|

3 Signs of Developing U.S. Economic Slowdown “Credit standards are tightening, thereby freezing out borrowers” Recent headlines about the U.S. economy are rosy: US economic growth for last quarter is revised up slightly to a healthy 3.4% annual rate (AP News, March 28) US economy continues to shine with help from consumers, labor market (Reuters,… Read more Signs of Economic Slowdown |

Gold Price Targets

|

Gold: Setting Near-Term Price Targets This was our “initial upside target” — which has now been exceeded. What’s next? Around the first week of the year, the outlook for gold was not looking promising, at least according to this Jan. 5 headline (Reuters): Gold set for weekly decline as dollar, yields climb The rally in… Read more Gold Price Targets |

Insider Selling in Stocks

|

Stocks: What to Make of All This Insider Selling Here are details of “The Great Cash-Out” Corporate insiders may sell the shares of their company for any number of reasons but one of them is not because they think the price is going up. In other words, insider selling can serve as a warning. For… Read more Insider Selling in Stocks |

Extreme Greed in Stocks

|

S&P 500: What to Make of Fear Versus Greed This sentiment index combines seven indicators into one useful trend measure That is — market participants generally go from feeling deeply pessimistic all the way to feeling highly optimistic — and then back again. These swings in investor psychology tend to produce similar circumstances at corresponding… Read more Extreme Greed in Stocks |

What the Fear Index VIX May be Saying

|

What “Fear Index” VIX May Be Signaling “Note the succession of higher closing low relative to higher highs in…” First, just a quick basic fact about the CBOE Volatility Index (VIX) — also known as the stock market’s “fear gauge”: the lower the reading, the higher the complacency among investors. Higher readings indicate increased investor… Read more What the Fear Index VIX May be Saying |

China’s Housing Bust

|

Here’s an Update on China’s Big Housing Bust “Property market weakness is now spreading into the overall economy.” If you’re wondering about the future value of your home or the housing market in general, you may want to pay attention to what’s going on in China. The bottom line: The way we see it at… Read more China’s Housing Bust |

Once in a Lifetime Debt Crisis

|

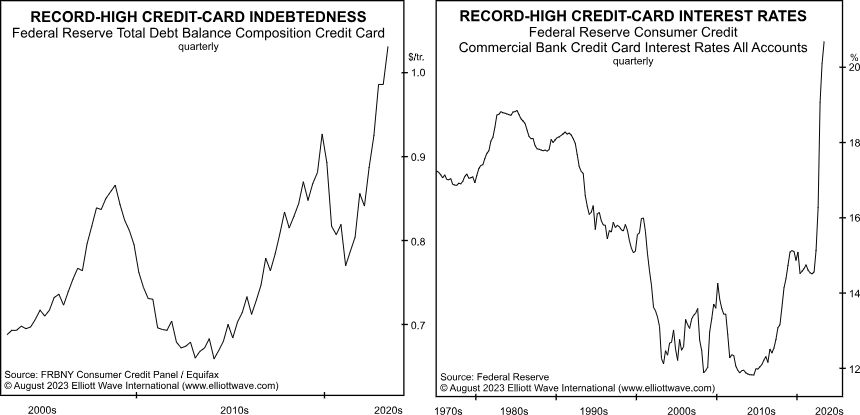

Why You Should Expect a Once-in-a-Lifetime Debt Crisis U.S. credit card debt surpasses $1 trillion On a national level, a debt crisis occurs when a country is unable to pay back its government debt. This might result from government spending exceeding tax revenues for an extended period. On an individual level, a crisis can result… Read more Once in a Lifetime Debt Crisis |

US Home Equity

|

What Will Happen to That $30 Trillion in U.S. Home Equity? “It’s like someone turned off the faucet” You probably remember the last big housing bust which began more than 15 years ago. Elliott Wave International has observed that falling housing prices are generally preceded by a decline in home sales. The lag time may… Read more US Home Equity |

