|

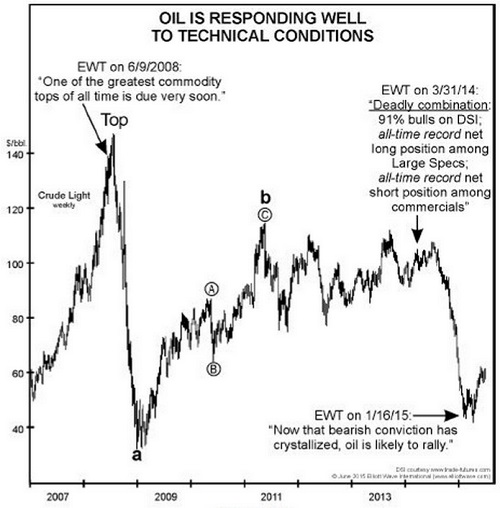

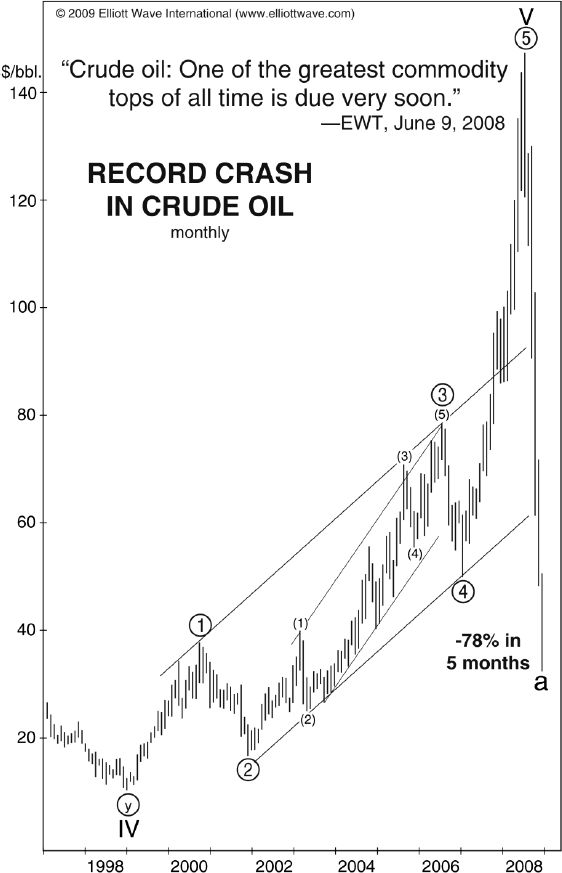

There is one solution to staying ahead of oil’s trend changes — Elliott wave analysis! You know the expression “God works in mysterious ways”? Well, according to an August 6 CNBC article, the price action of one financial market — i.e., crude oil — has out-mystified even God himself. Or, rather, the well-heeled star of… Read more Oil Trend Change? |

Category: Stock Market

Articles about stock market, market timing, technical indicators, stock market trends, market top, market bottom.

Peak Oil? Oil Price Decline Continues

|

Years ago we used to hear the chatter about how OIL price is going through the roof because either the world is about to reach peak production or has already done so. There was talk of the world running out of OIL and the price would inevitable skyrocket and there was no going back as… Read more Peak Oil? Oil Price Decline Continues |

