|

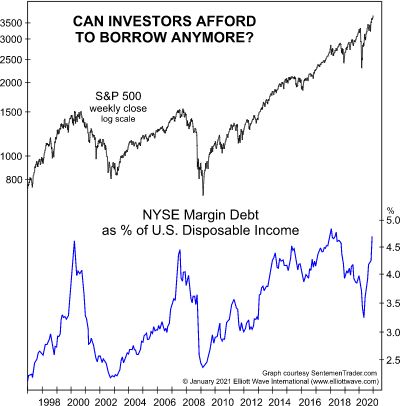

Why Next Wave of Margin Calls Will Be FAR More “Disruptive” Than in 2000 or 2007 “Can investors afford to borrow anymore?” Financial history shows that every bear market has been followed by a bull market and vice versa. So, the current bull market will end sooner or later. The prior two bull market tops… Read more Margin Call Tsunami |

Why did Bitcoin Crash?

|

Bitcoin’s 24-Hour Crash: FCA Warning Was a Slap in the Face. But It Wasn’t the Cause. See what ‘allowed’ for a turn down in the immediate future. In case you blinked over the last two days, bitcoin bulls had their hat abruptly handed to them when the cryptocurrency plummeted a jarring 26% in 48 hours.… Read more Why did Bitcoin Crash? |

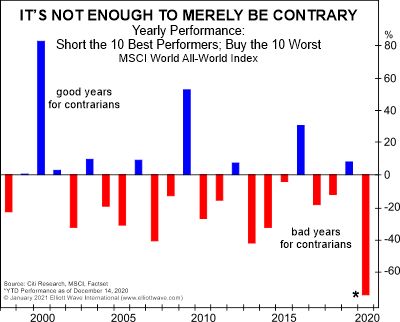

Contrarian Trade Failed in 2020

|

Here’s Why Blind Contrarianism Failed in 2020. There is only one instance when the investing crowd is right. Yes, there are many times when the market’s Elliott wave structure suggests that an investor should take a position “against the crowd,” or put another way, be a contrarian. Prime examples are at market bottoms and tops.… Read more Contrarian Trade Failed in 2020 |

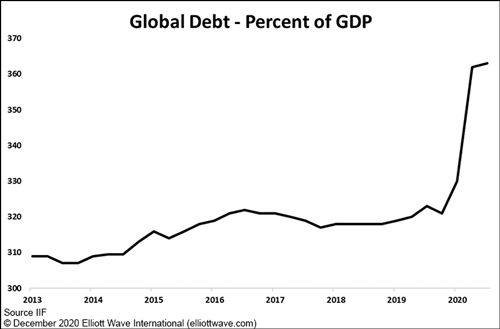

Debt: Precursor to an Economic Depression

|

Global Tipping Point: “Good” Debt Vs. “Bad” Debt (Which is Winning?) All major U.S. economic depressions were “set off” by this single factor! Isn’t all debt “bad”? Well, in a word, no. Broadly speaking, there are two types of debt. One of them actually adds value to the economy if handled in the right way,… Read more Debt: Precursor to an Economic Depression |