Climbing Oil Prices

|

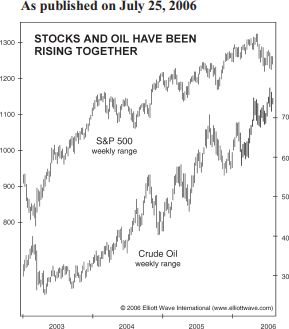

“Climbing Oil Prices Bearish for Stocks”? It’s a Myth! Oil and stocks sometimes trend together. Other times, they don’t. There’s a widespread belief that rising oil prices are bearish for the main stock indexes and falling oil prices are bullish for stocks. That belief is reflected in this Sept. 5 CNBC headline: Dow closes nearly… Read more Climbing Oil Prices |

Interest Rates

|

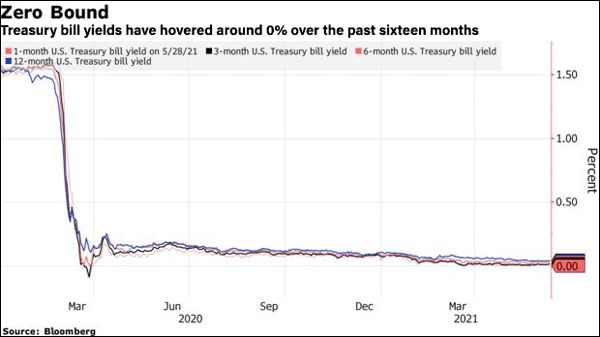

Interest Rates: From 0% to Above 5% — to …? “The lines in the chart will turn up, and no policy will stop it” As you’re probably aware, many people who want to borrow to make a major purchase like a house or a car are bemoaning higher interest rates. It wasn’t so long ago… Read more Interest Rates |

Why Do Traders Lose Money?

|

Why Do Traders Really Lose Money? Answer: It’s Not the Market’s Fault And 1 FREE course on how to help you stop self-sabotaging “good enough” trade plans I have always been a “who cares about the odds” kinda person. Meaning, if someone tells me the likelihood of succeeding at, say, learning to skateboard at 40,… Read more Why Do Traders Lose Money? |

Bold Call on Housing Prices

|

Here’s a “Bold Call” on U.S. Housing Prices (Don’t Hang Your Hat on It) This does not look like a bottom in median existing home prices Back in October 2022, none other than Realtor.com asked the question: Is America in a housing bubble–and is it getting ready to burst? That was 10 months ago and… Read more Bold Call on Housing Prices |

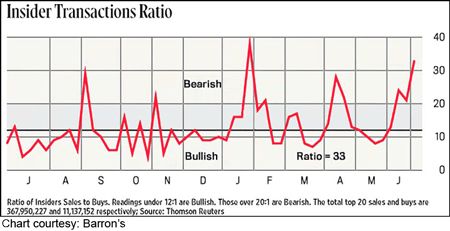

Insiders Selling

|

Pay Attention to This Group of Investors (They Know More) The stock market actions of corporate insiders is revealing It stands to reason that executives of a corporation know more about the goings-on of their business than outsiders. So, it’s wise to pay attention to their stock market actions regarding their own shares. Yes, the… Read more Insiders Selling |