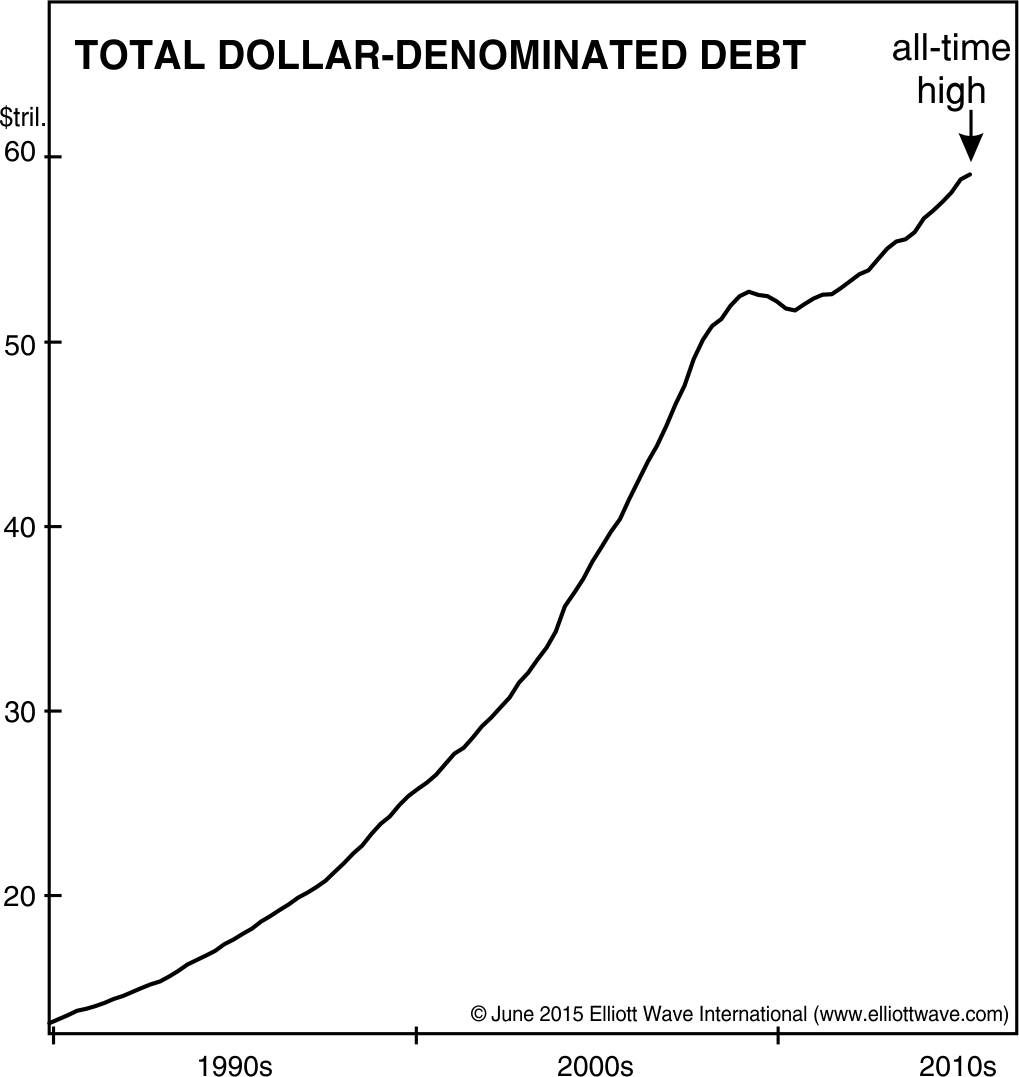

Unprecedented Extremes Indicate Stock Market Bubble

|

After the rally from 2009 stock market bottom, stocks relentlessly marched up often without a breather. We have reported complacency has reached extreme levels in the past. But that in itself does not pinpoint a top. But when we have multiple measures lining up, one has to stop and contemplate the possibility that we are… Read more Unprecedented Extremes Indicate Stock Market Bubble |

