|

Enjoy your 8 free chapters from Prechter’s Conquer the Crash — the book that foresaw what others have missed. March 16, 2010 By Editorial Staff There is no question that Robert Prechter’s Conquer the Crash foresaw and explained nearly every chapter of today’s financial crisis, years before it happened. Enjoy your 8 free chapters from… Read more What To Do With Your Pension Plan |

What Can Movies Tell You About the Stock Market?

|

By Editorial Staff The following article is adapted from a special report on "Popular Culture and the Stock Market" published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. Although originally published in 1985, "Popular Culture and the Stock Market" is so timeless and relevant that USA Today… Read more What Can Movies Tell You About the Stock Market? |

Paper Trading Is NOT What Will Teach You To Trade

|

By Editorial Staff This is an excerpt from Elliott Wave International's free Club EWI resource, "What a Trader Really Needs to be Successful" — a classic Special Report by EWI's president Robert Prechter. … 3. Experience. Some people advocate "paper trading" as a learning tool. Paper trading is useful for the testing of methodology, but… Read more Paper Trading Is NOT What Will Teach You To Trade |

Learn Elliott Wave Analysis — Free

|

By Editorial Staff Understand the basics of the subject matter, break it down to its smallest parts — and you've laid a good foundation for proper application of… well, anything, really. That's what we had in mind when we put together our free 10-lesson online Basic Elliott Wave Tutorial, based largely on Robert Prechter's classic… Read more Learn Elliott Wave Analysis — Free |

Surviving Deflation: First, Understand It

|

The following article is an excerpt from Elliott Wave International's free Club EWI resource, "The Guide to Understanding Deflation. Robert Prechter's Most Important Writings on Deflation." The Primary Precondition of Deflation Deflation requires a precondition: a major societal buildup in the extension of credit. Bank credit and Elliott wave expert Hamilton Bolton, in a 1957… Read more Surviving Deflation: First, Understand It |

More Credit Default Swaps Means Trouble for European Debt

|

By Editorial Staff Government debt is no longer just a problem for emerging countries. Portugal, Spain, France and Greece (as we have seen in recent weeks) are living in fear of credit default. Consequently, the value of their credit default swaps is skyrocketing. The following is an excerpt from the February issue of Global Market… Read more More Credit Default Swaps Means Trouble for European Debt |

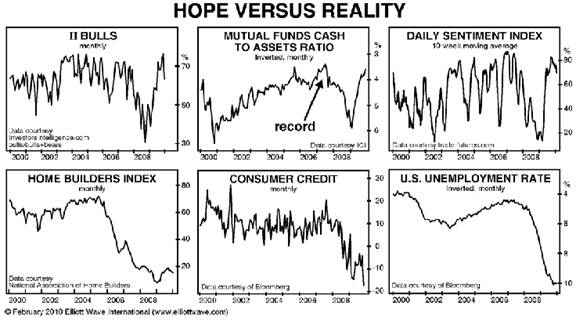

What Chinese Malls Tell Us about the Economic Reality

|

By Editorial Staff Investor expectations are decidely bullish right now, and many people expect an economic turnaround this year. What do the underlying economic conditions suggest? The Chinese mall "The Place" demonstrates the contrast between investor hope and economic reality. The following is an excerpt from the February issue of Global Market Perspective. For a… Read more What Chinese Malls Tell Us about the Economic Reality |

Europe’s Return to Risky Investment

|

By Editorial Staff Over 100 banks are opening soon, buying junk bonds is gaining popularity and emerging markets are the trendy investment. Sound familiar? Europe appears to be returning to some bad investment habits. The following is an excerpt from the February issue of Global Market Perspective. For a limited time, you can visit Elliott… Read more Europe’s Return to Risky Investment |

Robert Prechter on Herding and Markets’ “Irony and Paradox”

|

By Editorial Staff The following is an excerpt from a classic issue of Robert Prechter's Elliott Wave Theorist. For a limited time, you can visit Elliott Wave International to download the rest of the 10-page issue free. Market Herding Have you ever watched a dog interact with its owner? The dog repeatedly looks at the owner,… Read more Robert Prechter on Herding and Markets’ “Irony and Paradox” |

U.S. Stocks: Will The Bears Relinquish Control?

|

By Nico Isaac In case you were hiding out Tiger Woods' style far away from the mainstream media during the past month, let me be the first to say: January saw an abrupt end to the U.S. stock market's record-setting winning streak. Last count, the Dow Jones Industrial Average plummeted 4% in its worst monthly… Read more U.S. Stocks: Will The Bears Relinquish Control? |

EUR/USD: What Moves You?

|

By Vadim Pokhlebkin Today, the EUR/USD stands well below its November peak of $1.51. Find out what Elliott wave patterns are suggesting for the trend ahead now — FREE. You can access EWI’s intraday and end-of-day Forex forecasts right now through next Wednesday, February 10. This unique free opportunity only lasts a short time, so don't delay!… Read more EUR/USD: What Moves You? |

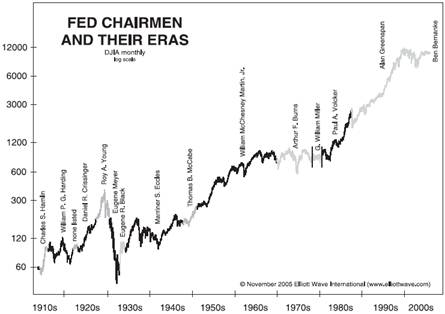

Bernanke’s Burn Notice

|

Bernanke’s Burn Notice: Why Now? Research Reveals Insight Into Fed Chairman’s Popularity By Elliott Wave International Like a spy who gets a burn notice, Federal Reserve Chairman Ben Bernanke has suddenly lost his support. Bernanke has gone from being Time magazine's Man of the Year in 2009 to … what? A Fed chairman embroiled in… Read more Bernanke’s Burn Notice |

