|

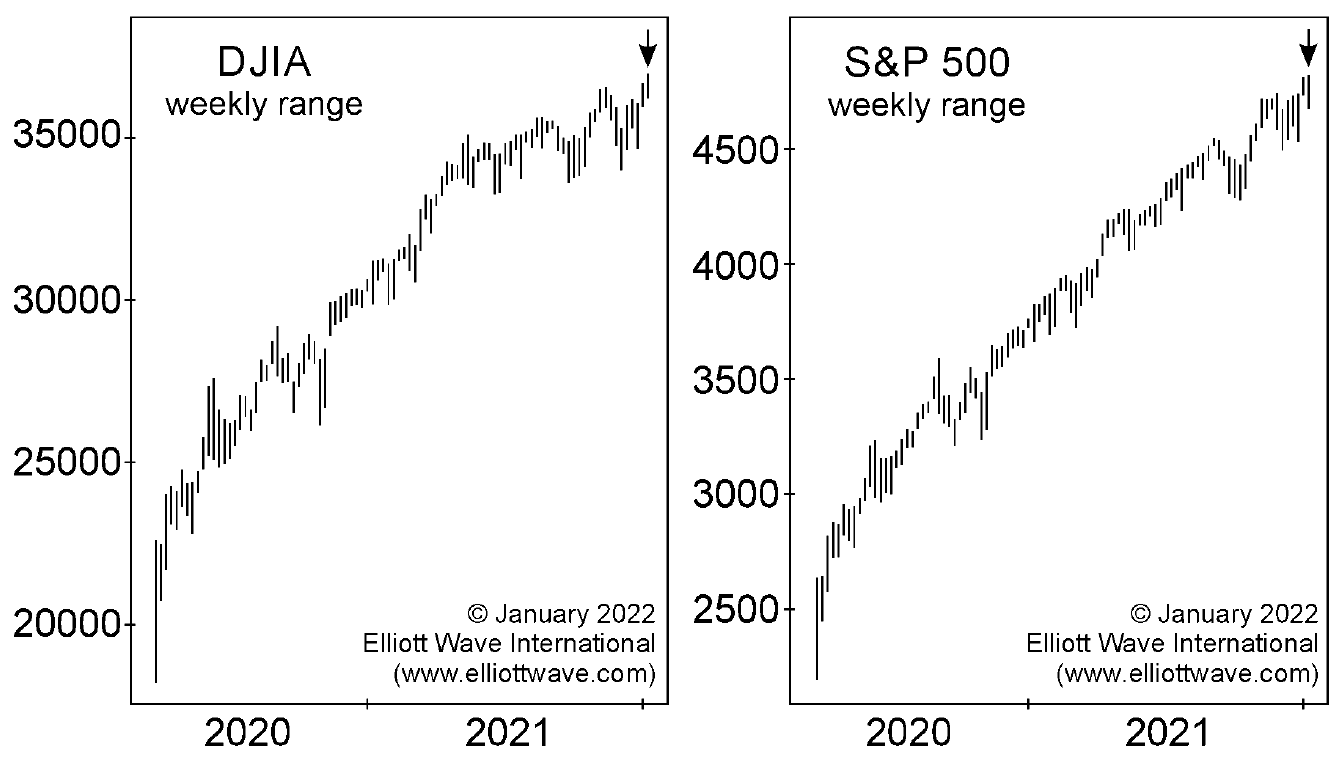

How “Insane Optimism” is at Work in the Stock Market “Stock investors are so bullish that they are…” Many technical indicators are highly useful, yet the price moves of the stock market really boil down to two things: optimism and pessimism. Major trend turns tend to occur when extremes are reached in either optimism or… Read more Insane Optimism in Stocks |

Category: Stock Market

Articles about stock market, market timing, technical indicators, stock market trends, market top, market bottom.

