|

The great stock market buying opportunity coming our way. |

A Reliable Stock Market Indicator

|

The Single Most Reliable Indicator The market is falling and has just broken the neck down in the widely watches head and shoulders pattern. Those who are trading stocks, the savvy ones who prefer stock market timing instead of buy and hold are shorting the stocks. Most people pay attention to the news and events… Read more A Reliable Stock Market Indicator |

European Bank Stress Tests

|

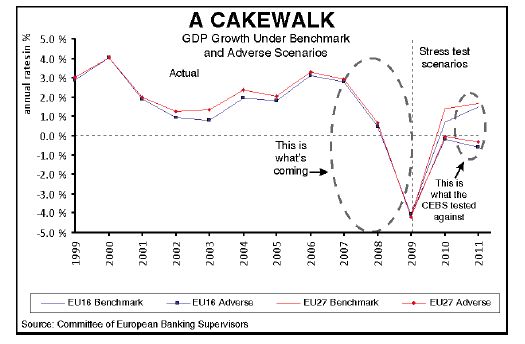

The European Banking Authority announced Friday that 8 banks had failed their stress tests and 16 more had narrowly passed. But the results drew much criticism from analysts, who said that the stress test is not strict enough. Indeed, this is something that European Financial Forecast readers have known since the first stress test last… Read more European Bank Stress Tests |

Spotting Trade Setups

|

Technical analysis helps in recognizing the markets direction and possible turning points. There is no one-size fits all silver bullet solution to get you ahead of the crowd all the time. By definition, only the few will make money in the stock market. And we can use some tools to enhance the odds in our… Read more Spotting Trade Setups |

Money in the Bank

|

Elliott Wave International’s free report “Discover the Top 100 Safest U.S. Banks” explains the true risk that you may face when a bank fails. Bank failures still dominate headlines as the number of failing banks continues at an alarming pace in 2011. The odds are that you’ve seen at least one bank failure in your… Read more Money in the Bank |

Quantitative Easing and Inflation

Can The FED Save The U.S. Economy?

|

Bernanke is at it again. His printing press is at work to create another 600 billion dollars. Bernanke declared the Economy needs it. The rationale is that if the government has more money coming from the FED, they can spend it and this Keynesian spending can jump start the economy. The assumption is that this… Read more Can The FED Save The U.S. Economy? |

What Really Moves the Markets

|

News? The Fed? The Real Answers Will Surprise You Bernanke made his QE2 promise real and started to print money again. Ironically the day of his announcement marked the low in US dollar index and dollar started to rally. Similarly, treasuries and mortgage rates staged their multi week rally after the announcement of QE2. We… Read more What Really Moves the Markets |

Understanding the Federal Reserve Bank

|

The world’s foremost Elliott wave expert Robert Prechter goes “behind the scenes” on the Federal Reserve Bank November 25, 2010 By Elliott Wave International The ongoing financial crisis has made the central bank’s decisions — interest rates, quantitative easing (QE2), monetary stimulus, etc. – a permanent fixture on six-o’clock news. Yet many of us don’t… Read more Understanding the Federal Reserve Bank |

Is the Plunge Protection Team Manipulating Stocks?

|

Rumors are, the U.S. government “is propping up the stock market.” By Elliott Wave International Out of thousands of questions recently submitted to us at Elliott Wave International, the most frequent one received is: “Can the Fed manipulate the stock market?” Read our expert’s answer on this and other misleading “investment wisdom.” Read more. You… Read more Is the Plunge Protection Team Manipulating Stocks? |

The Deflationary Spiral

|

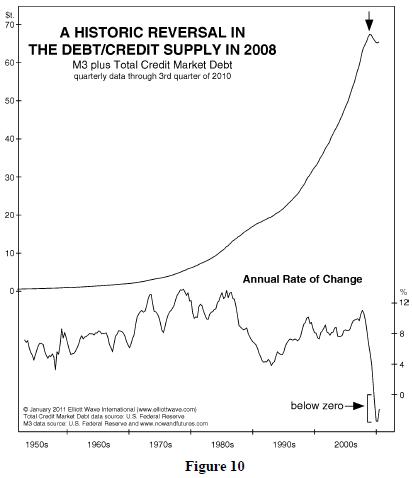

FED is getting ready to print more money to stimulate the economy. Total bank credit has stopped expanding. Total debt, which is principal + interest, is more than the money supply, which is principal only. As the shortage of US dollars forces foreclosures and bankrutpcies, FED and the government is cherry picking favored ones to… Read more The Deflationary Spiral |