Why You Should Care About DJIA Priced in Gold

|

By Vadim Pokhlebkin The following article is provided courtesy of Elliott Wave International (EWI). For more insights that challenge conventional financial wisdom, download EWI’s free 118-page Independent Investor eBook. ————- Of the many forward looking market indicators we at EWI employ, one of the most interesting tools (and least discussed in the financial media) is… Read more Why You Should Care About DJIA Priced in Gold |

Popular Culture and the Stock Market

|

By Robert Prechter, CMT The following article is adapted from a special report on "Popular Culture and the Stock Market" published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. Although originally published in 1985, "Popular Culture and the Stock Market" is so timeless and relevant that USA… Read more Popular Culture and the Stock Market |

Death of the Dollar, Again: Before You Mourn, See This Chart

|

The following article is based on analysis from Robert Prechter’s Elliott Wave Theorist. For more insights from Robert Prechter, download the 75-page eBook Independent Investor eBook. It’s a compilation of some of the New York Times bestselling author’s writings that challenge conventional financial market assumptions. Visit Elliott Wave International to download the eBook, free. By… Read more Death of the Dollar, Again: Before You Mourn, See This Chart |

The FDIC Anesthesia Is Wearing Off

|

By Robert Prechter The following article is an excerpt from Robert Prechter's Elliott Wave Theorist. For more information from Robert Prechter on bank safety, download his free report, Discover the Top 100 Safest U.S. Banks. Perhaps the single greatest reason for the unbridled expansion of credit over the past 50 years is the existence of… Read more The FDIC Anesthesia Is Wearing Off |

If Stocks Tank, Shouldn’t Gold Soar?

|

The following article is provided courtesy of Elliott Wave International (EWI). For more insights that challenge conventional financial wisdom, download EWI’s free 118-page Independent Investor eBook. ————- Large banks and more recently pension funds have suddenly become infatuated with gold. They chant the mantras that gold bugs have known for years: gold is a store… Read more If Stocks Tank, Shouldn’t Gold Soar? |

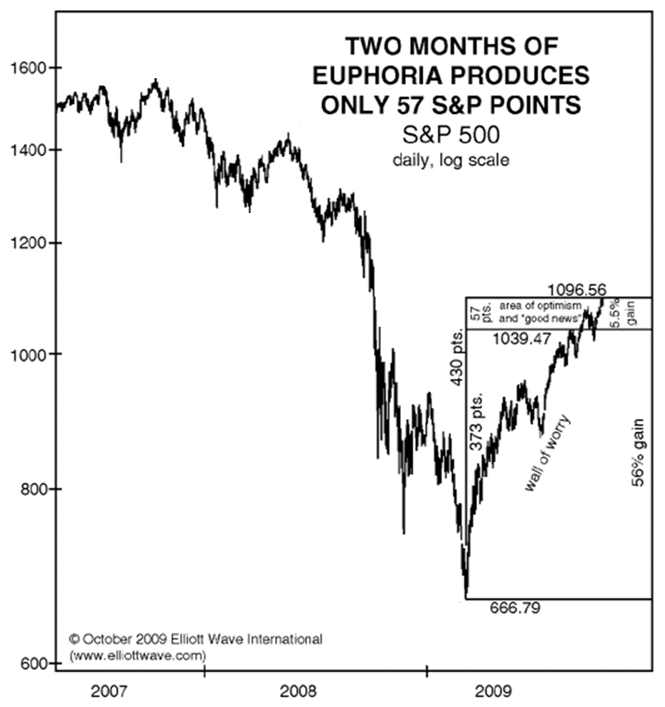

See for Yourself: This S&P 500 Chart Tells the Two-Part Truth

|

By Robert Folsom The following text is courtesy of Elliott Wave International. Until Nov. 11, EWI is allowing non-subscribers to download their latest market analysis and forecasts for free, including Robert Prechter's latest Elliott Wave Theorist and Steve Hochberg's and Pete Kendall's latest Elliott Wave Financial Forecast. Learn more about FreeWeek, and download your free… Read more See for Yourself: This S&P 500 Chart Tells the Two-Part Truth |

Earnings: Is That REALLY What’s Driving The DJIA Higher?

|

By Vadim Pokhlebkin It's corporate earnings season again, and everywhere you turn, analysts talk about the influence of earnings on the broad stock market: US Stocks Surge On Data, 3Q Earnings From JPMorgan, Intel (Wall Street Journal) Stocks Open Down on J&J Earnings (Washington Post) European Stocks Surge; US Earnings Lift Mood (Wall Street Journal)… Read more Earnings: Is That REALLY What’s Driving The DJIA Higher? |

How to Prepare for the Coming Crash and Preserve Your Wealth

|

Bob Prechter first released Conquer the Crash: You Can Survive and Prosper in a Deflationary Depression during a stock-market high in 2002, and it quickly became a New York Times–bestseller. Now he has updated the book with 188 new pages for a second edition, and it looks like it, too, will be published near a… Read more How to Prepare for the Coming Crash and Preserve Your Wealth |