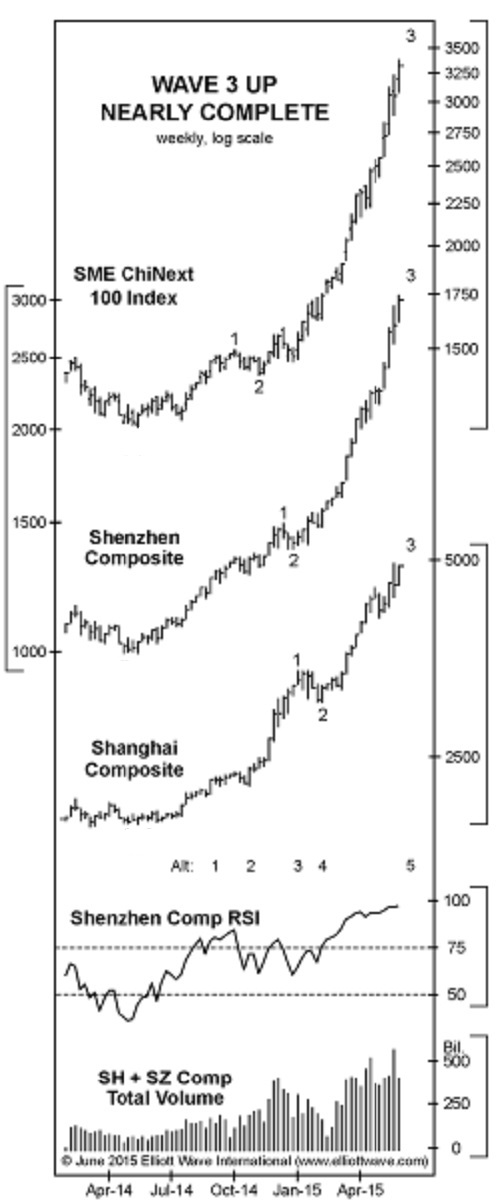

Volatility in Chinese Stock Market

|

“Chao gu” is the Chinese term for speculating in stocks. Roughly translated, it means “stir-frying” shares. Lately, though, for millions of Chinese investors, it means getting fried. Enter the “nerve-shredding,” “whiplash-inducing,” rollercoaster “tantrum” of China’s stock market. After soaring to 7-year highs on June 12, both the Shanghai Composite and Shenzhen stock indexes collapsed in… Read more Volatility in Chinese Stock Market |

The New Nasdaq Bubble

|

Most tech stocks lead by Silicon Valley companies had a great run after the 2009 bottom. Nasdaq once again reached above 5000. The Silicon Valley traffic is unbearable, the rents for tech workers are unpayable, housing in the valley challenges prior heights, or already above. Yet the stock market pundits make us believe stock have… Read more The New Nasdaq Bubble |

A Growing Economy is NOT Always Bullish for Stocks

|

A good economy is not necessarily bullish for the stock market! Learn how you can get our FREE, 53-page State of the Global Markets report now >> On Friday (Feb. 27), the 4th quarter U.S. GDP was revised downward to 2.2% from the original 2.6%. “U.S. stock markets shrugged off the revision,” wrote Fox Business.… Read more A Growing Economy is NOT Always Bullish for Stocks |

Why Did the Stock Market Go Down?

|

When the market goes up, or when it goes down, the mainstream media often explains via events or earnings. But very often, the morning headline gets stale by the afternoon on the same day. In the morning it goes something like: XYZ earnings disappoint investors, stocks are crashing! Then by the afternoon they have to… Read more Why Did the Stock Market Go Down? |