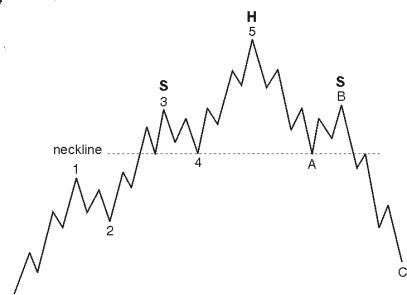

Next Shoe to Drop: Corporate Bonds

|

Corporate Bonds: “The Next Shoe to Drop” “The neckline has been broken over the last few days” A “calamity” is likely ahead for corporate bonds, says our head of global research, Murray Gunn. Some of Murray’s analysis involves the head and shoulders, a classic technical chart pattern. In case you’re unfamiliar with it, here’s an… Read more Next Shoe to Drop: Corporate Bonds |

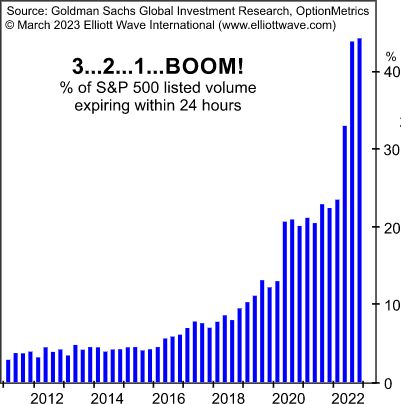

Rise in Stock Market Volatility Ahead

|

Explosive Rise in Stock Market Volatility! Why It May Be Ahead There are now S&P options that expire each day of the week. What that may mean. Here’s a Wall Street Journal headline from a couple of months ago that some people may have scanned without much contemplation (Jan. 11): VIX, Wall Street’s Fear Gauge,… Read more Rise in Stock Market Volatility Ahead |

Retail Investors Jump In

|

U.S. Stocks: Why Acting Independently Has Never Been More Important “Individual investors have been snapping up stocks at the fastest pace on record” More than 20 years ago, when I was working for another company, I remember hearing a colleague say that he doesn’t look at his monthly 401k statements. The implication was clear: He… Read more Retail Investors Jump In |

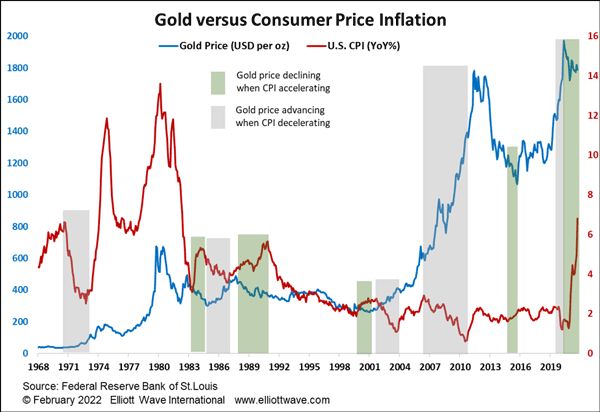

Gold Price and Inflation

|

Gold and Inflation: Here’s a Market Myth “If you believe in Gold as a consumer price inflation hedge then…” Back in the days of the Roman Empire, an ounce of gold could buy a Roman a well-made toga, belt and finely crafted sandals. In modern day Rome, lo and behold, a businessman can become sharply… Read more Gold Price and Inflation |

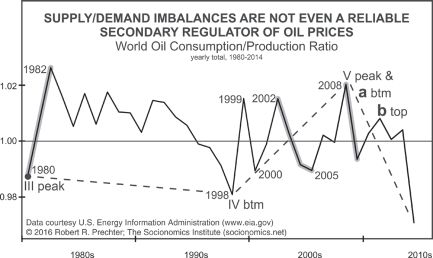

Why Oil Prices Fell Despite Supply Shock

|

Why Oil Prices Fell in the Face of “Supply Shock” “Crude should be at the forefront of a…” Looking back on 2022, one of the biggest fears about oil was that prices would skyrocket even more than they did due to a disruption in supply from Russia. Of course, Russia has been a major world… Read more Why Oil Prices Fell Despite Supply Shock |

