|

Why Stock Market Investors Should Expect the Unexpected Read our forecast for a market rally in the wake of Brexit Investors who jump on “sure things” in the stock market usually lick their wounds with regret. The decision of British voters to leave the European Union appeared to represent low-hanging fruit to short sellers. After… Read more Investors Should Expect the Unexpected |

Is There a Tech Bubble?

|

Silicon valley was not hit as hard during the financial crisis and the tech stocks have done well since. Nasdaq has reached all time high exceeding 2000 bubble levels, retreated a bit. Could we argue we are not at bubble levels yet? Was it business as usual for Facebook to pay 19 billion dollars for… Read more Is There a Tech Bubble? |

How to Invest for the Brexit?

|

Will the Britain exit EU? If you follow Europe’s major financial news networks, you’re no doubt inundated by all the rumor and conjecture surrounding the Brexit referendum — it dominates the headlines. Back across the pond, the Washington Post calls it the “most important vote in Europe in a half-century.” So will Great Britain exit… Read more How to Invest for the Brexit? |

Can the FED Go For Negative Interest Rates?

|

FED has kept interests close to 0% for many years. We went through many rounds of QE. We have inflated assets bubbles in housing and the stock market once again -according to some- to worse levels than 2007. FED has finally increased the rates marginally and the stocks started to come down furiously. After a… Read more Can the FED Go For Negative Interest Rates? |