Smart Money vs Dumb Money

|

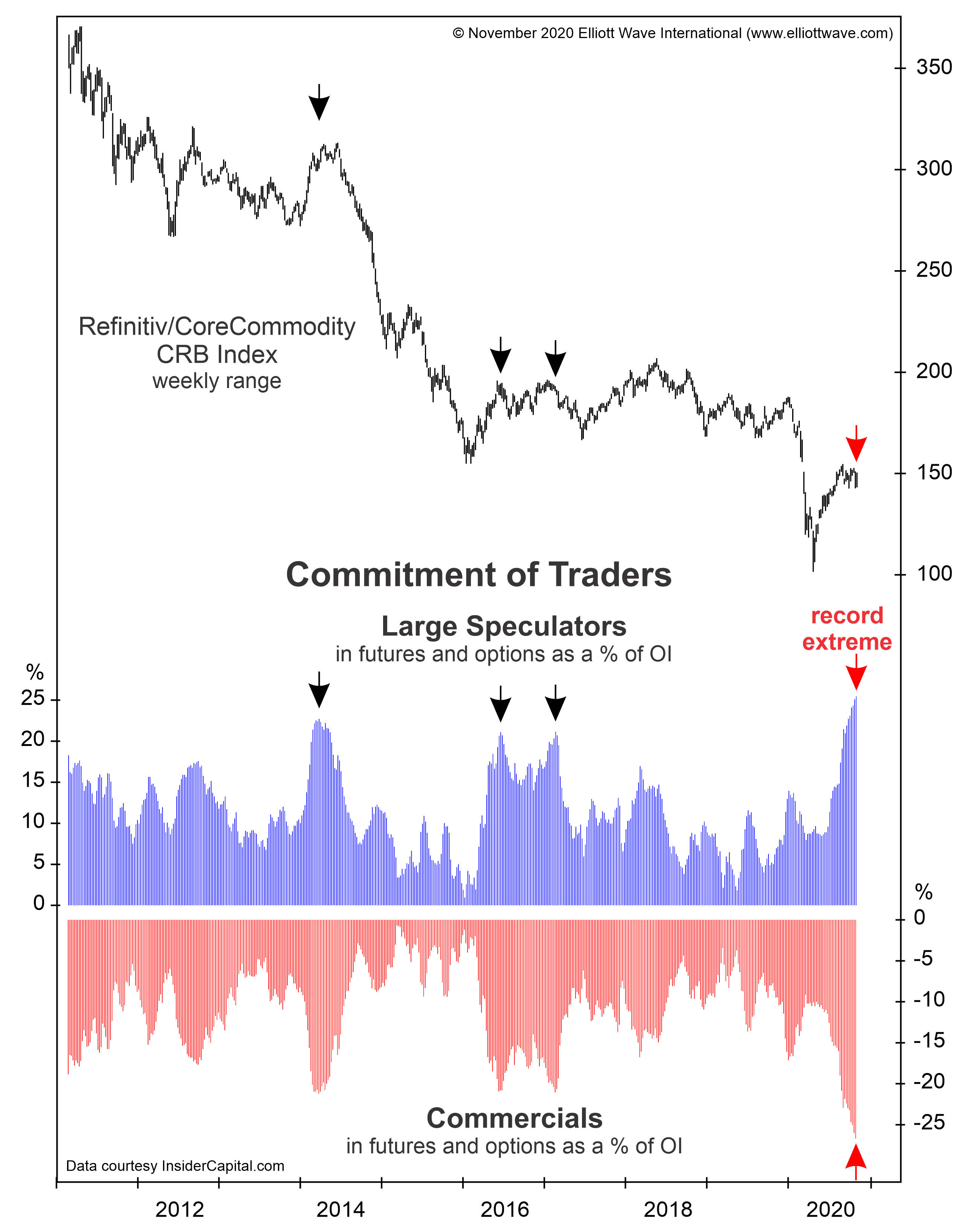

Small Traders vs. Large Traders vs. Commercials: Who Is Right Most Often? When one of these groups acts, “the odds become high for a change of trend” It’s useful to know who is doing what in particular financial markets. You’ll find out why as we proceed, however, let’s first start off with some basic background… Read more Smart Money vs Dumb Money |

Trump vs Biden

|

The U.S. presidential election is just days away. What does the stock market say about who is likely to win? Which party would be better for the stock market and the economy? And how can you anticipate trends in politics, the economy and broader society going forward, regardless of who wins? Get deeply researched answers… Read more Trump vs Biden |

Nobody is Selling Short – Is it a Top?

|

Fear Grips Stock Market Short-Sellers — What to Make of It “This is easily the lowest wager against rising S&P rises” in the history of the data As you may know, short-selling a stock means that a speculator is betting that the price will go down. This is a lot riskier than taking a “long”… Read more Nobody is Selling Short – Is it a Top? |

Gold Fibonacci Retracement

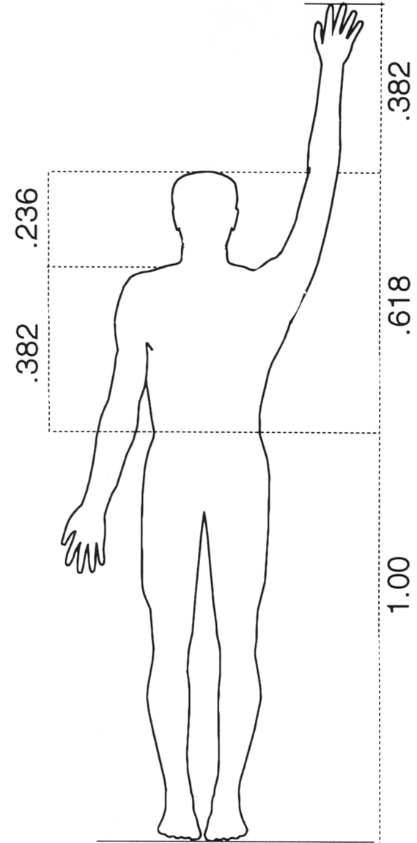

|

Gold: See What This Fibonacci Ratio Says About Trend A Fibonacci .618 retracement is a common reversal point in the markets Fibonacci numbers follow a sequence that begins with 0 and 1, and each subsequent number is the sum of the previous two (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so… Read more Gold Fibonacci Retracement |