2022 May Have Been the Preview of the Upcoming Crash

|

Stocks and Economy: Why 2022 May Have Just Been the Preview “Fight the inertia that will keep you from taking action to prepare for the downturn” The main show is likely about to begin. 2022 may have just been a preview of what’s ahead for stocks and the economy, which Robert Prechter’s Last Chance to… Read more 2022 May Have Been the Preview of the Upcoming Crash |

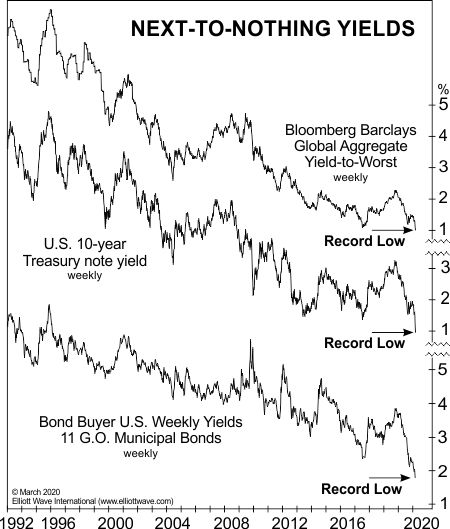

Stocks and Bonds Can Fall in Tandem

|

Why You Should Be Leery of the 60 / 40 Portfolio “The tidal wave of risk assumption … may be turning” Many investors allocate a percentage of their portfolios to bonds to cushion against a drop in the stock market. A popular allocation is a 60 / 40 mix of stocks and bonds. However, this… Read more Stocks and Bonds Can Fall in Tandem |

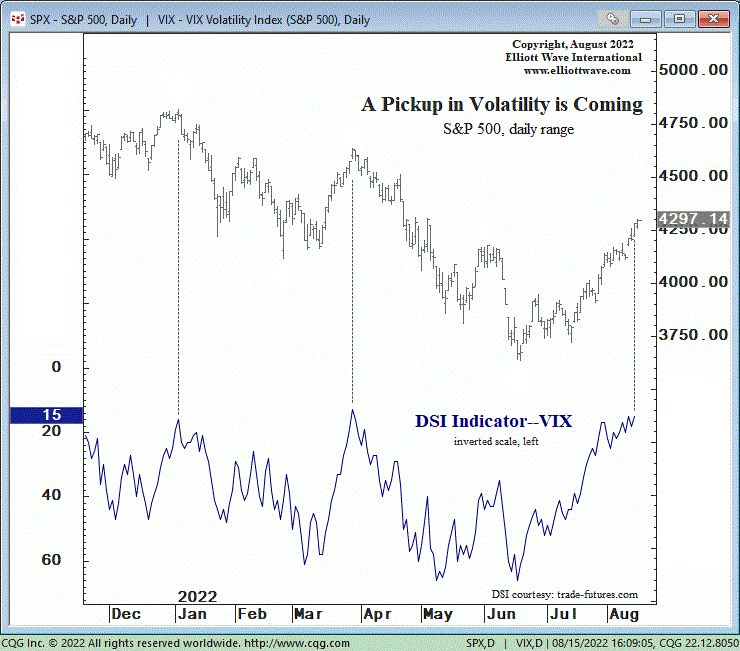

Daily Sentiment Index Extreme Says Volatility Is Next

|

Why You Should Expect a Pickup in Stock-Market Volatility “Traders are convinced the market volatility will remain subdued” When things get quiet in a horror movie, that’s when you need to really brace yourself. The monster or the killer will soon be on the scene. That’s a close enough analogy to what can happen in… Read more Daily Sentiment Index Extreme Says Volatility Is Next |

Only the Few Can Get Out at The Top

|

Severe Bear Market: Will You Be Among the Prepared 1.5%? “Oftentimes, rallies will end with an inter-index non-confirmation” A long-long time ago in a galaxy far away… errr, on the heels of the year 2000 dot-com crash, to be exact — which is ancient history for many investors today — the February 2003 Elliott Wave… Read more Only the Few Can Get Out at The Top |

