|

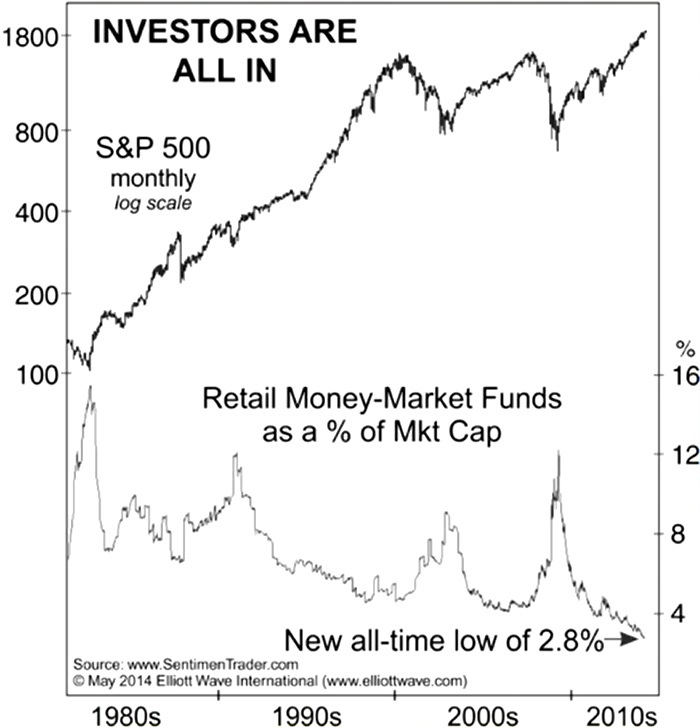

Stocks Top When Everyone Feels Safe Are the complacent investors heading for another cliff? Steve Hochberg on the state of retail money market funds vs. stock market capitalization, filmed at the 2014 Las Vegas Money Show Editor’s note: The article below is adapted from the transcript of the live presentation above, originally recorded at the… Read more Money Market Funds Signal Reversal For Stocks |

Is Deflation Coming Again?

|

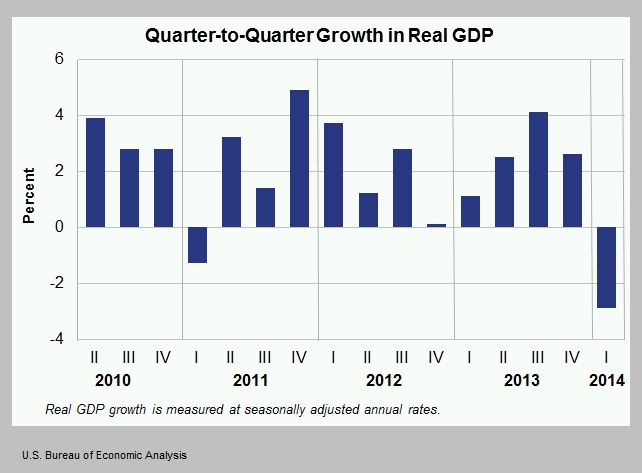

Not Inflation, But Deflation The Elliott Wave Financial Forecast warns that the contracting U.S. economy signals deflation ahead In June, the U.S. government, revising its previous number, reported that the economy shrank by 2.9% in the first quarter of 2014. The steep plunge caught the bulls by surprise. It was substantially worse than the preliminary… Read more Is Deflation Coming Again? |

Will Stocks Peak One Year After Bonds?

|

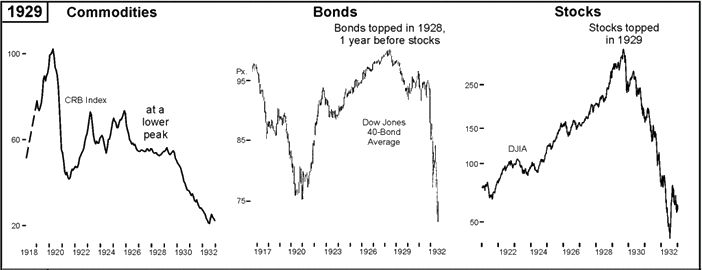

There are financial parallels between the 1920s and today – is history set to repeat? When the financial media mentions the late 1920s, they usually mean the 1929 stock market top and the market crash that followed. But today’s investors can also learn from what happened in 1928. That was the year that the bond market… Read more Will Stocks Peak One Year After Bonds? |