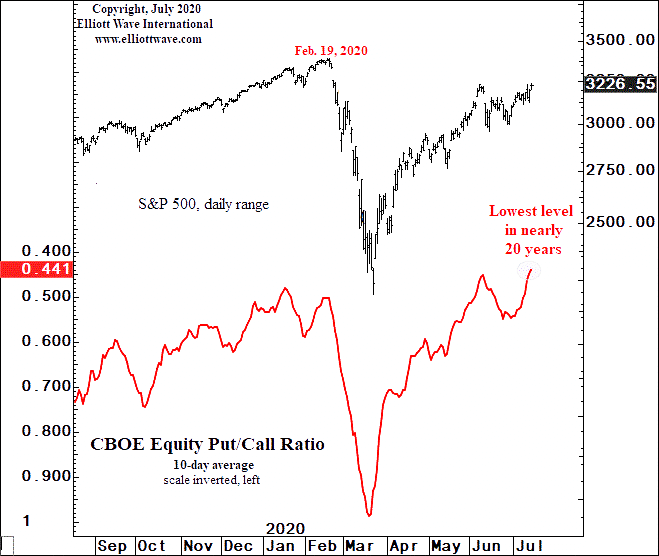

Put/Call Ratio at 20 Year Low

|

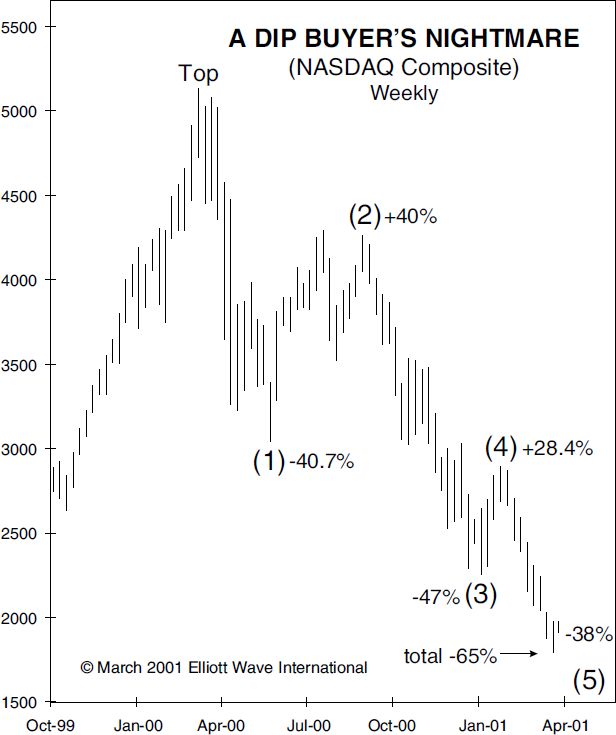

This Stock Market Indicator Reaches “Lowest Level in Nearly 20 Years” Here’s what happened “the last time the 10-day put/call ratio made a lower extreme” After a big trend reversal, it’s not unusual for the correction to retrace much of the initial sell-off or rally. Thus, many investors are fooled into believing that the old… Read more Put/Call Ratio at 20 Year Low |