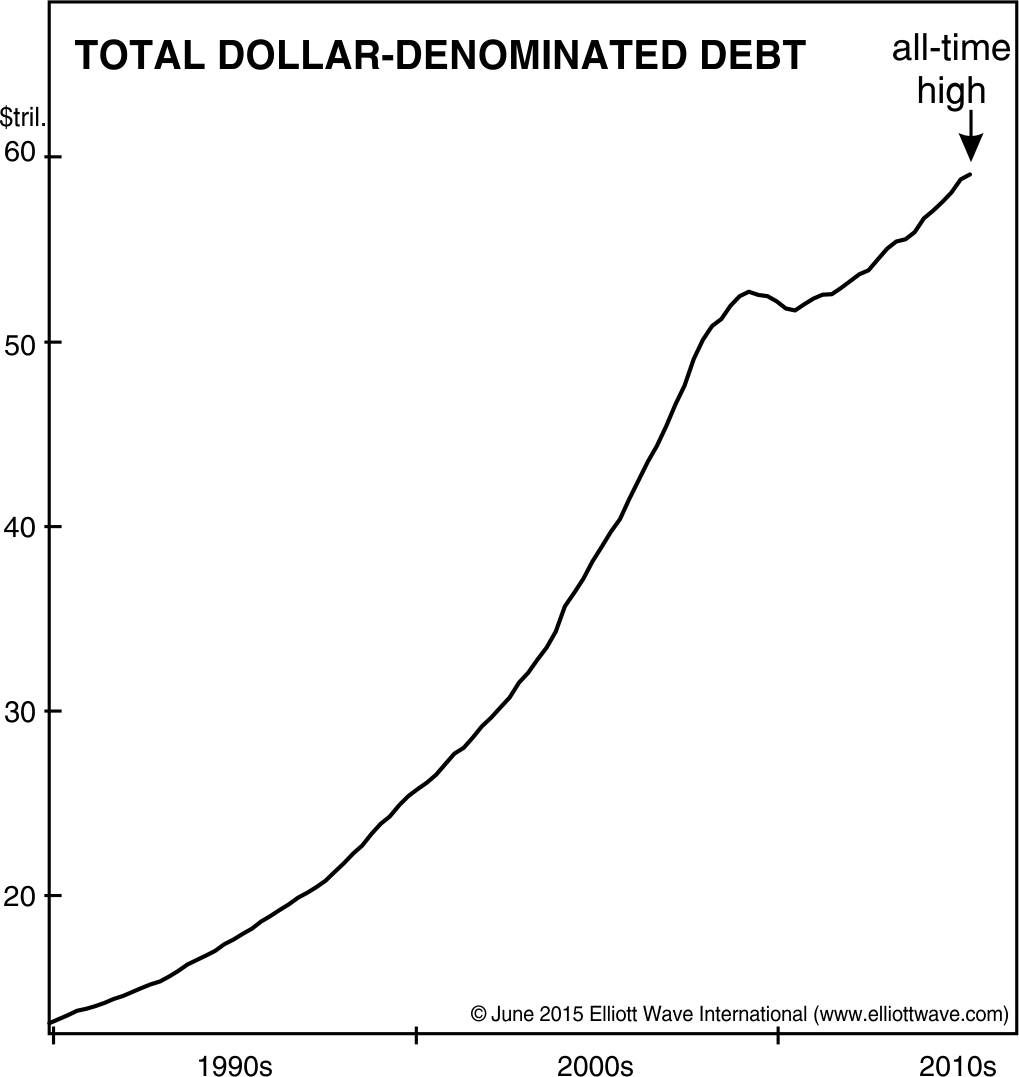

How to Survive a Global Financial Crisis

|

Gold topped in 2011, oil topped 2014. Various commodities topped within the past few years. Stocks and housing still survived till 2016. Over 3 trillion dollars have been wiped off the value of global stocks since the start of 2016. With that in mind, I urge you to read Robert Prechter’s free report, How to… Read more How to Survive a Global Financial Crisis |

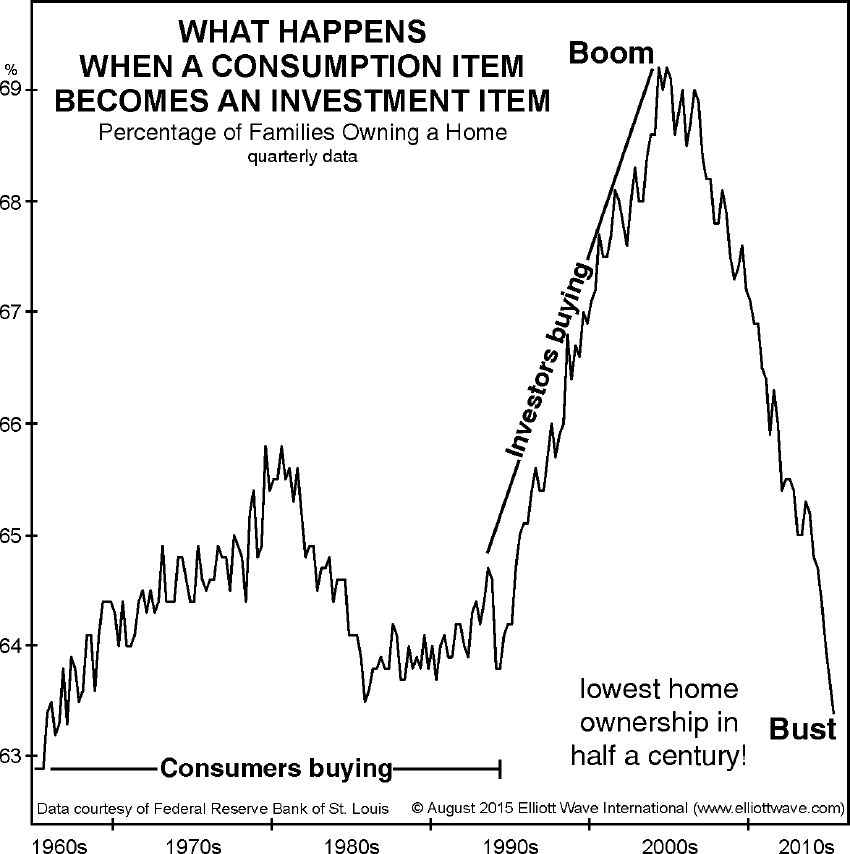

Housing Market Implosion Coming?