Deflationary Forces Preventing FED’s Rescue Efforts

|

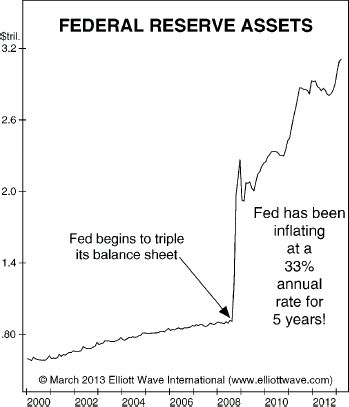

The Federal Reserve’s efforts to rescue the economy have been historically aggressive, starting with the initial round of quantitative easing in 2008 and continuing through 2013. Much money has been printed, despite what Bernanke says. M1 has been more than tripled. Yet Gold is down, commodities market is down, and inflation is still at historic low levels!… Read more Deflationary Forces Preventing FED’s Rescue Efforts |

15 Eye Popping Charts Reveal 2014 Forecast

|

Gold is down despite the printing press! Commodities are down! Peak OIL is not the topic anymore. Home prices have moved up with record low cost of lending and tremendous FED help. Stock market defied gravity in 2013 and is holding up so far. But how far can it go? Is the turn near once again? The financial community always… Read more 15 Eye Popping Charts Reveal 2014 Forecast |

Deflation Warning

|

Money Manager Startles Global Conference. History shows that the U.S. should pay attention to economies in Europe. The economy has been sluggish for five years. There’s no shortage of chatter about “why,” yet few observers mention deflation. Bernanke has been printing trillions. ECB and Bank of Japan has joined the reflation efforts and promised to… Read more Deflation Warning |

Is Deflation Possible?

|

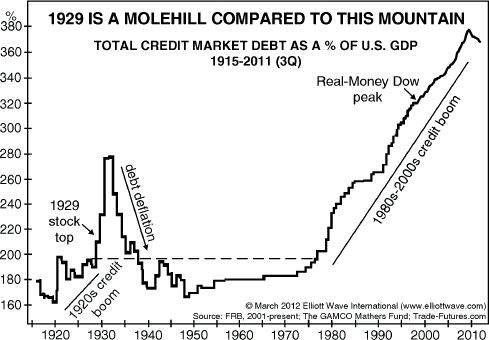

To understand the deflation problem, one must understand the nature of money and the amount of total debt in the US economy. In a credit based economy, money is created when banks make loans. Our money supply is not what Bernanke prints, but it is what we borrow. Fractional reserve banking coupled with interest based… Read more Is Deflation Possible? |

Social Mood, Politics and the Stock Market

|

Here is an interesting perspective on predicting the outcome of presidential elections. According to socionomic theory, bear markets come with a downturn in crowd psychology. When the crowd turns from optimism to pessimism, it is first seen in stocks, and then the rest of the economy, politics, culture. A president who is in the office during… Read more Social Mood, Politics and the Stock Market |

Financial Tsunami Coming

|

The size of the coming wave will surprise everyone It has been 4 years since the 2008 crash, and we have mostly forgotten about the dark days of financial calamity that almost destroyed the world economy. It was later revealed that FED made tens of trillions of loans to ailing institutions to save the world.… Read more Financial Tsunami Coming |

US Dollar Will Rise in Deflation

|

Before the 2008 crash, US dollar had been declining steadily. Everyone was on a borrowing spree. We borrowed and spent and inflated the money supply. Banks create money when we borrow. And more and more chequebook money was being created. Then we ran out of borrowers and deflation started. US dollar suddenly shot up. Once… Read more US Dollar Will Rise in Deflation |

Deflation and Kondratieff Winter is About to Intensify

|

After the crash of 2008-2009, Kondratieff Winter has eased. Money supply expansion has resumed with more borrowers stepping upto the plate. QE1 and QE2 has added to the base money supply and saved the banks – for now. But financial changes can happen at lightning speed in a way we do not foresee. History books… Read more Deflation and Kondratieff Winter is About to Intensify |