Extreme Bearish Sentiment in US Dollar

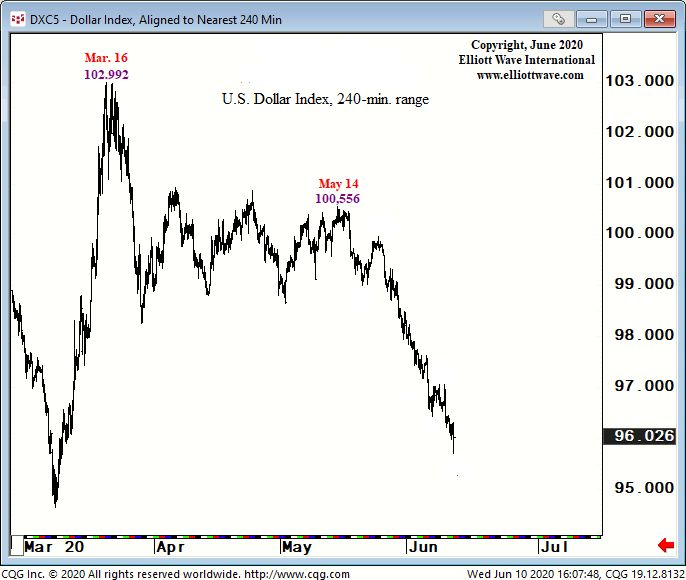

|

U.S. Dollar: When Almost Everyone Is Bearish… By Elliott Wave International June started off with speculators decidedly negative toward the U.S. dollar. On the second day of the month, the Financial Times said: Wall Street strategists say dollar could be set for “dramatic” falls Elliott Wave International’s June 10 U.S. Short Term Update, a three-times-a-week… Read more Extreme Bearish Sentiment in US Dollar |

