|

By Elliott Wave International Telegraph.go.uk, May 26: "US money supply plunges at 1930s pace… The M3 money supply in the U.S. is contracting at an accelerating rate that now matches the average decline seen from 1929 to 1933, despite near zero interest rates and the biggest fiscal blitz in history." Deflation is suddenly in the… Read more Deflation: How To Survive It |

‘Defensive’ Stocks: Are They the Ticket in a Downturn?

|

By Elliott Wave International Approximately three out of four stocks go down in a bear market. This ratio doesn't just apply to high beta names; historically, 75 percent of all stocks go down when the general market falls. Considering we could be headed into a severe bear market (read Bob Prechter's latest special two-issue Elliott… Read more ‘Defensive’ Stocks: Are They the Ticket in a Downturn? |

The Federal Reserve Does NOT Control the Market

|

By Elliott Wave International As the world's leading stock markets continue to play stomach-hockey with investors via one triple-digit turn after another, the mainstream community takes solace in this core belief: No matter how uncertain things become, the Federal Reserve can at any moment swoop in to set the economy right. In reality — the… Read more The Federal Reserve Does NOT Control the Market |

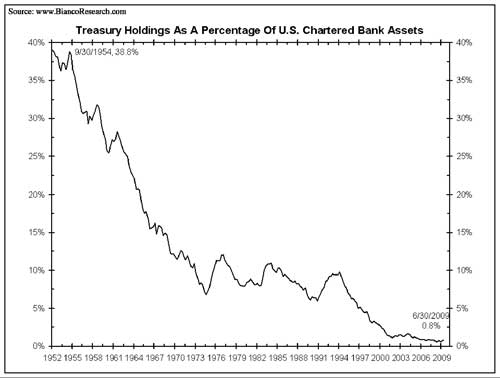

Signs of Deflation You Might Not be Able to See Clearly

|

By Editorial Staff, Elliott Wave International The following market analysis is courtesy of Bob Prechter's Elliott Wave International. Elliott Wave International is currently offering Bob's recent Elliott Wave Theorist, free. Continuing—and Looming—Deflationary Forces The Fed and the government quite effectively advertise their efforts to inflate the supply of money and credit. But deflationary forces, to… Read more Signs of Deflation You Might Not be Able to See Clearly |

What Do These 8 Technical Indicators Mean for the Markets?

|

Editor's Note: The following article is excerpted from Robert Prechter's April 2010 issue of the Elliott Wave Theorist. For a limited time, you can visit Elliott Wave International to download the full 10-page issue, free. By Robert Prechter, CMT Technical Indicators It is rare to have technical indicators all lined up on one side of… Read more What Do These 8 Technical Indicators Mean for the Markets? |

Enjoy 8 Free Chapters from Robert Prechter’s Conquer the Crash

|

By Editorial Staff In 2002, Elliott Wave International's president Robert Prechter published his New York Times and Wall Street Journal business best-seller Conquer the Crash, a prescient book that explained why a financial crisis was inevitable and predicted almost exactly how it would unfold. Now in the 2nd edition, Conquer the Crash remains a very… Read more Enjoy 8 Free Chapters from Robert Prechter’s Conquer the Crash |

Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part III

|

By Elliott Wave International In the November 2009 issue of Elliott Wave International's monthly Elliott Wave Financial Forecast, co-editors Steven Hochberg and Peter Kendall published a careful study of Goldman Sachs history — and made a sobering forecast for its future. In this special three-part series, we will release the entire Special Report to you… Read more Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part III |

Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part 1

|

By Vadim Pokhlebkin April 16, (Reuters) – Goldman Sachs Group Inc was charged with fraud on Friday by the U.S. Securities and Exchange Commission in the structuring and marketing of a debt product tied to subprime mortgages. Shocked? Most of the subscribers to Elliott Wave International's monthly Elliott Wave Financial Forecast probably weren't. In the… Read more Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part 1 |

Blaming “Market Manipulators” For Losses is a Huge Obstacle to Success

|

By Editorial Staff In 1984, Elliott Wave International's founder and president Robert Prechter won the U.S. Trading Championship, setting a new all-time profit record of 444.4% in a monitored real-money options account in 4 months. In the average 4-month contest, over 75% of contestants, mostly professionals, fail to report profits. In November 1986, in his… Read more Blaming “Market Manipulators” For Losses is a Huge Obstacle to Success |

Deflationary Crash?

|

What makes stocks rise? What makes steady Employment? What makes home prices increase? Social mood is what drives the markets, the economy, politics and the culture: http://www.tradingstocks.net/socionomics/ Early in the game when debt levels are down, as the social mood improves in capitalist economies, people start borrowing to create a good future for themselves. They work hard,… Read more Deflationary Crash? |

Market Myths Exposed: Inflation Is Not A Threat, Deflation Is

|

By Nico Isaac Most people are confident they can recognize a myth when they hear one: Wearing a hat causes baldness; eating a bunch of carrots gives you perfect vision; 'light' cigarettes are better for your health than the regular kind. But what about this sentence: Inflation is the number one threat to the US… Read more Market Myths Exposed: Inflation Is Not A Threat, Deflation Is |

What You Can Learn From a Multi-Millionaire Who Understood Market Psychology

|

By Elliott Wave International How much do you know about Bernard Baruch? He's mentioned in the foreword of The Elliott Wave Principle – Key To Market Behavior, A.J. Frost's and Robert Prechter's definitive book on wave analysis (emphasis added): "Baruch, a multimillionaire through stock market operation and adviser to American presidents, hit the nail on… Read more What You Can Learn From a Multi-Millionaire Who Understood Market Psychology |