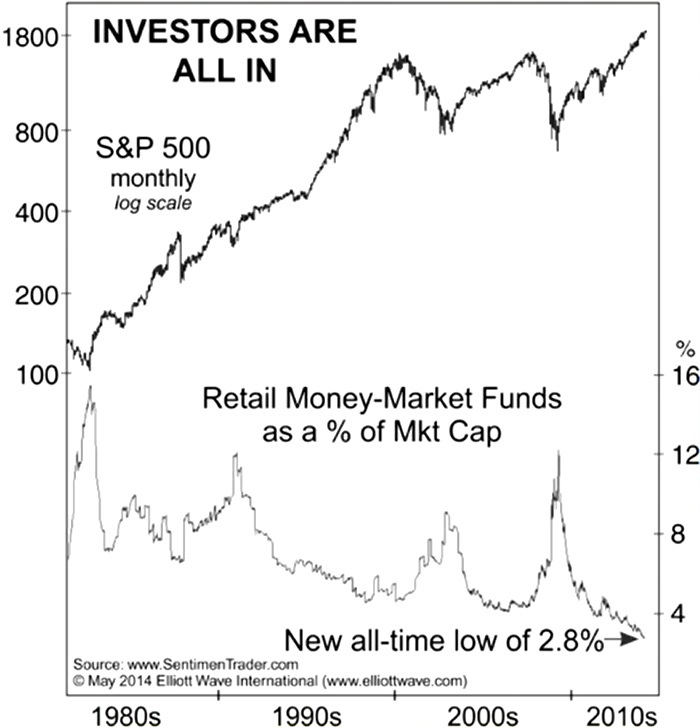

Money Market Funds Signal Reversal For Stocks

|

Stocks Top When Everyone Feels Safe Are the complacent investors heading for another cliff? Steve Hochberg on the state of retail money market funds vs. stock market capitalization, filmed at the 2014 Las Vegas Money Show Editor’s note: The article below is adapted from the transcript of the live presentation above, originally recorded at the… Read more Money Market Funds Signal Reversal For Stocks |

Will Stocks Peak One Year After Bonds?

|

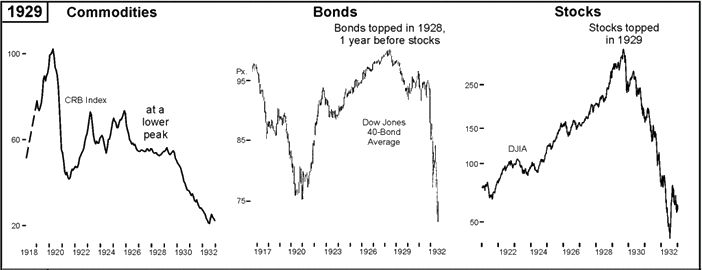

There are financial parallels between the 1920s and today – is history set to repeat? When the financial media mentions the late 1920s, they usually mean the 1929 stock market top and the market crash that followed. But today’s investors can also learn from what happened in 1928. That was the year that the bond market… Read more Will Stocks Peak One Year After Bonds? |

15 Eye Popping Charts Reveal 2014 Forecast

|

Gold is down despite the printing press! Commodities are down! Peak OIL is not the topic anymore. Home prices have moved up with record low cost of lending and tremendous FED help. Stock market defied gravity in 2013 and is holding up so far. But how far can it go? Is the turn near once again? The financial community always… Read more 15 Eye Popping Charts Reveal 2014 Forecast |

Social Mood, Politics and the Stock Market

|

Here is an interesting perspective on predicting the outcome of presidential elections. According to socionomic theory, bear markets come with a downturn in crowd psychology. When the crowd turns from optimism to pessimism, it is first seen in stocks, and then the rest of the economy, politics, culture. A president who is in the office during… Read more Social Mood, Politics and the Stock Market |

Do Low Interest Rates Move Stocks Higher?

|

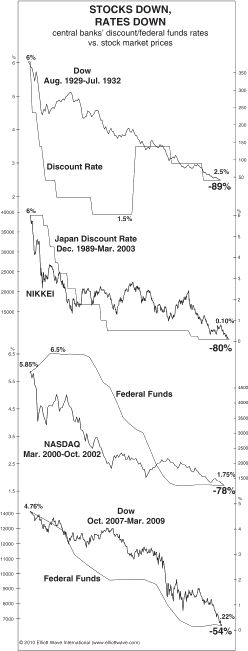

Many investors think that the Federal Reserve reduces the interest rates and that makes the stock market move higher. But there are two fallacies in this assumption. For one, the Federal Reserve does not set the interest rates, the market does. FED follows. Below we are going to show you a chart of declining interest… Read more Do Low Interest Rates Move Stocks Higher? |

What moves the stock market?

|

The widespread idea is that events around the world direct the financial markets. We are told to believe that the market reacts to the news and people’s mood changes accordingly. When the news are good, people feel good and they buy stocks they say. When the news are bad, people sell stocks according to the… Read more What moves the stock market? |

Is It a Bear Market Rally?