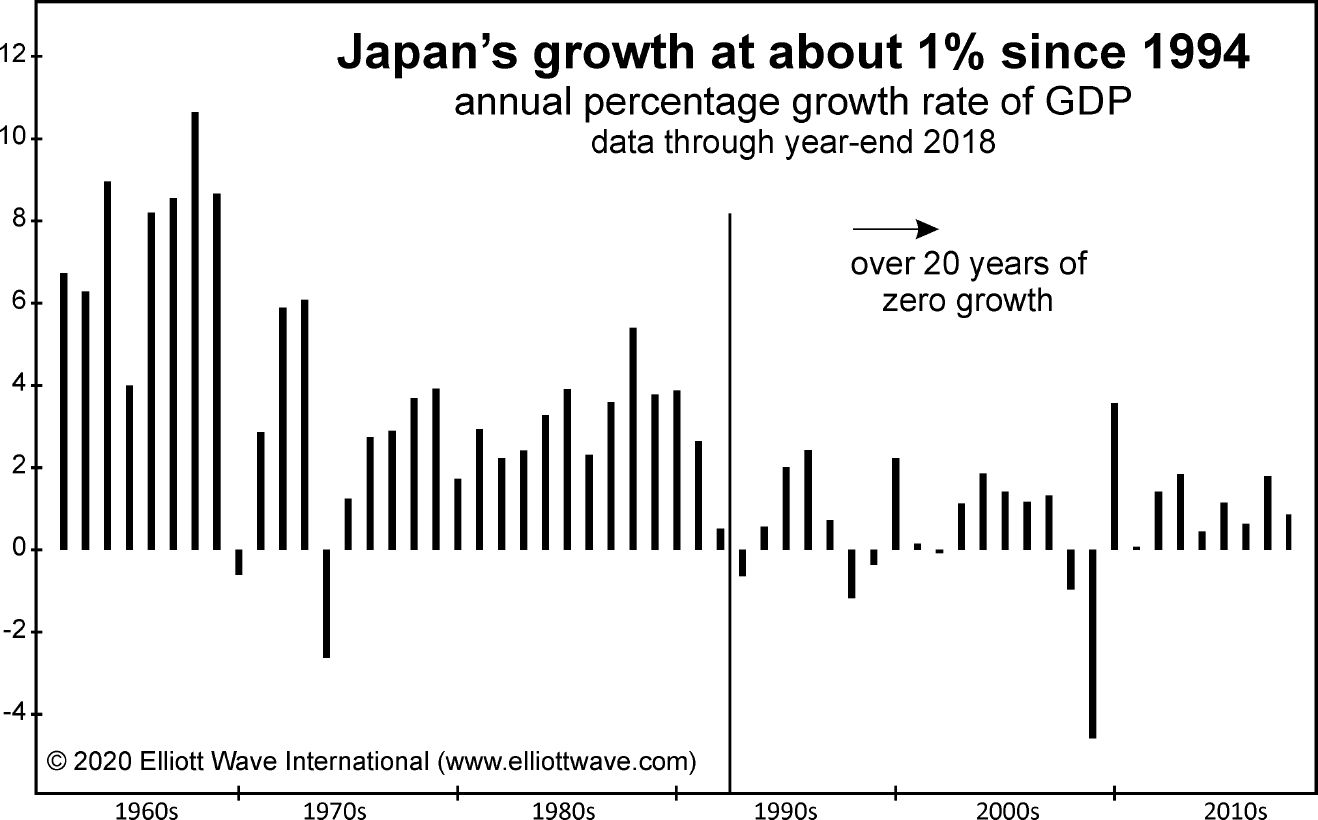

Japan Like Deflation in the United States

|

The U.S. faces the prospect of a Japan-like deflation. Let’s begin with a brief review of Japan. Here’s a chart and commentary from the 2020 edition of Robert Prechter’s Conquer the Crash: Japan had one of the strongest economies in the entire world, growing at a 9% rate for 20 years up to 1973, and… Read more Japan Like Deflation in the United States |

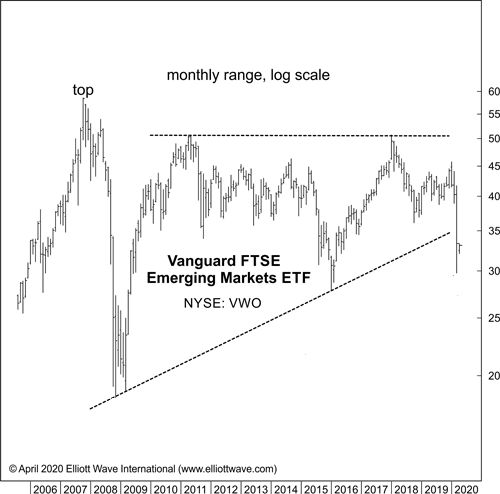

Emerging Markets and Epidemics

|

An Eye-Opening Perspective: Emerging Markets and Epidemics People across the entire planet remain very much aware of the COVID-19 health threat. The global disruption associated with the pandemic far surpasses other major health scares in modern history. Even so, you may recall 2009 news articles similar to this one from the New York Times (June… Read more Emerging Markets and Epidemics |

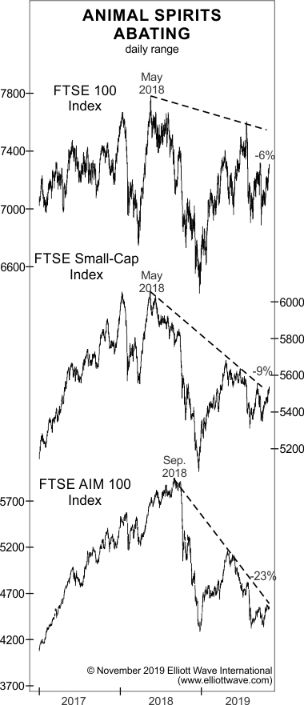

Why Non-Confirmations Matter

|

When a trend is strong, related markets tend to move in unison. However, when a trend is near exhaustion — a bullish or bearish trend, “non-confirmations” often occur. A non-confirmation occurs when one market makes a new high (or low), but a related market does not. As cases in point, our November Global Market Perspective… Read more Why Non-Confirmations Matter |

Is Gold at a Top?

|

Gold and Silver: Pay Attention to This Noteworthy Record High Here’s what usually occurs in related financial markets when “big changes in social mood are afoot” Related financial markets tend to move together. For example, gold and silver. Or, consider stocks. When the Dow Industrials are up on a given trading day, the NASDAQ is… Read more Is Gold at a Top? |

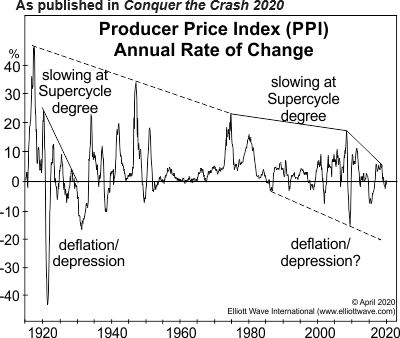

Deflation vs the FED

|

Weeks before the February top in the DJIA, the January Elliott Wave Theorist (Elliott Wave International President Robert Prechter’s monthly publication about financial markets and social trends since 1979) said: Most economists believe the Fed can prevent financial crises and depressions. [EWI’s analysts] disagree. Socionomic theory proposes that naturally fluctuating waves of social mood regulate… Read more Deflation vs the FED |