|

University students live in the lap of luxury The U.S. housing market may be about to implode — again. Before I get into the “why,” know that the residential real estate market never fully recovered. Annualized new home sales this past July stood at 507,000, vs. the July 2005 peak of 1.39 million. The chart… Read more Housing Market Implosion Coming? |

Bear Markets Move Fast!

|

With today’s market action, I don’t have a lot of time, and I’m sure you don’t either, but I want to drop a quick note before things get too crazy this week. Here’s the deal: This morning, the Dow crashed 1,000 at the open and has since rebounded. China declined 8.5%. Europe and the S&P… Read more Bear Markets Move Fast! |

Stocks Slide Globally

|

Is this the start of a global financial crash? “When the alarm goes off and the dreamers awake, it will be pandemonium in the stock market.” — Bob Prechter, from the just-released Elliott Wave Theorist. You would agree that markets around the world have served investors a lot of surprises lately: Crude oil just fell… Read more Stocks Slide Globally |

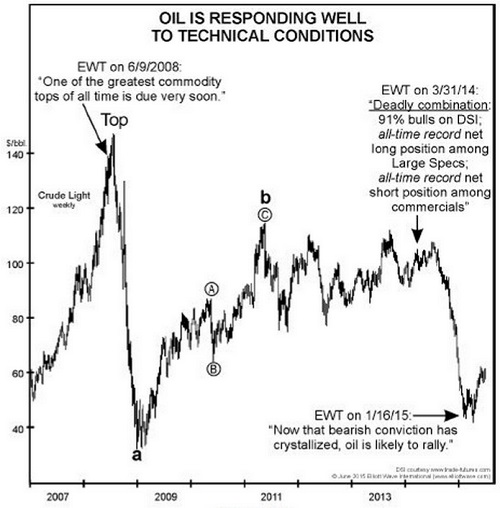

Oil Trend Change?

|

There is one solution to staying ahead of oil’s trend changes — Elliott wave analysis! You know the expression “God works in mysterious ways”? Well, according to an August 6 CNBC article, the price action of one financial market — i.e., crude oil — has out-mystified even God himself. Or, rather, the well-heeled star of… Read more Oil Trend Change? |

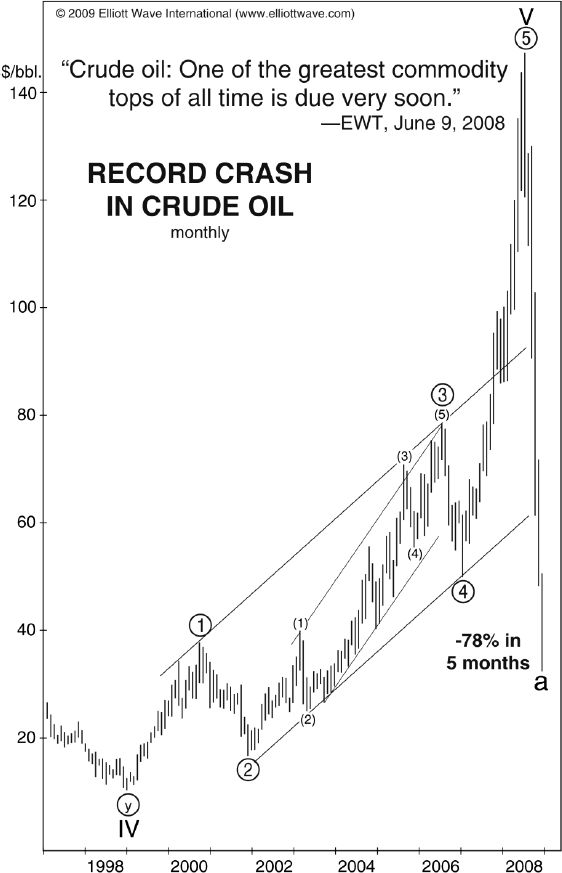

Peak Oil? Oil Price Decline Continues

|

Years ago we used to hear the chatter about how OIL price is going through the roof because either the world is about to reach peak production or has already done so. There was talk of the world running out of OIL and the price would inevitable skyrocket and there was no going back as… Read more Peak Oil? Oil Price Decline Continues |