Conquer the Crash in Kondratieff Winter

|

Financial assets has still not recovered from the financial crash of 2008. One could argue we are still in Kondratieff Winter. But will it get better or will it get worse? Have we seen the stock market bottom in 2009? Is it safe to buy and hold stocks for the long run? Or is buy… Read more Conquer the Crash in Kondratieff Winter |

Austerity in America

|

What will austerity look like in America? State and local governments are broke. Pension plans are unfunded. Unemployment is as high as ever. Sovereign debt is a problem. The total debt in the world economy is too high. Entire western world has borrowed excessive amounts in the last few decades. This is not just the… Read more Austerity in America |

Global Debt Bubble

|

Debt Bubble is More Threatening Than Any Single Economic Sector Now History shows that once a financial bubble bursts, it can take a long time to bounce back. We had a crash in 2008 and since then nothing has been fixed other than printing money and handing it out to the failed banks. Now we are doing… Read more Global Debt Bubble |

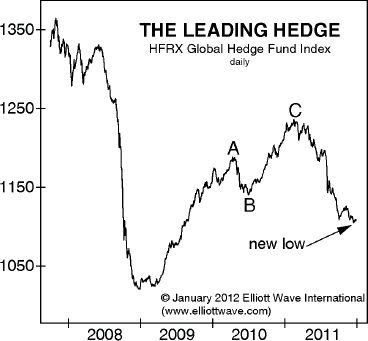

Public Pension Funds Are In Trouble

|

It has been years since the great recession, but unemployment remains stubbornly high. Europe is struggling with the debt problems of it’s members and the debt problem of the US is in check by strong demand to US dollar despite Bernanke’s printing press. But is a bull market ahead of us despite all of our… Read more Public Pension Funds Are In Trouble |

Is the World’s Central Bankers’ Strategy Working?

|

Debt is the world’s problem. After decades of credit inflation, deflationary pressures have been forcing central banks to take actions across the globe. The Fed is not the world’s only central bank dealing with debt. Watch as Steve Hochberg, EWI’s chief market analyst, shows what has happened to GDP in countries around the world as… Read more Is the World’s Central Bankers’ Strategy Working? |

Largest US City Bankruptcy is Coming

|

As pundits chatter about an economic recovery, 80 miles east of San Francisco you’ll find a city (pop. 292,000) facing bankruptcy: Stockton is on the verge of becoming the largest city in the United States to declare bankruptcy… San Francisco Chronicle (3/4) Bloomberg reports (2/25) that it costs the city $175,000 just to get a… Read more Largest US City Bankruptcy is Coming |

Who is Going To Win the Presidential Elections?

|

Is Obama going to win the elections to serve his second term? Can the Republican nominee beat Obama? Does it matter if it is Romney or Santorum or Ron Paul? or Gingrich? Or does Obama’s destiny rests on something else? A recently-published, landmark research paper shows the link between stock market performance and presidential election… Read more Who is Going To Win the Presidential Elections? |

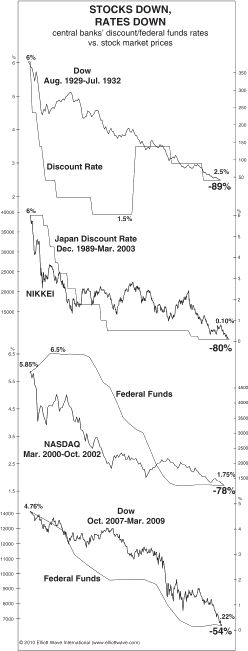

Do Low Interest Rates Move Stocks Higher?

|

Many investors think that the Federal Reserve reduces the interest rates and that makes the stock market move higher. But there are two fallacies in this assumption. For one, the Federal Reserve does not set the interest rates, the market does. FED follows. Below we are going to show you a chart of declining interest… Read more Do Low Interest Rates Move Stocks Higher? |

Credit Crisis: Is The Perfect Storm Coming?

|

Robert Prechter discusses what’s backing your dollars In this video clip, taken from Robert Prechter’s interview with The Mind of Money, Prechter and host Douglass Lodmell discuss “real” money vs the FIAT money system, and what is backing your dollars under our current system. Enjoy this 4-minute clip and then watch Prechter’s full 45-minute interview… Read more Credit Crisis: Is The Perfect Storm Coming? |