US dollar goes up in a Deflationary Crash

|

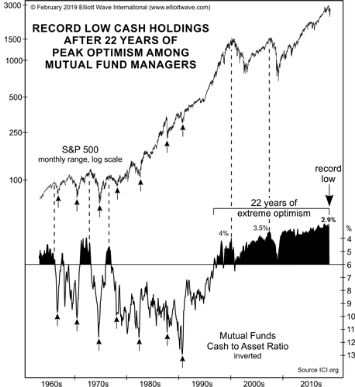

The relative value of cash will necessarily zoom higher when stocks plunge. A negative sentiment toward cash had been in place for quite some time. Let’s go back a little more than a year when our Feb. 2019 Elliott Wave Theorist showed this chart and said: The average cash holding in mutual funds just fell… Read more US dollar goes up in a Deflationary Crash |

Buying the dip?

|

Stocks: Why “Buying the Dip” is Fraught with Danger Investors know that the main U.S. stock indexes have tumbled very quickly. On a historical basis, some may not realize just how quickly. A March 23 Marketwatch headline referred to a “mind-bending stat”: The S&P 500 has dropped 30% from peak to trough faster than any… Read more Buying the dip? |

Did the Oil Crash Wreck the Stock Market?

|

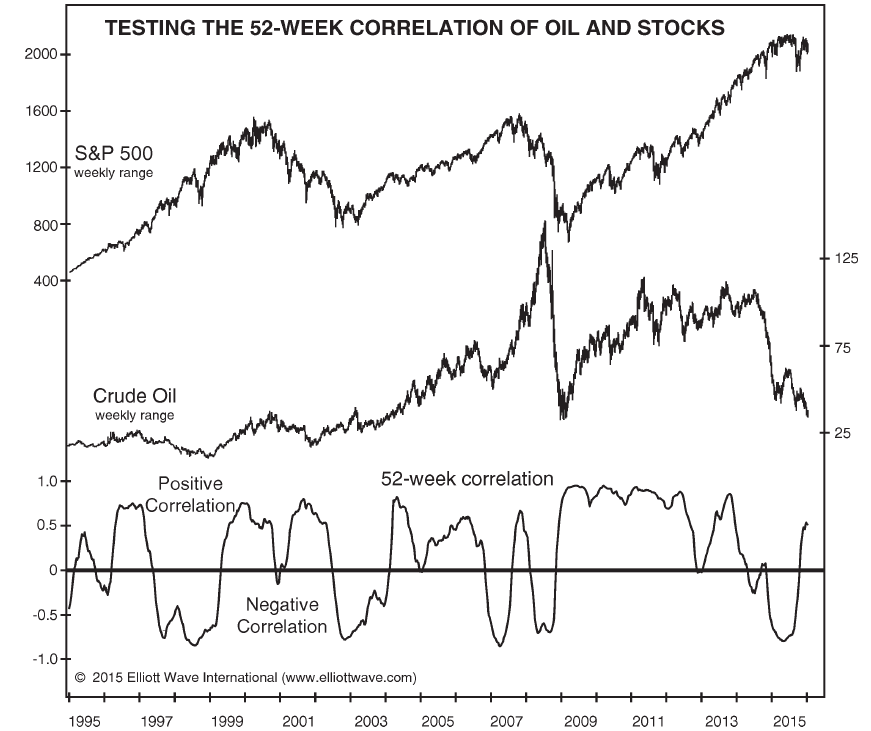

Crude oil took a 30% dive on Sunday, March 8. Yet what’s happened in oil this year is so much bigger than that headline-grabbing, one-day move. In January, oil was $64 a barrel. It hit $27.34 intraday on Monday, March 9, so the price of oil fell 57% in just two months. Talk about a… Read more Did the Oil Crash Wreck the Stock Market? |

Pension Plans Investing in Stock Market

|

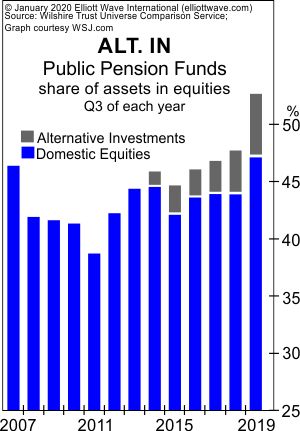

You Won’t Believe WHEN Pension Funds “Embraced Stocks as a Safe Investment” Pension funds were already in a highly precarious position before the DJIA’s February 12 high and the subsequent start of the high drama in stock moves. The 2018 edition of Robert Prechter’s Conquer the Crash noted: The bull market in stocks has gone… Read more Pension Plans Investing in Stock Market |