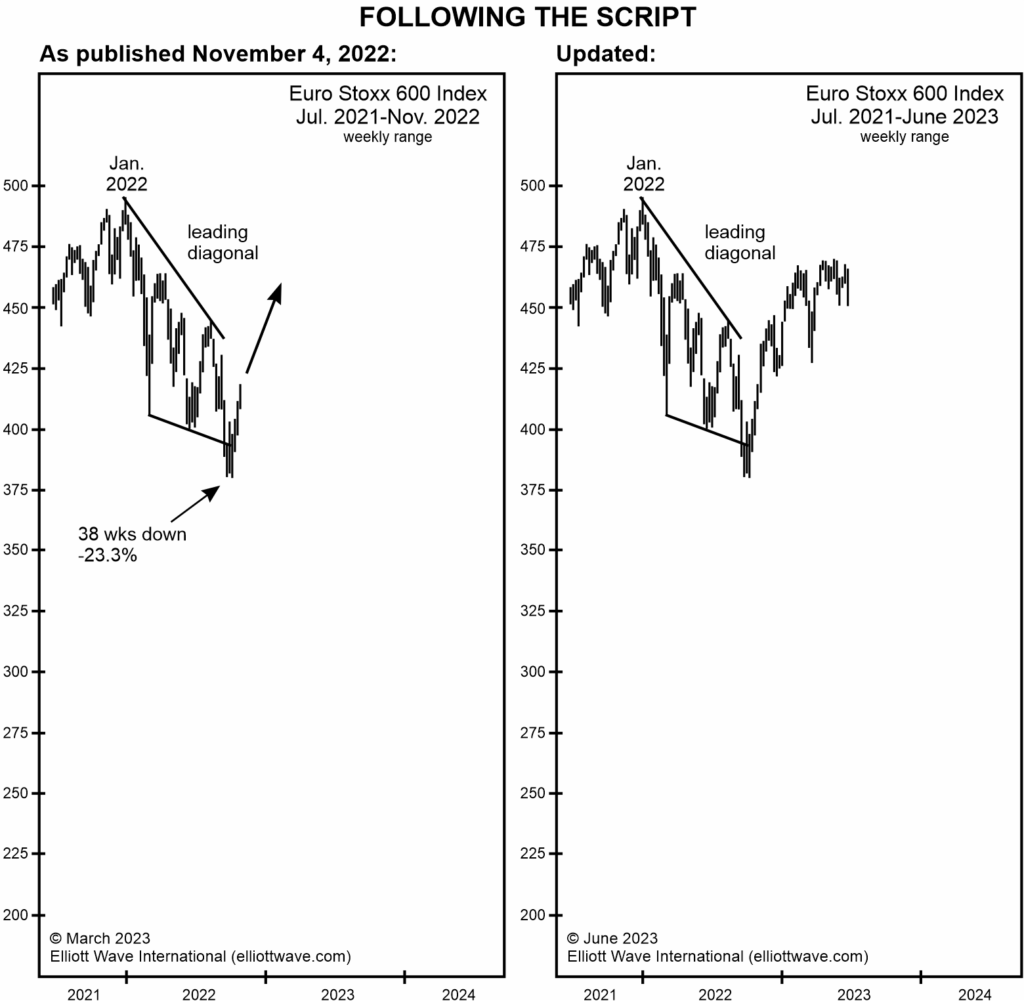

Euro Stoxx 600 Following the Script

|

Euro Stoxx 600: “Following the Script” “If the 2007 analogue holds, the current rally [will] persist …” On Oct. 24, 2022, Bloomberg said: Forget about a Santa rally to rescue European stocks from their doldrums, say strategists from Goldman Sachs Group Inc. to Bank of America Corp. A week and a half later, our November… Read more Euro Stoxx 600 Following the Script |

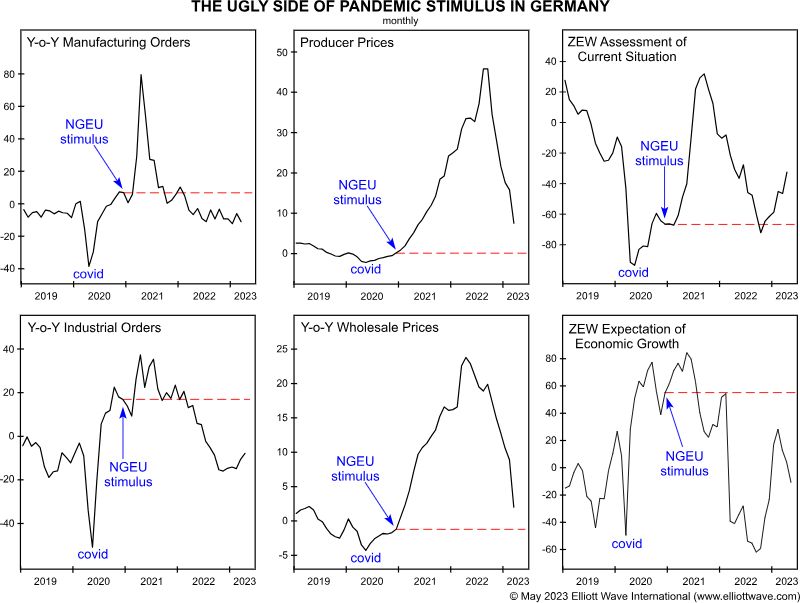

German Economy is Broken

|

How Germany’s Economy is Turning Ugly This economic gauge “dipped back below zero in less than a year” In November 2020, when fears were rampant over a second wave of the coronavirus pandemic, the president of the European Central Bank called for economic stimulus (Reuters): Facing gloomy outlook, Lagarde calls for unlocking EU aid In… Read more German Economy is Broken |