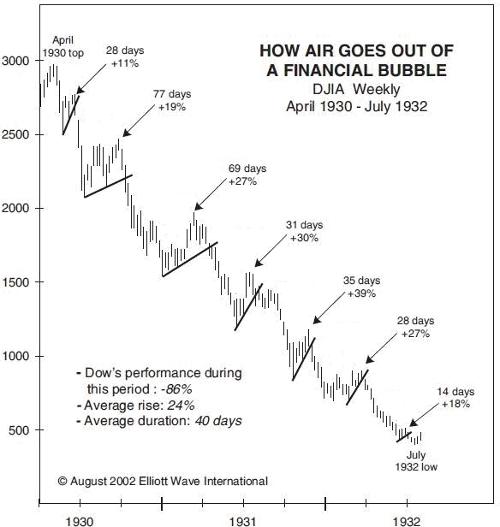

|

Market had a sharp decline 2 months ago. We are well below 200 day average, and we have bounced off of 38.6% fibonacci retracement level a few times. Price support level has been holding well. Now the sentiment in the mainstream media is that this is a healthy pullback, a buying opportunity in the stock market. One needs to… Read more Is It a Bear Market Rally? |

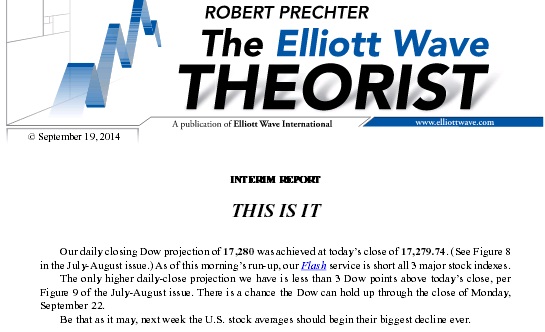

Prechter Explains ‘Triple Top’ Forming in U.S. Stock Market

|

(Video) Bob Prechter Explains ‘Triple Top’ Forming in U.S. Stock Market This excerpt from the special video issue of the August Elliott Wave Theorist brings you Bob Prechter’s analysis of the triple top that has been forming in the U.S. stock market over the past 12 years. Watch as Bob himself explains what this pattern… Read more Prechter Explains ‘Triple Top’ Forming in U.S. Stock Market |

Once in a Life Time Stock Market Trade

A Reliable Stock Market Indicator

|

The Single Most Reliable Indicator The market is falling and has just broken the neck down in the widely watches head and shoulders pattern. Those who are trading stocks, the savvy ones who prefer stock market timing instead of buy and hold are shorting the stocks. Most people pay attention to the news and events… Read more A Reliable Stock Market Indicator |

Spotting Trade Setups

|

Technical analysis helps in recognizing the markets direction and possible turning points. There is no one-size fits all silver bullet solution to get you ahead of the crowd all the time. By definition, only the few will make money in the stock market. And we can use some tools to enhance the odds in our… Read more Spotting Trade Setups |

What Really Moves the Markets

|

News? The Fed? The Real Answers Will Surprise You Bernanke made his QE2 promise real and started to print money again. Ironically the day of his announcement marked the low in US dollar index and dollar started to rally. Similarly, treasuries and mortgage rates staged their multi week rally after the announcement of QE2. We… Read more What Really Moves the Markets |

Is the Plunge Protection Team Manipulating Stocks?

|

Rumors are, the U.S. government “is propping up the stock market.” By Elliott Wave International Out of thousands of questions recently submitted to us at Elliott Wave International, the most frequent one received is: “Can the Fed manipulate the stock market?” Read our expert’s answer on this and other misleading “investment wisdom.” Read more. You… Read more Is the Plunge Protection Team Manipulating Stocks? |