Unprecedented Extremes Indicate Stock Market Bubble

|

After the rally from 2009 stock market bottom, stocks relentlessly marched up often without a breather. We have reported complacency has reached extreme levels in the past. But that in itself does not pinpoint a top. But when we have multiple measures lining up, one has to stop and contemplate the possibility that we are… Read more Unprecedented Extremes Indicate Stock Market Bubble |

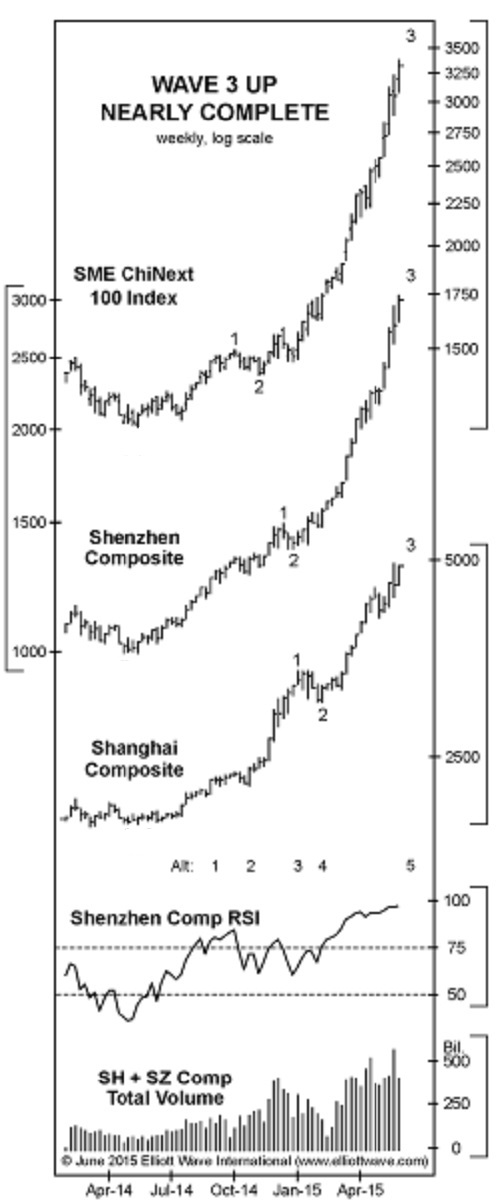

Volatility in Chinese Stock Market

|

“Chao gu” is the Chinese term for speculating in stocks. Roughly translated, it means “stir-frying” shares. Lately, though, for millions of Chinese investors, it means getting fried. Enter the “nerve-shredding,” “whiplash-inducing,” rollercoaster “tantrum” of China’s stock market. After soaring to 7-year highs on June 12, both the Shanghai Composite and Shenzhen stock indexes collapsed in… Read more Volatility in Chinese Stock Market |

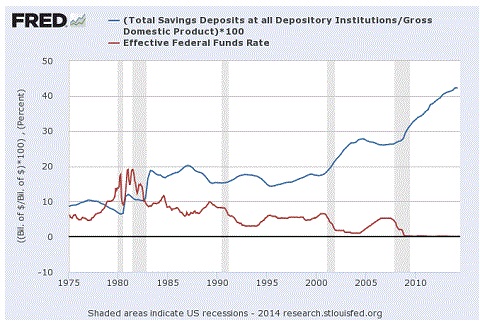

Consumers Are Now Savers

|

The real reason consumers aren’t spending is not a matter of monetary policy; it’s a matter of psychology. On June 2, the postman rang once — and, boy, did he ring. That day, the Wall Street Journal published a strongly worded letter titled, “Grand Central: A Letter to Stingy American Consumers,” which included these notable… Read more Consumers Are Now Savers |

