There are financial parallels between the 1920s and today – is history set to repeat?

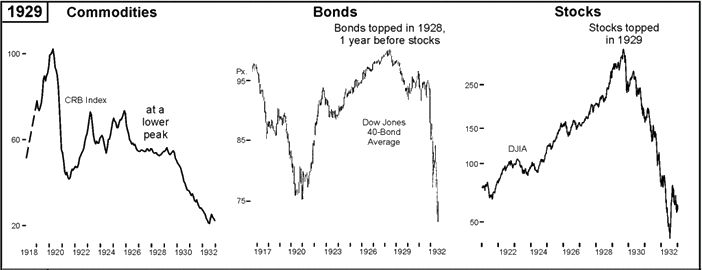

When the financial media mentions the late 1920s, they usually mean the 1929 stock market top and the market crash that followed. But today’s investors can also learn from what happened in 1928. That was the year that the bond market topped, while commodities peaked even earlier.

You can see this for yourself in a chart published in the September 2013 issue of Robert Prechter’s Elliott Wave Theorist.

In the deflationary crash of 1929-32, commodities fell from lower peaks, not higher peaks; stocks fell from all-time highs down to the bottom; and bond prices fell from an all-time high a year earlier.

The Elliott Wave Theorist, July-August, 2013

These markets could see a similar outcome in the near future: Commodities peaked in 2008, while Treasury bonds topped in 2012. The high in the Dow Industrials remains December 31, 2013.

Of course, history doesn’t always repeat itself. Whether December 31 proves to be a long-term high in the Dow remains to be seen. The stock market rally since March 2009 has been doggedly persistent. Prices have surged several times just as the indicators suggested the uptrend was over.

|

Bad Start for Stocks in 2014: Buying opportunity or more pain to come? You can benefit greatly from looking at charts that take a historical look at what’s going on in the financial markets. Robert Prechter has just released an issue of his Elliott Wave Theorist publication that includes 15 charts of the S&P 500, NASDAQ, gold, and mutual funds — along with his analysis. With this information, his Elliott Wave Theorist subscribers are now prepared for 2014. And you can be, too, because you can get the full issue, FREE. Download your free 10-page report here Don’t delay! |

I believe you are right on the money. Not engouh commodity production capacity, partly due to purely natural constraints, and partly due to investment t having gone elsewhere for a good while. And overcapacity to produce higher order goods.Now, overcapacity is generally a self-correcting phenomenon. Prices decline, profits drop, plants fail, and that’s that. But now, this process is being fought tooth and nail, under guise of stimulus. Cheap credit, artificial end user demand stimulation etc., etc. all contribute to prolonging the clearing out of intermediate and final goods productive capacity.Now, from a sustainability perspective, this is doubly bad. Firstly, resources, including commodities, produce less and less well being , the more is being used of them. Hence, the commodities being used by artificially kept alive higher order producers, are largely wasted in an economic sense. Not really the wisest use of stuff that are scarce and getting scarcer.Secondly, overcapacity upstream creates artificial demand signals to commodity producers, leading them to increase investment in order to be able to extract more to keep up with this demand. Again, not exactly what one would like to see from a sustainability perspective.On a very fundamental level, assuming one believes the world is currently living beyond its natural resource means; bailing out, stimulating, on the cheap financing and by other means keeping those doing that living from being forced to adjust, is not exactly productive use of resources.