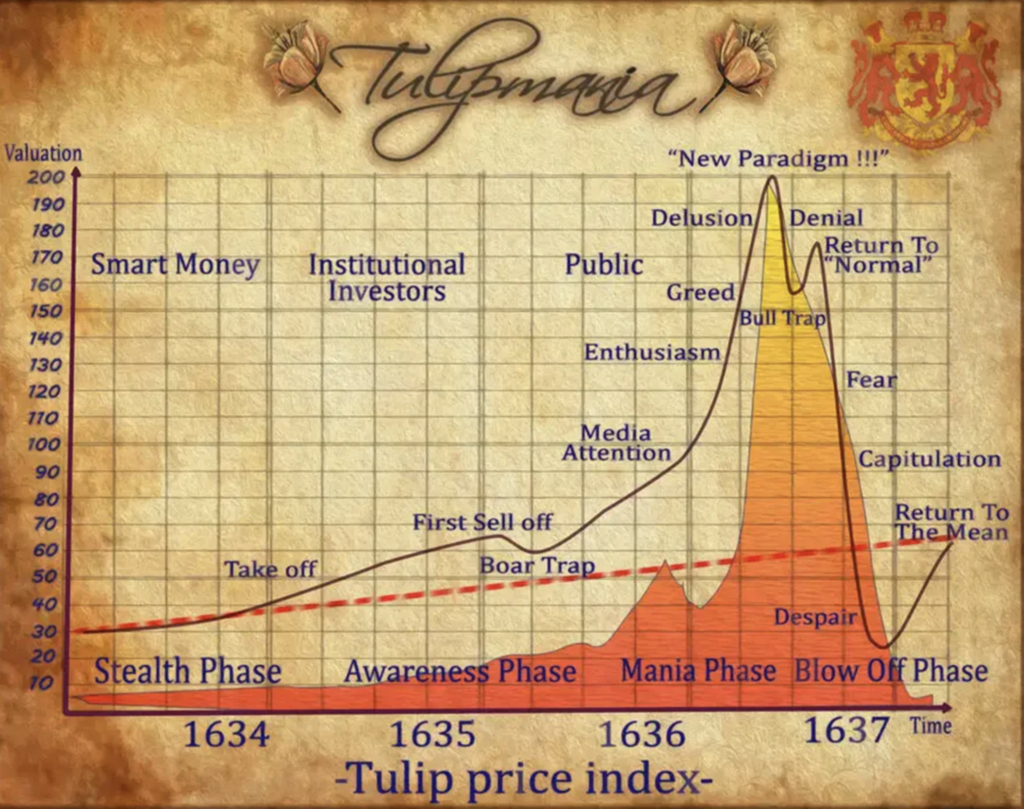

Tulip Mania Was Nothing

|

Recently, Elliott Wave International’s president Robert Prechter gave a rare interview. He covered a lot of ground – from stocks and Bitcoin to the economy and gold. Our friends at Elliott Wave International are sharing Prechter’s interview with you free. Listen as Prechter explains why 2021’s extreme market sentiment made the Tulip Mania look like… Read more Tulip Mania Was Nothing |