The Wave Principle: Where The Rubber Hits The Road

|

By Nico Isaac You could be to technical analysis what tweens are to texting, and it wouldn't make a lick of difference: You still wouldn't necessarily be trading at your fullest potential. The reason being: Without Elliott wave in your technical analysis toolbox, it's like looking at the world of opportunity through a narrow keyhole… Read more The Wave Principle: Where The Rubber Hits The Road |

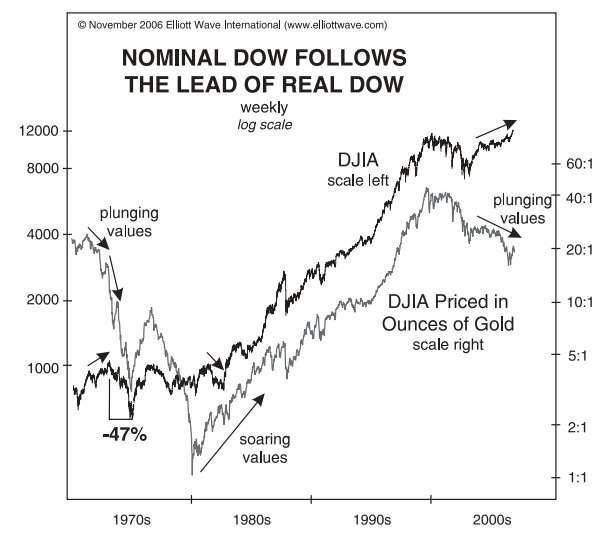

Your Cheatin’ Chart Will Tell On You

|

By Elliott Wave International "Your cheating chart will tell on you." Hank Williams may not have known about Elliott waves, but he did know when a story doesn't add up. Such is the case with the nominal rise of the Dow Jones Industrials from 2000 to 2007. In the language of country music, this stock… Read more Your Cheatin’ Chart Will Tell On You |

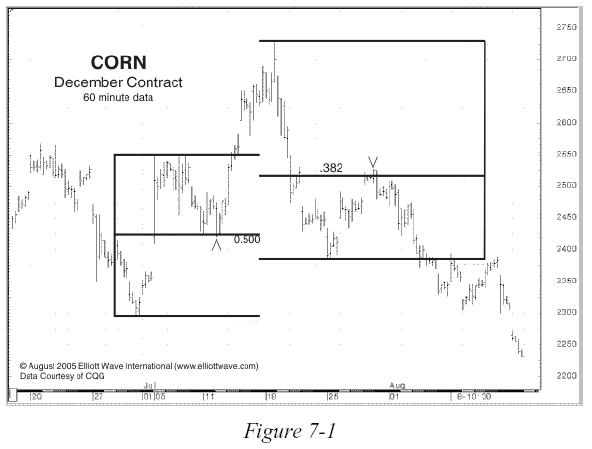

Fibonacci Techniques for Math Geeks and Everyone Else, Too

|

By Editorial Staff The word Fibonacci (pronounced fib-oh-notch-ee) can draw either blank stares or an enthusiastic response. There's hardly any in-between ground. But for those who ask how an esoteric mathematical relationship can apply to price charts and trading, here's a quick lesson. Everyone who uses Elliott wave analysis will sooner or later want to… Read more Fibonacci Techniques for Math Geeks and Everyone Else, Too |

The Stock Market Is Patterned — Here’s Proof

|

By Editorial Staff This is an excerpt from Elliott Wave International's free Club EWI resource, "What Can a Fractal Teach Me About the Stock Market?" by EWI's president Robert Prechter. In the 1930s, Ralph Nelson Elliott described the stock market as a fractal — an object that is similarly shaped at different scales. Scientists today… Read more The Stock Market Is Patterned — Here’s Proof |

What To Do With Your Pension Plan

|

Enjoy your 8 free chapters from Prechter’s Conquer the Crash — the book that foresaw what others have missed. March 16, 2010 By Editorial Staff There is no question that Robert Prechter’s Conquer the Crash foresaw and explained nearly every chapter of today’s financial crisis, years before it happened. Enjoy your 8 free chapters from… Read more What To Do With Your Pension Plan |

What Can Movies Tell You About the Stock Market?

|

By Editorial Staff The following article is adapted from a special report on "Popular Culture and the Stock Market" published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. Although originally published in 1985, "Popular Culture and the Stock Market" is so timeless and relevant that USA Today… Read more What Can Movies Tell You About the Stock Market? |

Paper Trading Is NOT What Will Teach You To Trade

|

By Editorial Staff This is an excerpt from Elliott Wave International's free Club EWI resource, "What a Trader Really Needs to be Successful" — a classic Special Report by EWI's president Robert Prechter. … 3. Experience. Some people advocate "paper trading" as a learning tool. Paper trading is useful for the testing of methodology, but… Read more Paper Trading Is NOT What Will Teach You To Trade |

Learn Elliott Wave Analysis — Free

|

By Editorial Staff Understand the basics of the subject matter, break it down to its smallest parts — and you've laid a good foundation for proper application of… well, anything, really. That's what we had in mind when we put together our free 10-lesson online Basic Elliott Wave Tutorial, based largely on Robert Prechter's classic… Read more Learn Elliott Wave Analysis — Free |