“Downside surprises should become the norm”

The Wave Principle’s basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves, as illustrated in both bull and bear markets below:

You probably recall the bursting of the dot-com bubble when the tech-heavy Nasdaq 100 plummeted 78% between March 2000 and October 2002.

In recent months, a slew of financial articles compares today’s “tech wreck” to that dot-com crash of about 20 years ago.

Here are just a couple of sample headlines:

- ‘Tech wreck’ looks more like another dotcom bubble bursting (March 9, The Financial Times)

- It’s looking a lot like the dot-com crash again. … (May 22, Fortune)

It’s been said that history may not repeat exactly but it does often rhyme. And the current downturn in many tech names does remind of that dot-com bubble.

You may be interested in knowing that our Global Market Perspective, a monthly Elliott Wave International publication which covers 50-plus worldwide financial markets, provided this prescient warning as far back as November 2020:

Big tech is transitioning from a bull market to a bear market at a high degree of trend, so downside surprises should become the norm.

Price shocks across the tech sector began almost immediately after that analysis.

Here’s the latest from our June 2022 Global Market Perspective:

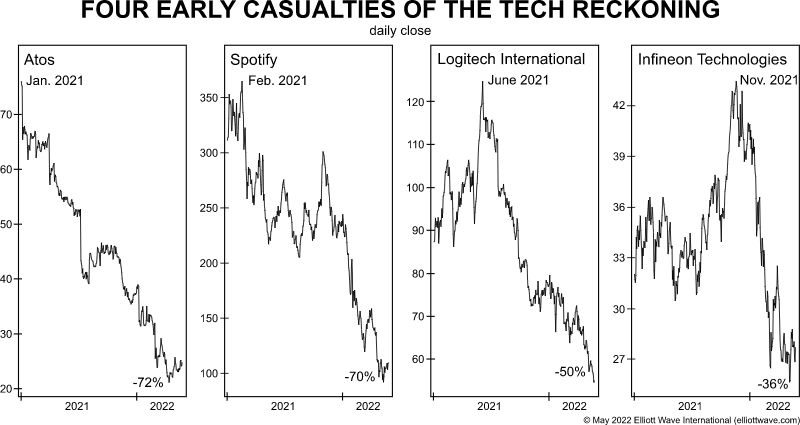

French IT company Atos dropped 12% on January 7, 2021, and investors have sold the stock relentlessly ever since. Sweden’s Spotify, the world’s largest music streaming service, peaked in February 2021 and fell 70% to its current level. Switzerland’s Logitech (computer peripherals) and Germany’s Infineon Technologies (semiconductors) held up a bit longer, but the companies’ bear-to-date losses have piled up to 50% and 36%, respectively.

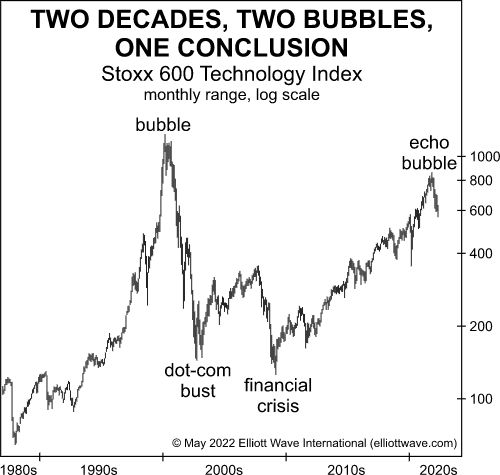

So, yes, the current trend in the tech sector does rhyme with the dot-com bust — or, call it an “echo.” Here’s more analysis from the June Global Market Perspective:

It took until November 2021 for the broader technology complex to reverse. The Stoxx 600 Technology Index peaked after failing to surpass its top from the dot-com mania, and, at this point, the “echo bubble” is producing a host of air pockets, flash crashes and general market disturbances.

Here’s what you need to know: In addition to the European tech sector, our Global Market Perspective offers insights into U.S. and Asian-Pacific tech names and indexes.

You’ll also find Elliott wave analysis of other stock market indexes, cryptocurrencies, forex, bonds, crude oil, gold, silver – all in all, more than 50 worldwide financial markets.

If you’re new to Elliott wave analysis or need a refresher, an ideal book to read is Frost & Prechter’s Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the Wall Street classic:

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market’s position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable. Many areas of mass human activity display the Wave Principle, but it is most popularly used in the stock market.

Here’s good news: You can read the entire online version of the book for free once you become a member of Club EWI, the world’s largest Elliott wave educational community.

A Club EWI membership is free and opens the door to instant access to a treasure trove of Elliott wave resources on investing and trading – all without obligation and 100% free.

Get started right away by following this link: Elliott Wave Principle: Key to Market Behavior – free and unlimited access.