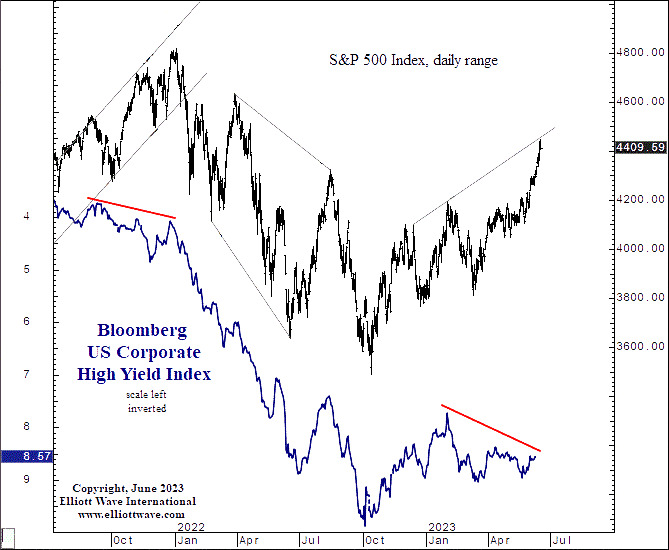

Divergence in Stocks vs Junk Bonds

|

Stocks and Junk Bonds: “This Divergence Appears Meaningful” “Everything was aligned until February 2” The trends of the junk bond and stock markets tend to be correlated. The reason why is that junk bonds and stocks are closely affiliated in the pecking order of creditors in case of default. The rank of junk bonds is… Read more Divergence in Stocks vs Junk Bonds |

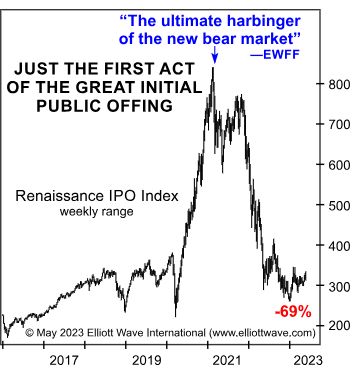

Harbinger of the Bear Market

|

Insights into This “Ultimate Harbinger” of the Bear Market Enthusiasm for U.S. IPOs seems to be dramatically decreasing Back in early 2021, many investors were chomping at the bits to invest in entities about which they knew next to nothing. These entities are known as Special Purpose Acquisition Companies (SPACs), which may be described as… Read more Harbinger of the Bear Market |