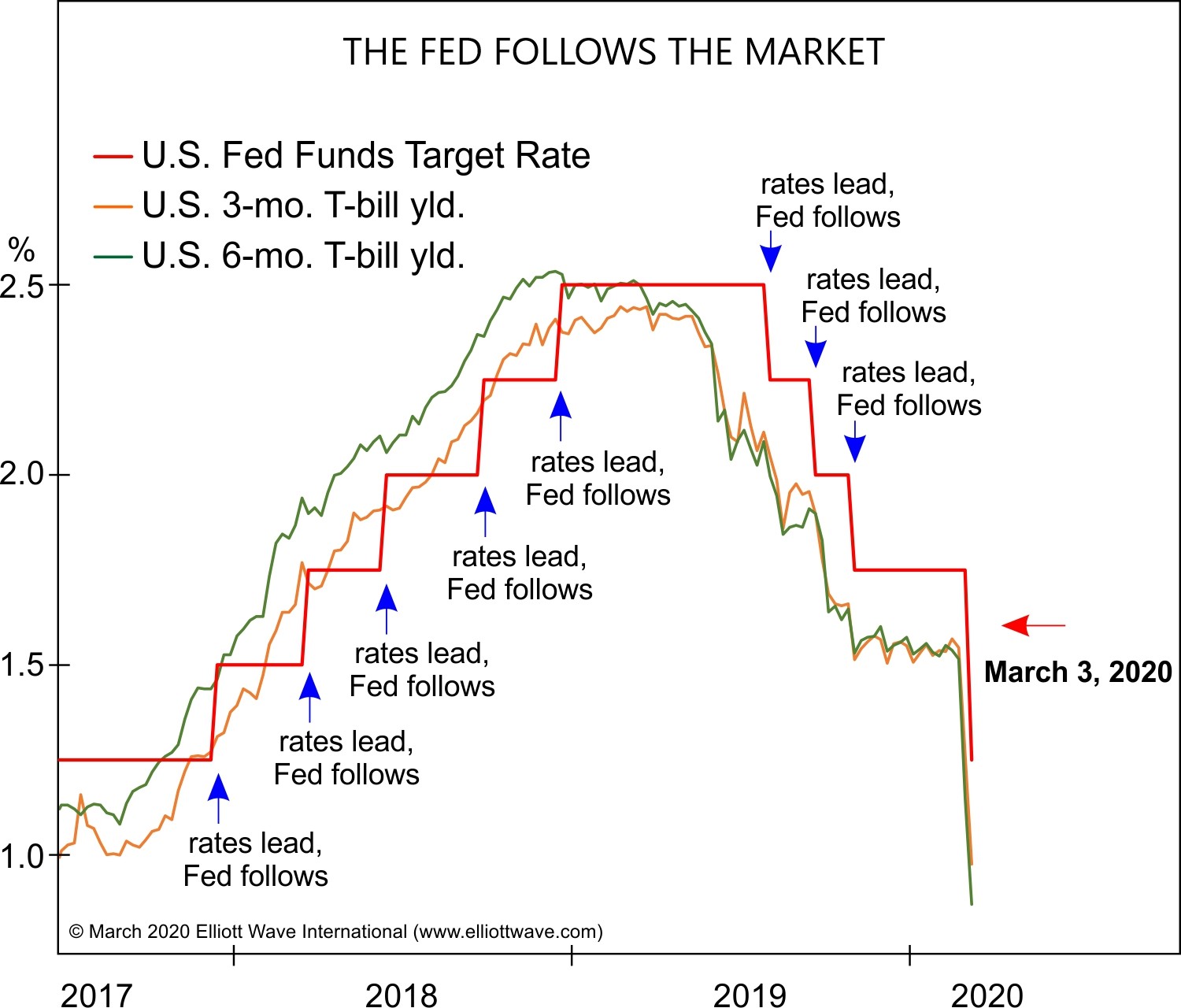

Why did the Fed cut the rates

|

Think the Fed’s Emergency Rate Cut is Proactive? Think Again. You might think that the Fed’s recent, unscheduled 50 basis-point cut in the federal funds rate is a proactive move that places the central bank at the vanguard of revolutionary uses of monetary policy. But that could hardly be further from the truth. For decades… Read more Why did the Fed cut the rates |