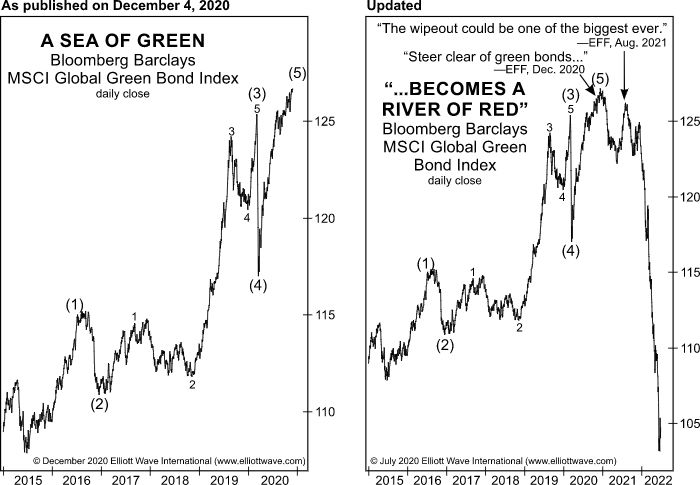

Wipeout of Green Bonds

|

Wipeout! New Update on Our “Green Bond” (ESG) Forecast Excessive euphoria in financial markets is usually a big reason to be “skeptical” Environmental, Social and Governance bonds (ESG) — also called “green” bonds — are offered by companies which want to advance the causes of social justice, social inclusion and green technology. This form of… Read more Wipeout of Green Bonds |

How to Navigate a Bear Market

|

Market action this year has hurt A LOT of people. Cryptos. Meme stocks. Tech stocks. We’ve seen some huge percentage declines — all against a backdrop of historic leaps in interest rates and inflation. Lifestyles irrevocably changed, not for the better. Economists missed it. The Fed missed it. Politicians missed it. But a few folks… Read more How to Navigate a Bear Market |

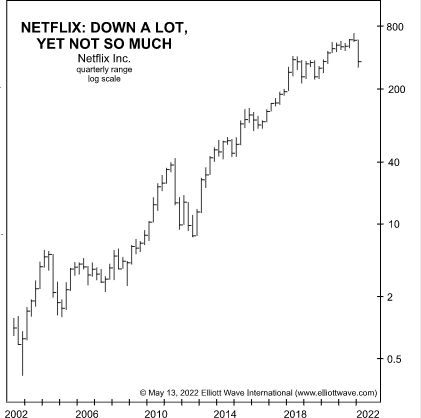

NETFLIX Decline is Only the Beginning

|

Netflix: Way More Room to Drop “Doubled eleven times in 19 years … then cut in half twice” The glory days of at least one of the FAANG stocks appear to be all but over — at least for now. As revenue shrinks at Netflix, more heads have rolled at the subscription-based streaming service of… Read more NETFLIX Decline is Only the Beginning |

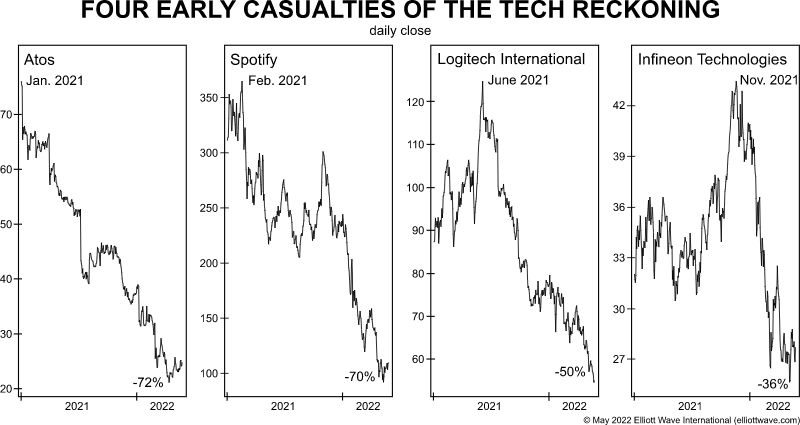

Tech Stocks and the Dot-com “Echo”

|

“Downside surprises should become the norm” The Wave Principle’s basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves, as illustrated in both bull and bear markets below: You probably recall the bursting of the dot-com bubble when the tech-heavy Nasdaq 100 plummeted 78% between March 2000 and… Read more Tech Stocks and the Dot-com “Echo” |

