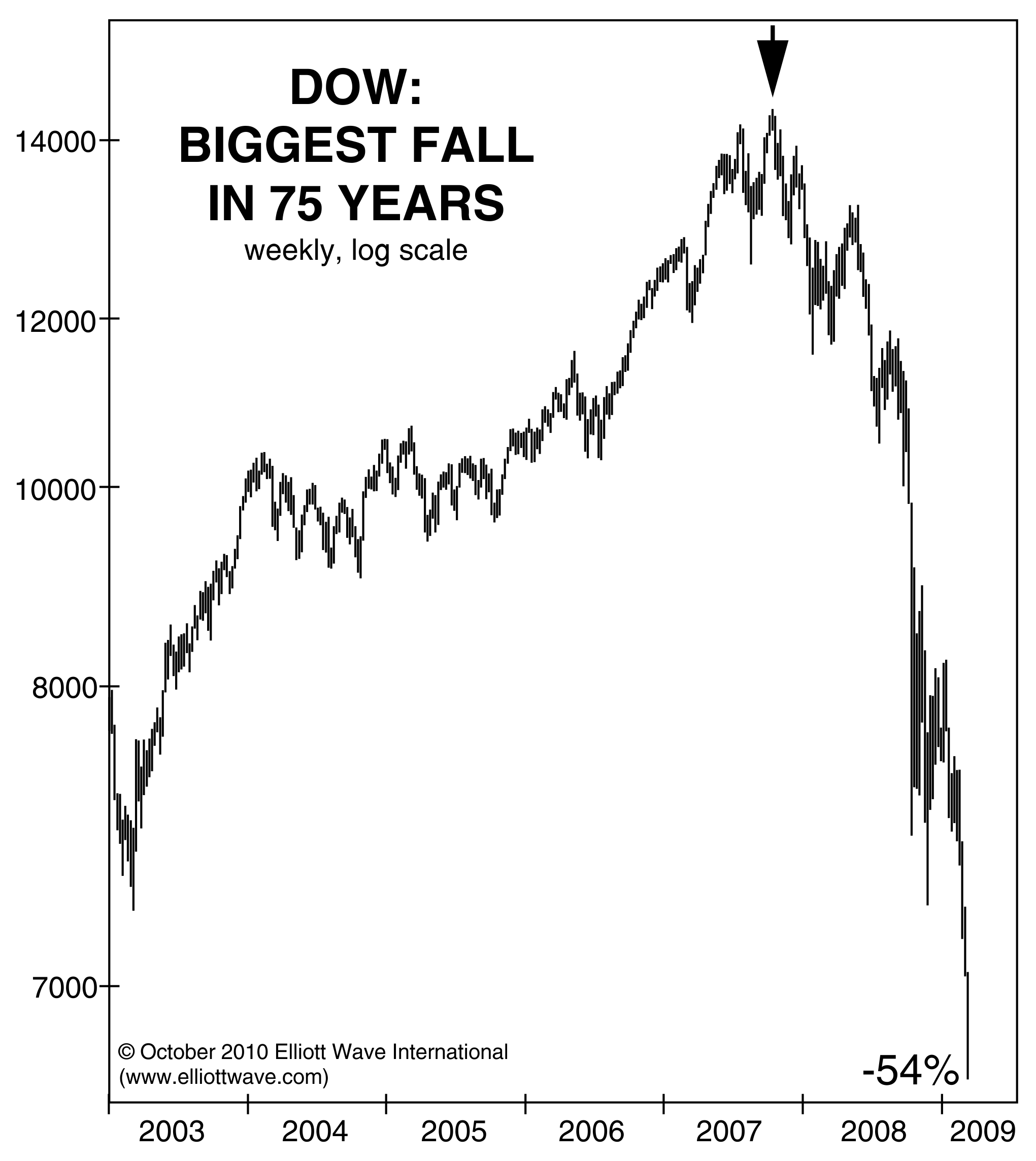

Possible Replay of History

|

Stocks: Possible Replay of an Ominous Price Pattern “I became panicky and covered at a considerable loss…” The reason price patterns tend to repeat in the stock market is that investor psychology never changes. The Elliott wave model directly reflects these largely predictable swings in investor psychology. That’s what the Elliott wave principle is all… Read more Possible Replay of History |

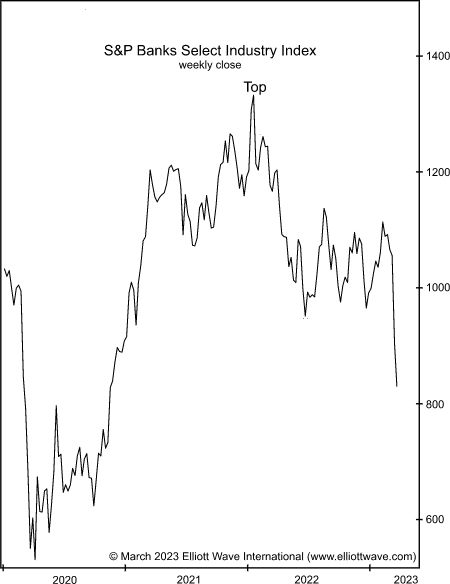

Sectors Leading Lower

|

Will These 2 Sectors Lead the Stock Market Lower? This key sector continues to be “fragile” Although it doesn’t feel like it sometimes, the U.S. stock market has been in a downtrend since January 2022. The reason it doesn’t feel like it is because the S&P 500 has been in a narrow trading range between… Read more Sectors Leading Lower |