How Germany’s Economy is Turning Ugly

This economic gauge “dipped back below zero in less than a year”

In November 2020, when fears were rampant over a second wave of the coronavirus pandemic, the president of the European Central Bank called for economic stimulus (Reuters):

Facing gloomy outlook, Lagarde calls for unlocking EU aid

In December of 2020, what is known as the Next Generation EU package became operational. This economic aid was massive, amounting to more than €2 trillion at current prices.

But you wouldn’t know it by looking at what’s going on in Germany. It took just 24 months for the European Union’s largest economy to resume its decline.

Here’s an overview from the June 2023 Global Market Perspective, a monthly Elliott Wave International publication which covers an array of financial markets:

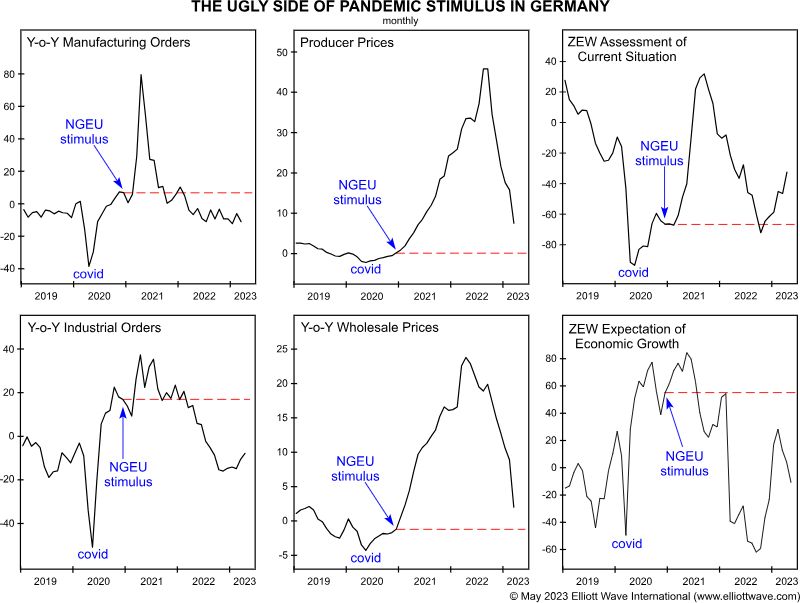

German manufacturing orders (top left) dipped back below zero in less than a year. Industrial orders (bottom left), which had already rebounded before stimulus was enacted, returned to their old growth rate within 18 months.

Meanwhile, producer prices (middle column) fell to 4% yearly growth in April — down from 46% in August 2022 — while wholesale prices, which tend to lead the consumer-prices indexes, have dipped below zero for the first time since December 2021. … The two ZEW surveys shown in the right column reflect sentiment among institutional investors. Their views about the economy’s current situation (top) and its future growth prospects (bottom) are declining from multi-year highs.

As Bloomberg reported on May 25:

Europe’s Economic Engine Is Breaking Down

Germany is at risk of a long, slow decline — with consequences for the whole of the EU

But what about other major economies in the European Union, as well as Britain?

Indeed, what does the economic picture look like in the world’s two biggest economies, the U.S. and China?

Our Global Market Perspective covers 50-plus financial markets as well as the world’s major economies.

Elliott Wave International’s main way to analyze these 50 financial markets is to employ the Elliott wave model.

If you’d like to get insights into Elliott wave analysis, read Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

The Wave Principle is governed by man’s social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.

Sometimes the market appears to reflect outside conditions and events, but at other times it is entirely detached from what most people assume are causal conditions. The reason is that the market has a law of its own. It is not propelled by the external causality to which one becomes accustomed in the everyday experiences of life. The path of prices is not a product of news. Nor is the market the cyclically rhythmic machine that some declare it to be. Its movement reflects a repetition of forms that is independent both of presumed causal events and of periodicity.

The market’s progression unfolds in waves. Waves are patterns of directional movement.

If you’d like to read the entire online version of the book for free, you may do so once you become a member of Club EWI, the world’s largest Elliott wave educational community.

A Club EWI membership is also free and allows for complimentary access to a wealth of Elliott wave resources on investing and trading.

Join Club EWI now by following this link: Elliott Wave Principle: Key to Market Behavior.