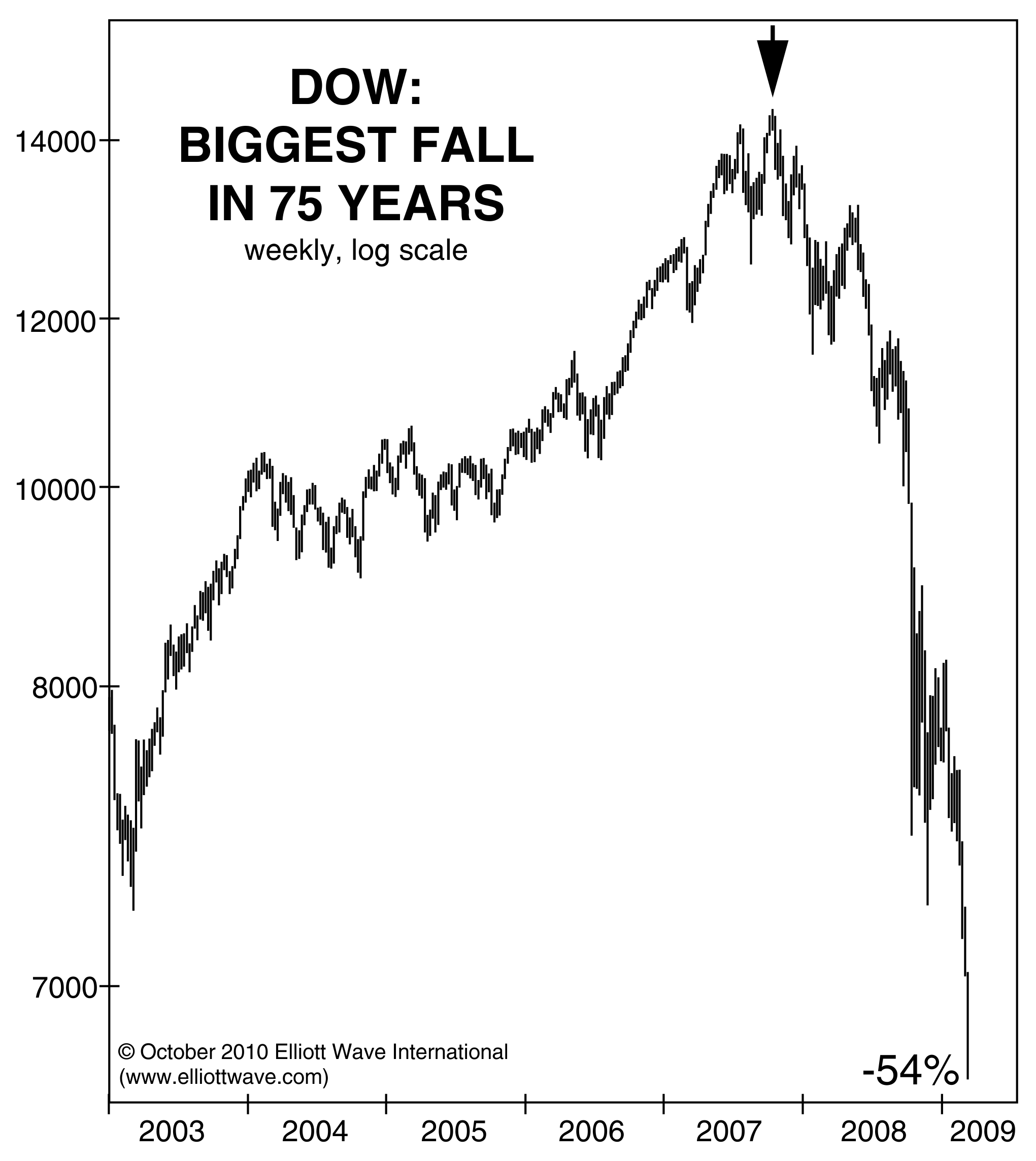

Possible Replay of History

|

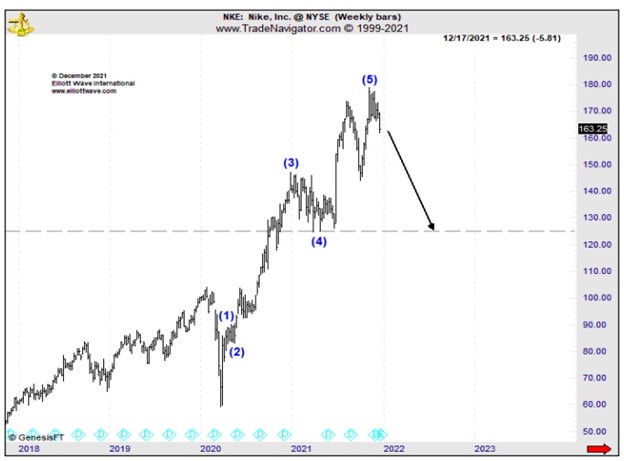

Stocks: Possible Replay of an Ominous Price Pattern “I became panicky and covered at a considerable loss…” The reason price patterns tend to repeat in the stock market is that investor psychology never changes. The Elliott wave model directly reflects these largely predictable swings in investor psychology. That’s what the Elliott wave principle is all… Read more Possible Replay of History |

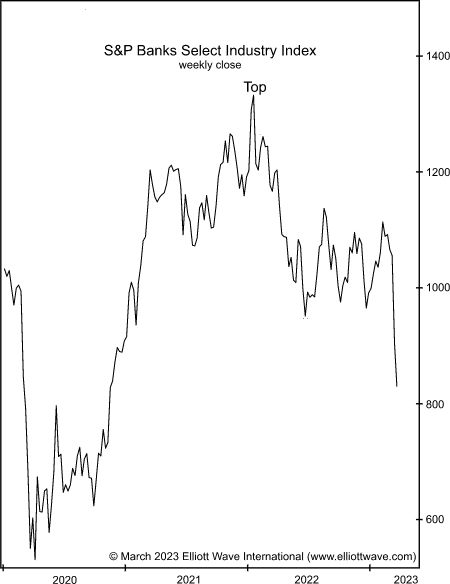

Sectors Leading Lower

|

Will These 2 Sectors Lead the Stock Market Lower? This key sector continues to be “fragile” Although it doesn’t feel like it sometimes, the U.S. stock market has been in a downtrend since January 2022. The reason it doesn’t feel like it is because the S&P 500 has been in a narrow trading range between… Read more Sectors Leading Lower |