Scary Part Just Ahead

|

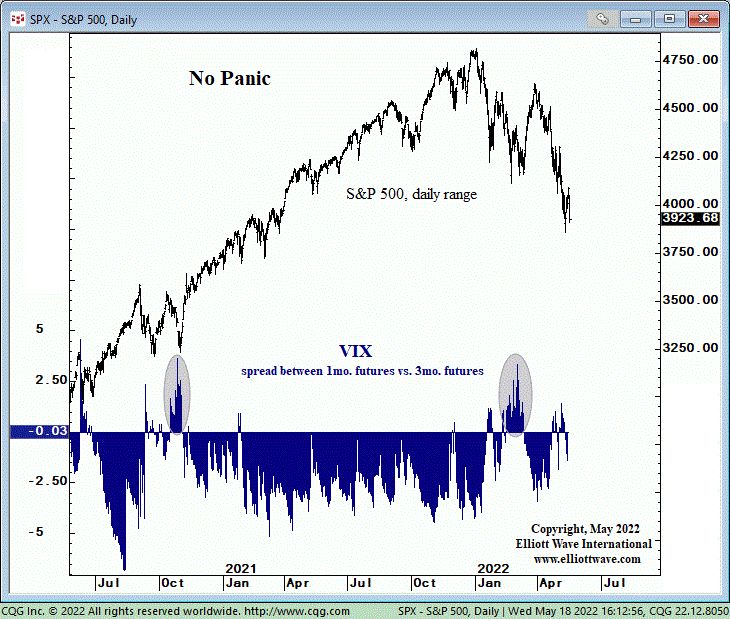

Stocks: Is the Really Scary Part Just Ahead? Here’s one of the actions which investors take when they get “rattled” Big daily selloffs have occurred since the stock market’s downtrend began in January. For instance, on May 18, the Dow Industrials closed lower by 1,161 points — a 3.6% drop. The S&P 500 shed 4%… Read more Scary Part Just Ahead |

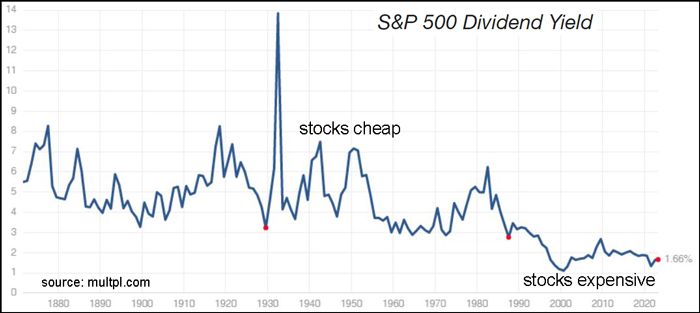

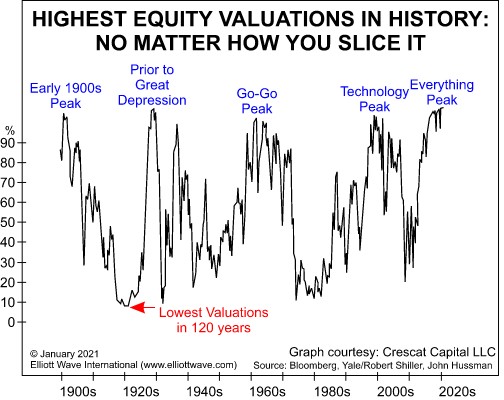

Are Stocks Overvalued?