Slicing the Neckline: A Classic Technical Pattern

|

A Classic Technical Pattern Agrees with the Elliott Wave Count: Slicing the Neckline In the August issue of his Elliott Wave Theorist, market forecaster Robert Prechter alerted readers that the U.S. stock market was slicing the neckline of a classic head-and-shoulders pattern in technical analysis, and that this may send the market into critical condition.… Read more Slicing the Neckline: A Classic Technical Pattern |

Day of Reckoning: Deflationary Depression is Near

|

The total outstanding debt in the world is approaching record levels. Most are preparing for inflation thinking that central banks will be printing money to pay the debt. What if someone told you inflation is not the immediate danger, but deflation is? Why? Because our money supply is not printed money. It is debt. When… Read more Day of Reckoning: Deflationary Depression is Near |

Is it time to invest in China and Japan?

|

Chinese GDP growth was more than 10% according to yesterday’s report. China is taking steps to clamp down on credit expansion to avoid an over heating economy. As you likely know, the Asian markets have become an undeniable force in the global economy, and they have provided some of the most exciting investment opportunities in… Read more Is it time to invest in China and Japan? |

Can The Government Prevent Double-Dip?

|

By Elliott Wave International There has been a lot of debate about what the government is doing to stave off a so-called double-dip recession. Some say it will cause runaway inflation; others say it’s simply delaying the inevitable. The man you’ll hear from below says DEFLATION is the true concern. It’s true that Robert Prechter… Read more Can The Government Prevent Double-Dip? |

Long Bear Market Looming

|

Prechter on CNBC: Market Pro: Long Bear Market Looming Robert Prechter, president of Elliott Wave International, tells host Maria Bartiromo why he sees dark days ahead on CNBC’s Closing Bell. Download Your FREE 50-Page Ultimate Technical Analysis Handbook In this free 50-page eBook from Bob Prechter’s Elliott Wave International, you will discover some of the… Read more Long Bear Market Looming |

Big Bear Markets: More Than Falling Stock Prices

|

By Elliott Wave International Fear and uncertainty that drive a severe bear market are the same emotions which can set the stage for authoritarianism, in most any nation. "Bear markets of sufficient size appear to bring about a desire to slaughter groups of successful people. In 1793-1794, radical Frenchmen guillotined countless members of high society.… Read more Big Bear Markets: More Than Falling Stock Prices |

Deflation: How To Survive It

|

By Elliott Wave International Telegraph.go.uk, May 26: "US money supply plunges at 1930s pace… The M3 money supply in the U.S. is contracting at an accelerating rate that now matches the average decline seen from 1929 to 1933, despite near zero interest rates and the biggest fiscal blitz in history." Deflation is suddenly in the… Read more Deflation: How To Survive It |

‘Defensive’ Stocks: Are They the Ticket in a Downturn?

|

By Elliott Wave International Approximately three out of four stocks go down in a bear market. This ratio doesn't just apply to high beta names; historically, 75 percent of all stocks go down when the general market falls. Considering we could be headed into a severe bear market (read Bob Prechter's latest special two-issue Elliott… Read more ‘Defensive’ Stocks: Are They the Ticket in a Downturn? |

The Federal Reserve Does NOT Control the Market

|

By Elliott Wave International As the world's leading stock markets continue to play stomach-hockey with investors via one triple-digit turn after another, the mainstream community takes solace in this core belief: No matter how uncertain things become, the Federal Reserve can at any moment swoop in to set the economy right. In reality — the… Read more The Federal Reserve Does NOT Control the Market |