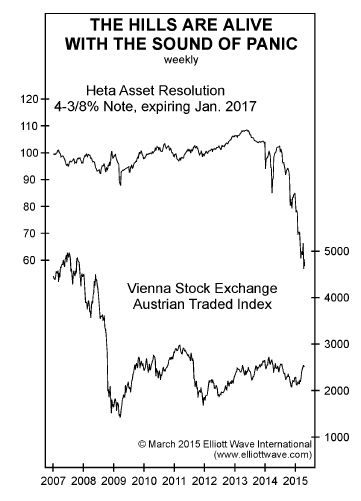

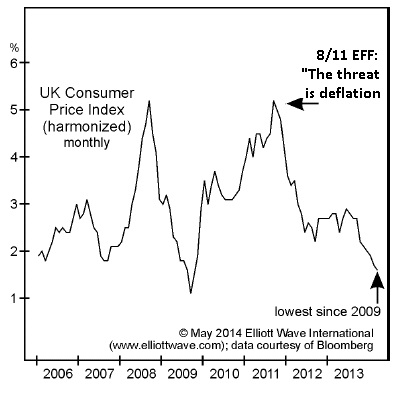

Deflation Nightmare in Europe

|

Elliott Wave International’s European markets expert Brian Whitmer often cautions his subscribers to beware of the pitfalls that will accompany the developing deflation in Europe. On May 20-27, Brian is hosting a free 5-video event at elliottwave.com: Investing in Europe: 5 Critical Insights. “Europe seems to be leading the way on important global trends, so… Read more Deflation Nightmare in Europe |

IRS Seizes All Money from Country Store

|

Another shot fired in the “War on Cash” Learn how your hard-earned money may be in jeopardy. Read War on Cash Follow this link to download your free report » Lyndon McLellan owns the L&M Convenience Mart in rural North Carolina. A few months ago, the Internal Revenue Service went to McLellan’s bank and seized… Read more IRS Seizes All Money from Country Store |

The New Nasdaq Bubble

|

Most tech stocks lead by Silicon Valley companies had a great run after the 2009 bottom. Nasdaq once again reached above 5000. The Silicon Valley traffic is unbearable, the rents for tech workers are unpayable, housing in the valley challenges prior heights, or already above. Yet the stock market pundits make us believe stock have… Read more The New Nasdaq Bubble |

A Growing Economy is NOT Always Bullish for Stocks

|

A good economy is not necessarily bullish for the stock market! Learn how you can get our FREE, 53-page State of the Global Markets report now >> On Friday (Feb. 27), the 4th quarter U.S. GDP was revised downward to 2.2% from the original 2.6%. “U.S. stock markets shrugged off the revision,” wrote Fox Business.… Read more A Growing Economy is NOT Always Bullish for Stocks |

New Perspectives on Gold, Euro & Crude Oil

|

Experienced traders say that sometimes, just 2 or 3 good trades make their entire year. True: If you get in early and ride the trend for a few weeks or months, that may be all you need. That’s why having a perspective on the markets is so important. That’s also why, our friends at Elliott… Read more New Perspectives on Gold, Euro & Crude Oil |

What is Next for Crude Oil?

|

Crashing oil is all over the news. Mainstream media tells us why the oil fell. And we keep hearing that it will continue to fall. But back in June all we heard was why the oil was destined for new highs. Why is the new so useless? Because 99% of oil forecasts out there are… Read more What is Next for Crude Oil? |

What is Scarier Than Deflation?

|

As early as 2011, our analysis warned that Europe’s deflation was coming — here’s why For the economies of Europe, the past few months have felt like one long ice-bucket challenge that never ends: A perpetual state of shock induced by the bone-chilling fact thatdeflation “…has become a reality in many European countries.” (Oct. 24,… Read more What is Scarier Than Deflation? |