|

Are stocks overvalued? A quick look at the long term perspective. Take a minute and look at a valuation chart for the stock market: What we have here on the X axis is the bond yield/stock yield ratio for the S&P 400 companies. Sounds fancy, but all it means is that the further you go… Read more Are Stocks Overvalued? |

Most Funds Ill Prepared for Bear Market

|

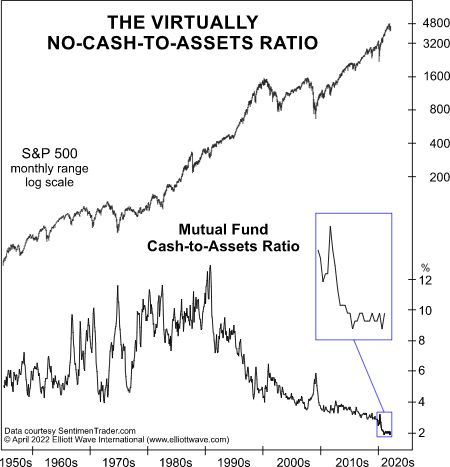

Why Most Equity Mutual Funds Are (Again) Ill-Prepared for a Bear Market Professional money managers herd “right along with other speculators” Is a bear market already underway in the U.S.? Only time will tell for sure. What is known is that the Dow Industrials and S&P 500 index topped in January and the NASDAQ registered… Read more Most Funds Ill Prepared for Bear Market |

Stock Buybacks Peak at the Top

|

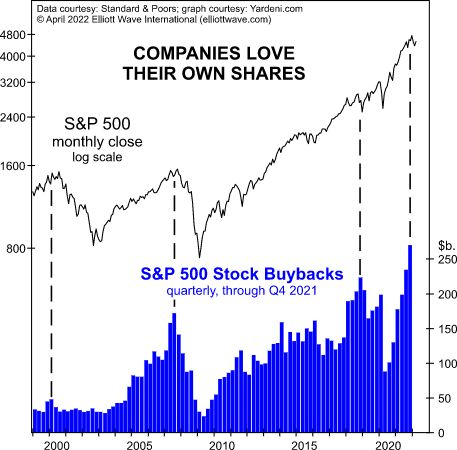

Peaking stock buybacks is consistent with the early stage of a long bear market. Intraday on April 27, the S&P 500 is trading 12.10% lower than it was at the start of the year. Right — not a huge setback — but negative nonetheless. Of course, it’s always possible that this is just the start… Read more Stock Buybacks Peak at the Top |

Why Is the Stock Market Falling?

|

“Why Is the Stock Market Falling?” — (Not Because of These Reasons) Financial journalists almost always mention “reasons” for a given day’s market action. For example, on April 22, an intraday Marketwatch headline gave two reasons for that day’s plummeting prices: Why is the stock market falling? Dow drops over 500 points as investors weigh… Read more Why Is the Stock Market Falling? |

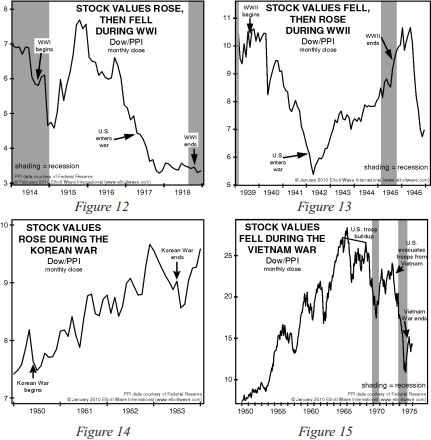

Is War Negative for Stocks?

|

Here’s what really drives the trends of global stock markets Let’s first state the obvious: war is tragic as it brings death and destruction. But does war make the stock market go down? Many observers seem to believe so. Here are some Feb. 22 headlines: U.S. stocks fall sharply as Russia sends troops into breakaway… Read more Is War Negative for Stocks? |