Here’s what “leads” the effective federal funds rate

Forbes magazine summed up the Fed’s January statement this way (Jan. 26):

The federal funds rate remains on hold at zero to 0.25% for now, bond purchases should end in March — and then it’s time to raise rates.

The speculation on Wall Street is that the U.S. central bank will raise its federal funds rate by 25 basis points at least twice in 2022. Some Fed watchers expect a bump up as many as four times.

The federal funds rate is the interest rate that banks charge each other to borrow or lend excess reserves overnight and, yes, the central bank sets that rate.

However, what many investors may not realize is that the market leads and the Fed follows. In other words, it’s really the market which determines the trend of interest rates.

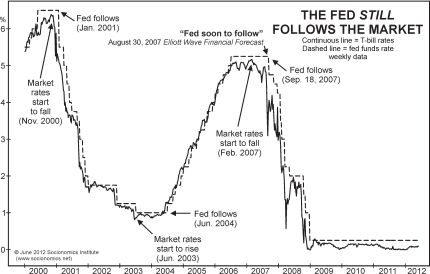

The evidence is easily provided. Here’s a chart and commentary from Robert Prechter’s landmark book, The Socionomic Theory of Finance:

No one monitoring the Fed’s decisions can predict when T-bill rates will change, but anyone monitoring the T-bill rate can predict with fair accuracy when the Fed’s rates will change. We demonstrated this ability in August 2007 by predicting that the Fed was about to lower its federal funds rate dramatically.

As you can see, the chart shows when the prediction was made and the aftermath.

Financial history shows other times when the market led, and the Fed followed.

Yet, many Fed watchers point to the early 1980s, when interest rates and inflation had reached historically high levels. The conventional narrative is that then Fed Chairman Paul Volcker decided to strangle the 20% inflation by raising interest rates. In this interpretation, it was the Fed who was proactive. It was the Fed who brought down inflation.

But, the evidence shows that the market was leading and the Fed was following — the whole time.

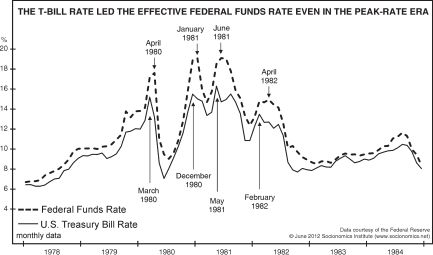

Here’s another chart, along with commentary, from The Socionomic Theory of Finance:

The chart plots T-bill rates and the effective federal funds rate from 1978 to 1984. T-bill rates peaked four times in 1980-1982. Each of those peaks occurred a month or more before subsequent and reactive peaks in the federal funds rate. The Fed’s rate also lags at bottoms, as depicted on the chart at the lows of 1980, 1981 and 1982-3.

The Socionomic Theory of Finance goes on to say:

That interest rates were in a relentless upward trend during the entire decade of the 1970s and that they have been stuck at zero since 2008 — in both cases despite the Federal Reserve’s contrary desires — is powerful evidence reinforcing the point that the Fed is not in control of interest rates.

So, it’s a myth that the Fed leads the way on the direction of interest rates (and bond yields).

Interest rates (and bond yields) are set by the market and in turn, the market is governed by the repetitive — hence, predictable — patterns of the Elliott Wave Principle.

Get insights into how the Elliott wave model can help you analyze financial markets by reading Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior.

Here’s a quote from the book:

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market’s position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Here’s the good news: You can read the entire online version for free once you become a Club EWI member.

Club EWI is the world’s largest Elliott wave educational community and is free to join. As a Club EWI member, you’ll enjoy free access to a wealth of Elliott wave resources on investing and trading without any obligations.

Follow this link for free and unlimited access to Elliott Wave Principle: Key to Market Behavior.