Why the Recession Consensus Might Be Too Optimistic

“Major stock market declines lead directly to…”

The verdict seems to be in: The economy is headed for a recession.

These headlines from the past few months show what I’m talking about:

- A 2023 recession would mean job losses for most industries … (USA Today, Feb. 3)

- Recession watch: U.S. economy is on shaky ground (MarketWatch, Jan. 28)

- There’s close to 100% certainty there will be a recession in the U.S. this year, CIO says (CNBC, Jan. 25)

- Bank of America CEO sees ‘mild recession’ in 2023 (Fox Business, Jan. 21)

- Guggenheim CIO: We are predicting the recession to start mid-year (CNBC, Jan. 18)

- World Bank … says globe is ‘perilously close’ to recession (CNBC, Jan. 10)

- A Recession Is Widely Expected. Here’s How to Prepare (Time, Dec. 10)

This is a way whittled down list of headlines. I included as many as I did to emphasize that the expectations for recession are widespread.

Yet, the consensus is rarely correct. So, this might mean that there will not be a recession. On the other hand, it could imply that the expectations for a recession are way too conservative — too optimistic. In other words, something worse might be ahead.

This speculation is not just based on the majority being wrong most of the time, but on the historical observation that the economy tends to follow the stock market.

In other words, if the stock market gets into a great bull market, a major economic boom tends to follow. On the other hand, if stocks experience a major bear market (think 1929-1932), the economy tends to suffer a depression.

As Robert Prechter noted in Last Chance to Conquer the Crash:

Major stock market declines lead directly to depressions.

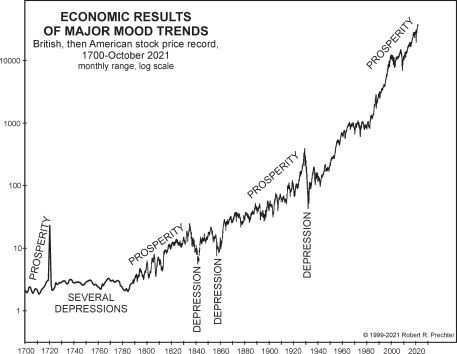

This chart is from that must-read book:

Robert Prechter shows that three of the biggest market declines of the past 300 years did indeed lead to economic depression: 1720-1784, 1835-1842 and 1929-1932.

Many people believe economic conditions lead to depressions. But as the chart makes plain, the stock market leads the economy.

If the stock market declines deeply in 2023 (and perhaps beyond), a depression may follow.

Indeed, here’s what Robert Prechter wrote in his must-read book, Last Chance to Conquer the Crash:

For the purposes of this book, all you need to know is that the degree of the economic contraction that I anticipate is too large to be labeled a “recession” such as our economy has experienced thirteen times since 1933. If my outlook is correct, by the time the…

Learn more — waymore — by getting free access to the first two chapters of Last Chance to Conquer the Crash.